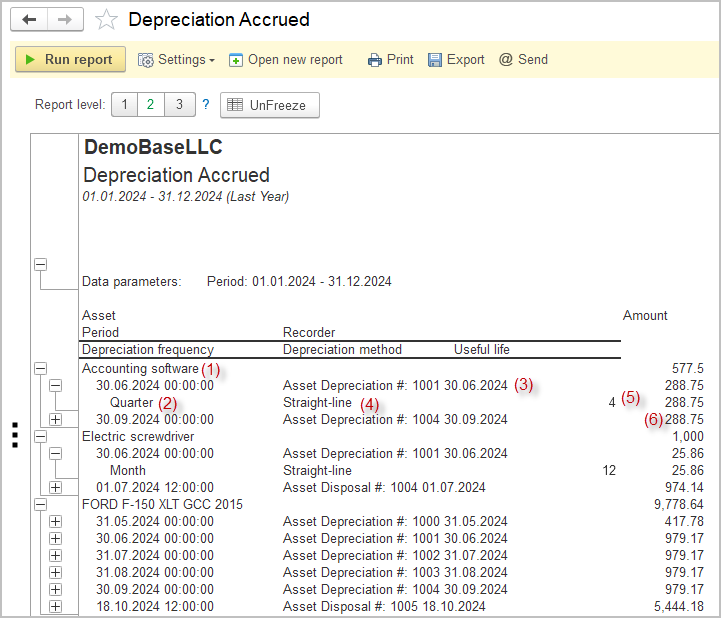

This report displayes the details of depreciation of fixed assets, amortization of intangible assets and expense recognition for prepaid expenses and low-value assets.

For the selected time period, the report shows:

- asset name (1);

- derpreciation frequency (2);

- document, that has recorded the depreciation (or amortization for an intangible asset, or expense recognition for prepaid expenses and low-value assets) – this is commonly the Depreciation or Disposal document (3);

- depreciation method (4);

- actual useful life (5);

- amount charged (6).