Reversing a document in AccountingSuite allows users to cancel or undo a previously posted transaction that was entered incorrectly. This process creates a new reversing document that negates the effects of the original, maintaining accurate financial records without deleting historical data.

Setting a document “Back to Draft” means changing its status so it can be edited again without losing its history. Deleting a document removes it completely from the system, making it unrecoverable. Reversing a document is different — it means undoing the effects or actions caused by the document while keeping a record for audit purposes.

When to Reverse a Document #

- If a posted document contains errors or inaccuracies.

- To cancel a transaction that should not have been recorded.

- When you need to adjust entries without deleting audit trails.

Preconditions for Reversal / Storno #

- The document must be a posted document.

- There should be no cleared or settled items linked to the document (how to unlink docments)

- The accounting period to which the document belongs must be open (in the Accounting Settings)

Options to Reverse a Document #

- The Journal Entry with a Voiding Type can be used to reverse any document. You can use a journal entry either to make the opposite entry or to make the same entry with a negative sign, depending on your accounting goal and local legislation. This flexibility allows you to accurately adjust your accounts either by reversing the original transaction directly or by recording a negative amount to offset it, in compliance with applicable accounting standards and regulations.

- However, there are specific options for certain documents:

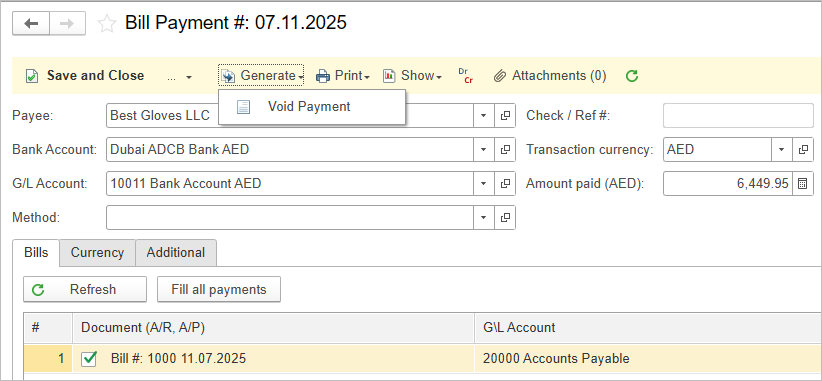

- In the cash flow documents (Bill Payment and Cash Receipt), click Generate – Void Payment. It will create Voiding Entry document with Storno Dr/Cr records;

- To reverse the Journal Entry, click Generate – Reverse;

- To reverse VAT amounts, it is recommended to use VAT adjustment document, because the amounts become traceable in the VAT Details report, ensuring transparency and easier verification during tax audits;

- To reverse Inventory, it is recommended to use Inventory adjustment document, because this ensures accurate representation of actual inventory levels and values in reports (like Item Activity Report), maintaining the integrity of inventory data.

After Reversal #

- Review reports to ensure the reversal has been accounted for properly.

- Communicate with relevant departments (e.g., accounting, finance) if necessary for reconciliation.