AccountingSuite Demobase includes a description of the documents examples.

In the demo base, navigate to Support – Features and Learning – Demo Cases.

Here, you can explore a range of real-world scenarios and examples that showcase the power and versatility of AccountingSuite. The demo cases are linked to documents in the demo base and offer valuable insights and practical solutions.

Click on scenario below to open demobase directly to demo case. Use login/password demo/demo.

- Scenario 1. Purchase of goods from a vendor with deferred payment terms (Net 15)

- Scenario 2. Goods purchased under Scenario 1 sold to the Customer using a sales quote and “Due on Receipt” payment terms

- Scenario 3. Goods purchased under Scenario 1 sold to the Customer using a sales order and cash receipt

- Scenario 4. Goods purchased under Scenario 1 sold to individual Customers at the point of sale

- Scenario 5. Goods purchased under Scenario 1 sold to Customer

- Scenario 6. Goods sold under Scenario 2 returned by Customer (no refund requested)

- Scenario 7. Customer’s credit under Scenario 6 applied to a new sale

- Scenario 8. Purchase of goods from a Vendor

- Scenario 9. Goods purchased under Scenario 9 returned to vendor (no refund requested)

- Scenario 10. Purchase of goods from a vendor at the price in US dollars

- Scenario 11. Goods sold through Dropship sales

- Scenario 12. Assembly of fur coats from materials purchased

- Scenario 13. Fur coats produced under Scenario 14 sold through Consignment sales

- Scenario 14. Disassembly of unprocessed leather into components, assembly of leather garment from these components

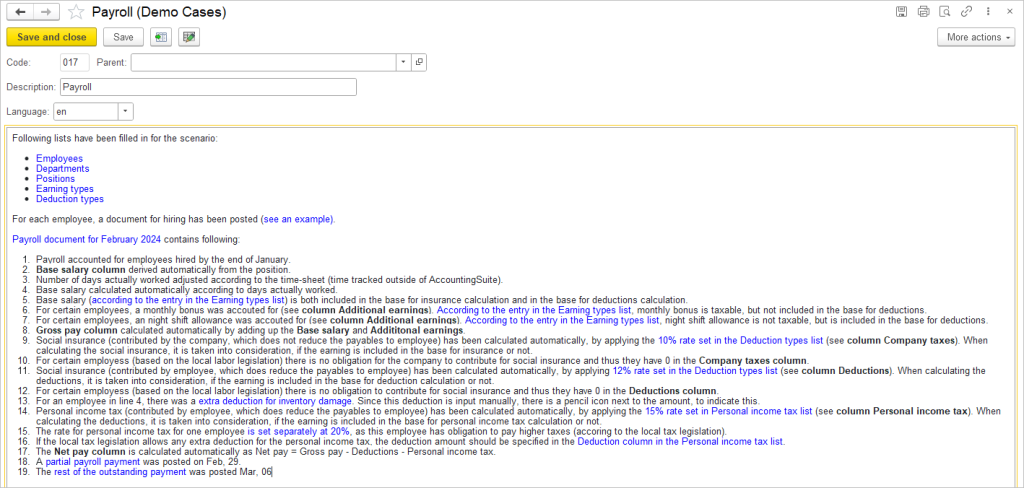

- Scenario 15. Payroll in system currency

- Scenario 16. Assets: Fixed asset acquired and sold

- Scenario 17. Assets: Intangible asset

- Scenario 18. Assets: Prepaid expenses

- Scenario 19. Assets: Low value asset

- Scenario 20. Goods (subject to VAT and WHT) purchased under 100% prepayment terms

- Scenario 21. Goods (subject to VAT and WHT) sold under 50% prepayment terms

- Scenario 22. Inventory taking and adjustment

- Scenario 23. Excisable and levied goods sold to Customer

- Scenario 24. Purchase from foreign Vendor, Reverse charge VAT

- Scenario 25. Purchase from Vendor, VAT is non-deductible

- Scenario 26. Expense report with a postpayment