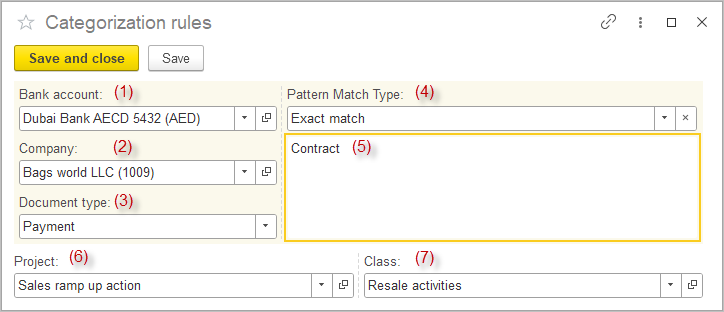

The Categorization Rules tool for Bank Import supports the automatic assignment of payment records to categories such as Project, Class and document types when importing bank transactions.

This tool provides option to configure rules that help classify imported bank statement lines. By setting specific criteria, users can ensure that payments and receipts are automatically matched to relevant accounts, projects, and organizational structures, reducing manual processing and errors

Setting up Categorization Rules is optional — all attributes can be assigned manually during the import process; however, using rules may save time by automating the classification of imported transactions.

- Bank Account Selection (1): The Bank account dropdown allows users to select which account the rule applies to. This is a required field and cannot be left blank.

- Company Filtering (2): The Company field lets users narrow the rule’s application to a specific Company. If left blank, the rule will apply to all Companies.

- Document Type Assignment (3): The Document type dropdown determines which document type will be generated or assigned when the rule is triggered, supporting various workflows. Available types are: Deposit, Payment, Cash Sale, Cash Receipt (Customer Prepayment, Refund Receipt), Bank Transfer, Bill Payment (Vendor Prepayment, Refund Payment).

- Pattern Matching (4): Under Pattern Match Type and the associated text box (5), users enter values (such as reference numbers, keywords, or codes) to match transaction descriptions or details. This section enables flexible matching—only transactions containing the specified pattern will trigger the rule. Will not be applied if left blank.

- Project (6) and Class (7) Assignment: allow transactions to be mapped directly to the selected project or class for accurate categorization and reporting.

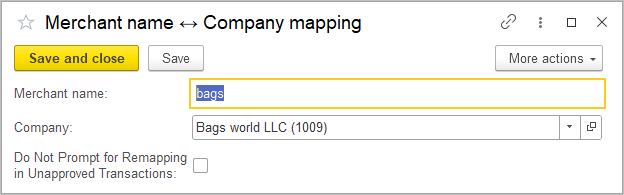

Merchant Name – Company Mapping #

The Merchant Name ↔ Company Mapping tool is designed to facilitate the bank import process by linking merchant names from bank statements to the corresponding Companies. This mapping ensures that transactions imported from bank files are automatically assigned to the correct company, improving accuracy and saving time during reconciliation.

If the bank statement includes the Tax Registration Number, it can be used to identify the Company. Otherwise, this mapping will be helpful.

This tool is an optional setting, because users can manually select the Company for each transaction during the import process. However, this mapping saves time by automatically assigning transactions to the correct Company.

Users can create and edit mappings where a merchant name, as it appears in bank transaction data, is linked to an existing company record in the system. The interface allows entering the merchant name and selecting the associated company from a dropdown list. Additionally, there is an option to prevent prompts for remapping unapproved transactions, streamlining the import workflow.

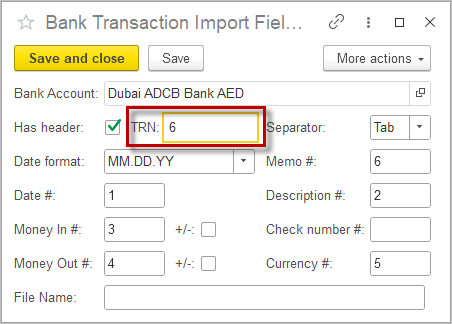

For proper recognition, please specify the number of the column with Company name in the TRN field in the Bank account settings.