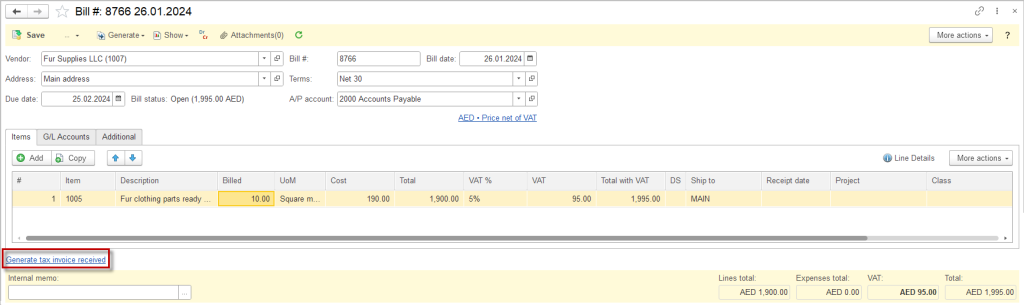

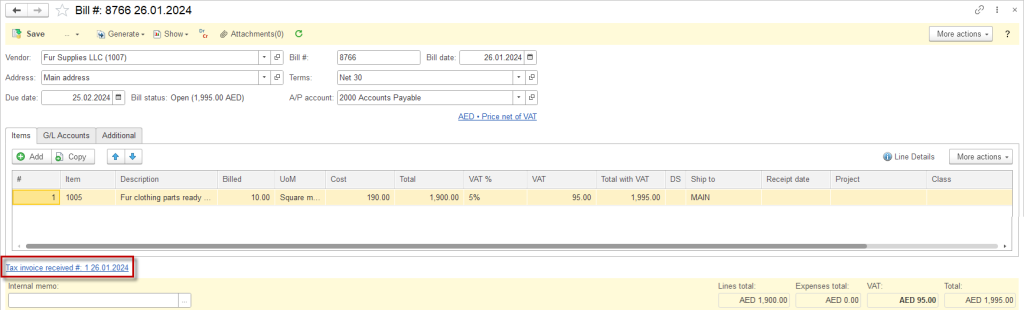

Tax invoice received #

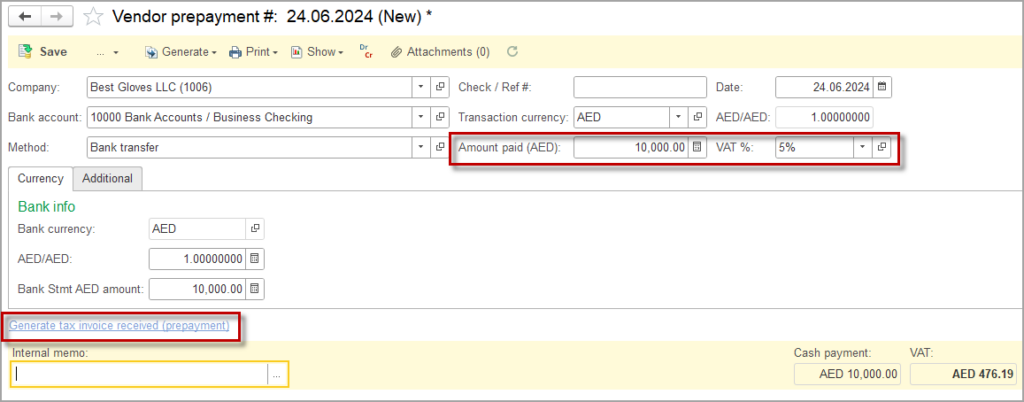

Create Tax invoice received for paid prepayment #

- Open the respective Purchase order.

- Click Generate – Prepayment.

- Specify the amount paid and the applicable VAT rate.

- Once the Prepayment is posted, the Generate Tax Invoice received panel below becomes active.

- Click Generate Tax Invoice received (prepayment).

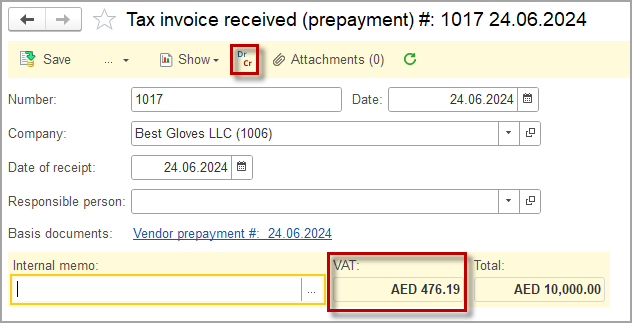

- Tax invoice will open, showing the VAT and the total amount.

- Under Dr Cr button you will find the respective postings. Please note, that the account effected by tax invoice are set in the VAT accounts.

- Save the Tax invoice.

- Generated invoice is accessible via Purchase order.

Accounting #

Recording a Tax invoice received creates the following transactions in the General Journal:

- Debits: VAT calculation account (from the Accounting settings)

- Credits: Incoming VAT account (from the Accounting settings)

Note: If the accounts set in the Accounting settings for Incoming VAT and VAT calculation are the same, no posting will be made, as Dr equals Cr.

Tax debit note #

Create Tax debit note #

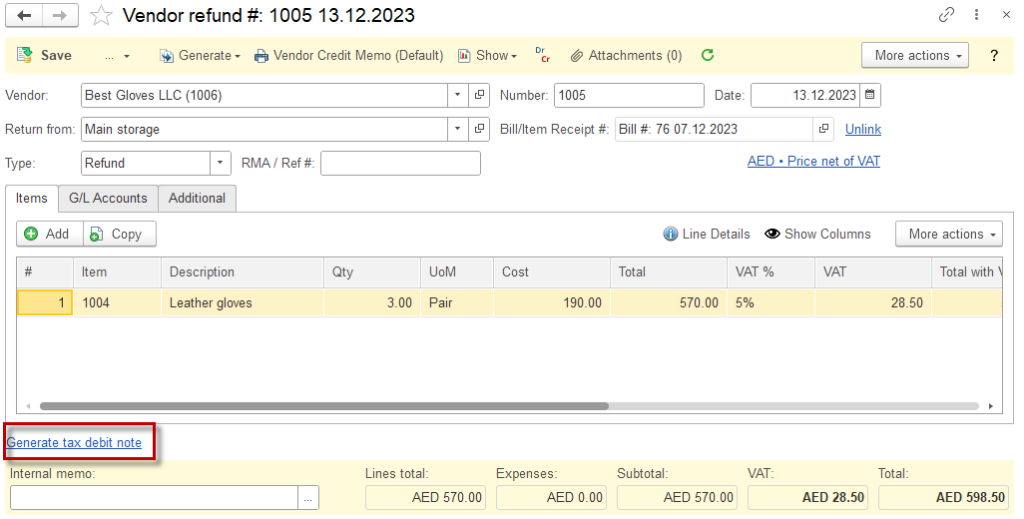

- Open the respective Vendor credit memo

- Once the Vendor credit memo is posted, the Generate Tax Debit note panel below becomes active.

- Click Generate Tax Debit note.

- Generated Tax Debit note is accessible via Vendor credit memo or under Purchases – Tax invoices received and Tax Debit notes.

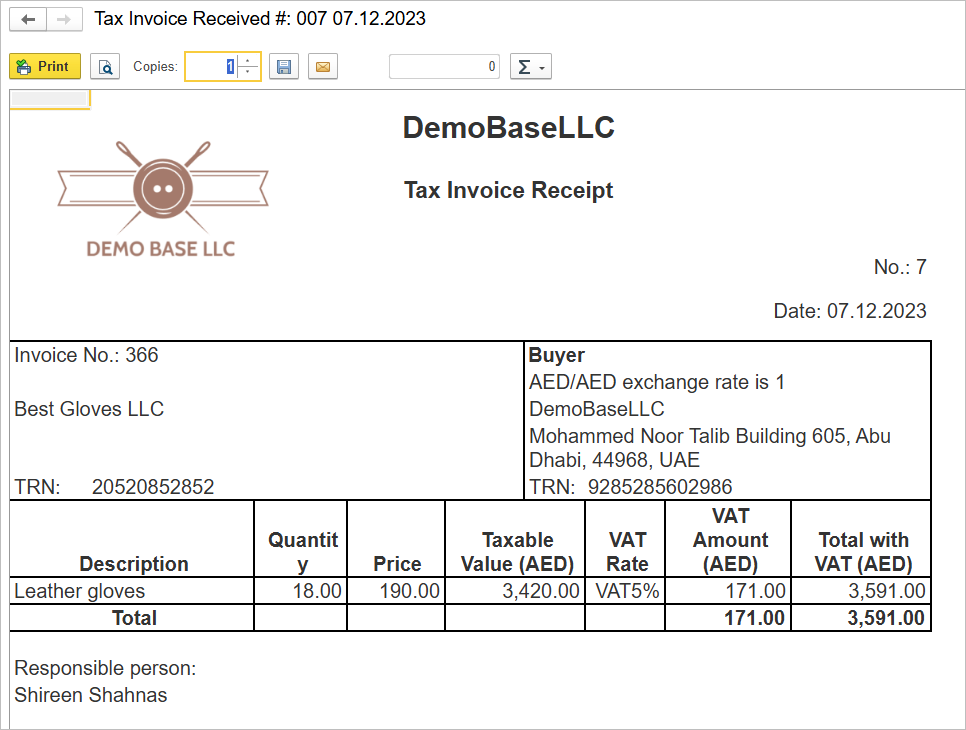

Print forms for Tax invoice received and Tax debit note #

Open Tax invoice print form #

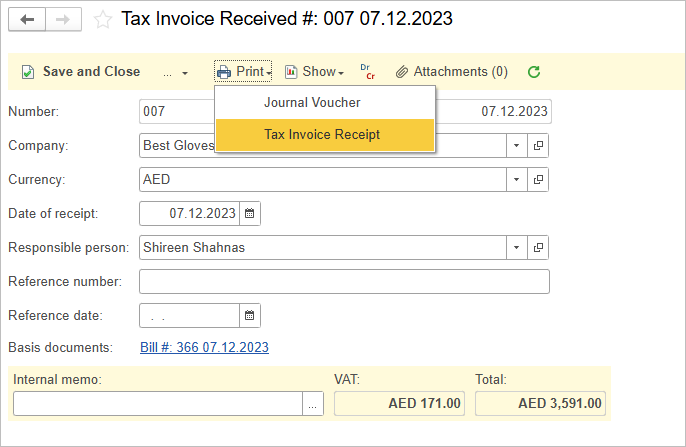

- Open the respective Tax invoice received (or the respective Tax debit note)

- Click Print – Tax Invoice Receipt (or Print – Tax Debit Note)

- Print form will open. You can Print, Save or E-mail the Tax invoice.

- To edit the print from according to your business needs please refer to a video tutorial.

The print form.