VAT RCM (reverse charge mechanism) is a mechanism where the responsibility for reporting VAT shifts from the seller to the buyer (e.g., when purchase from a foreign Vendor). This typically applies in cross-border transactions or specific domestic scenarios, allowing the buyer to account for the VAT on their purchase instead of the seller charging it. This can simplify tax compliance and reduce the risk of fraud. AccountingSuite supports this process by providing options to easily apply the reverse charge mechanism, ensuring accurate VAT reporting and compliance.

Required settings for RCM #

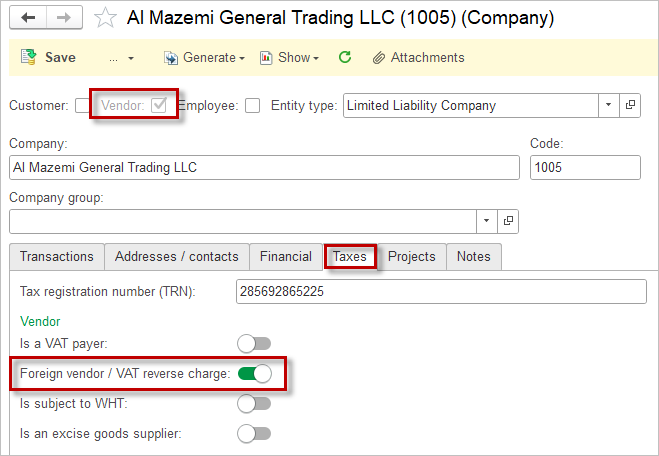

First, the Foreign Vendor/ VAT reverse charge option must be ticked in the Vendor on the tab Taxes:

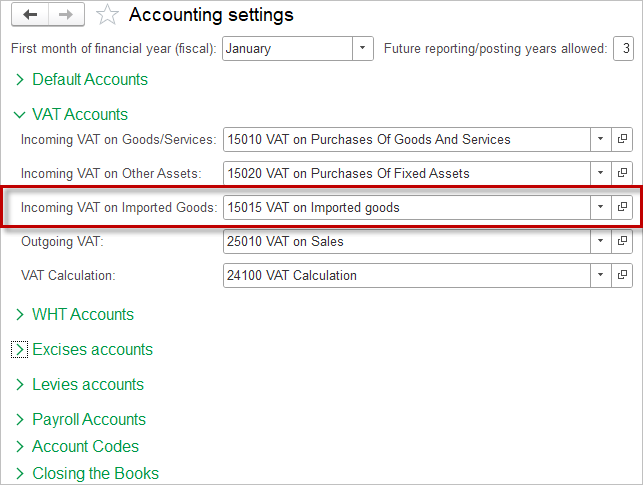

In the Accounting settings, select the defaulf posting account for VAT on imported goods and services. It is strongly recommended that a separate VAT account is set up for this purpose to ensure correct accounting entries.

Posting the Bill #

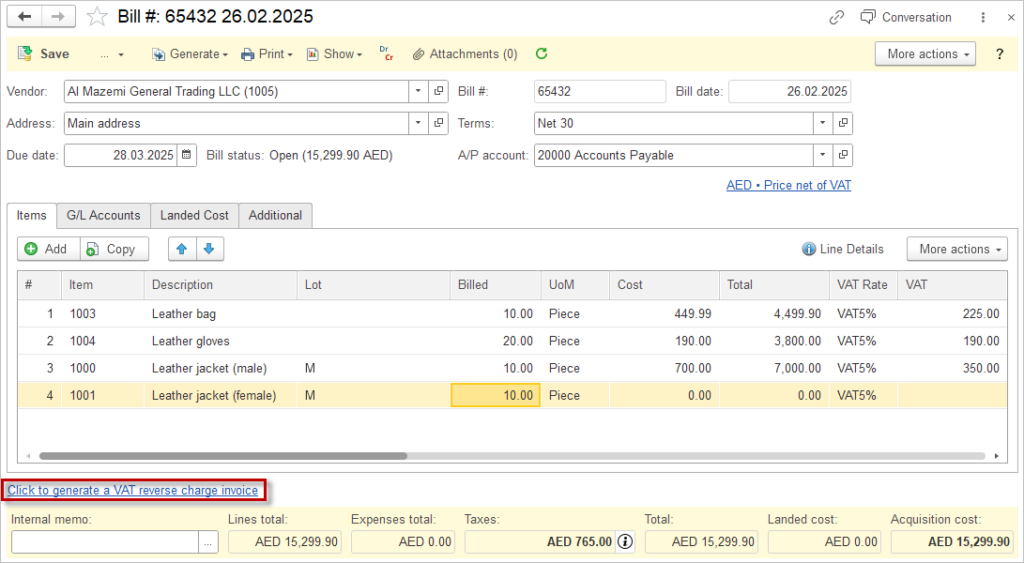

- Follow the common process of posting a Bill.

- Generate the VAT reverse charge invoice right from the Bill.

Accounting #

Recording a Bill from a foreign Vendor creates the following transactions in the General Journal:

- Debits: Inventory (or whatever has been purchased – e.g. asset or expense)

- Credits: Accounts payable (amount net of VAT)

- Debits: VAT on imported goods and services (set in the Accounting settings)

- Credits: VAT calculation account (set in the Accounting settings)

Accounting #

Recording a VAT Reverse Charge Invoice from a foreign Vendor creates the following transactions in the General Journal:

- Debits: VAT calculation account (set in the Accounting settings)

- Credits: VAT on imported goods and services (set in the Accounting settings)

The VAT has therefore been reversed. The final effect on the VAT balance is zero.

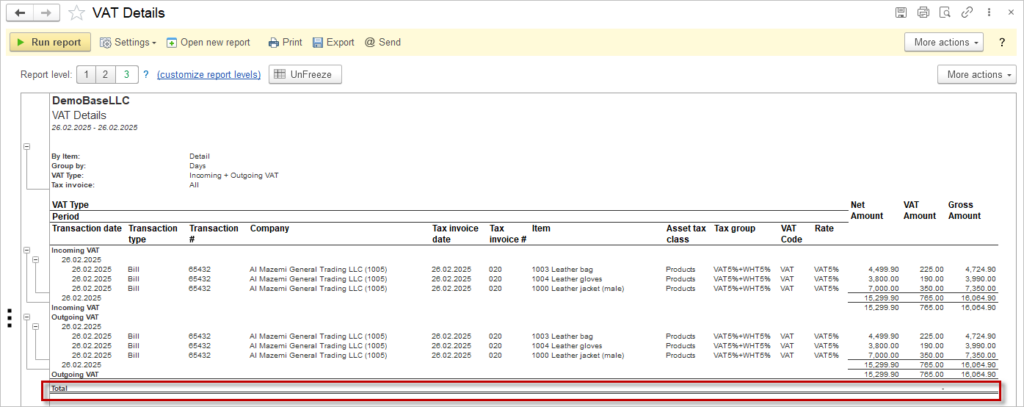

Use the VAT Details report to assess the impact of the VAT RCM.

The Bill will have posted the incoming VAT, while the VAT reverse charge invoice will have posted the outgoing VAT for the same amount, giving a balance of zero.