AccountingSuite offers support for multi-currency functionality, which must be enabled in the General Settings. It is essential to ensure that all required Currencies are properly added to the Currencies list, and that their exchange rates are regularly updated to reflect current values accurately. The system allows users to change the currency on any document, providing flexibility for transactions conducted in different currencies.

However, it is important to understand how income and expense items are handled in journal vouchers when multiple currencies are involved.

It is not possible to recognize income and expense items in multiple currencies within a single journal voucher. While balance sheet accounts can be maintained and tracked in two or more currencies simultaneously, income and expense accounts are always recorded and reported in the system’s default currency.

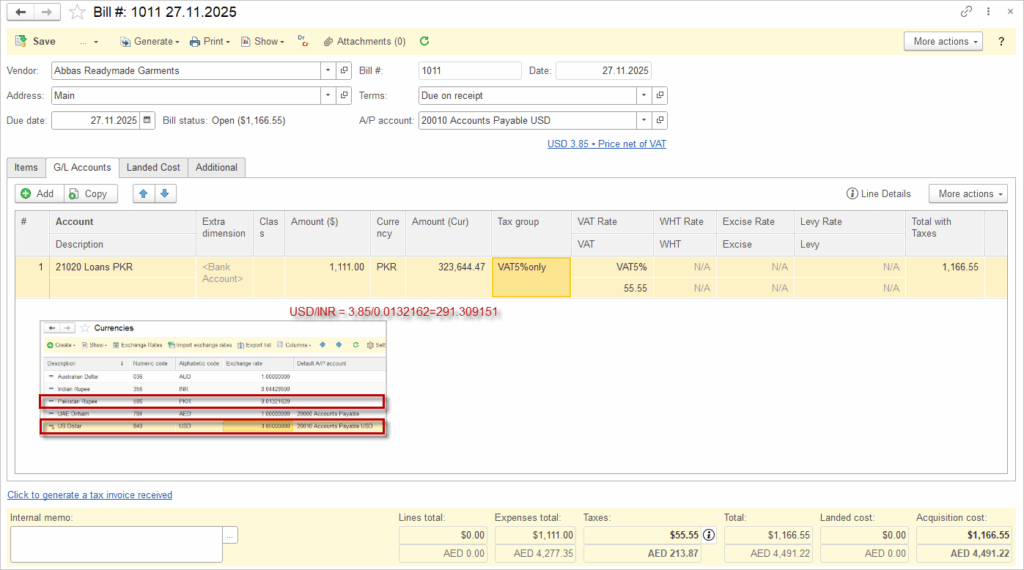

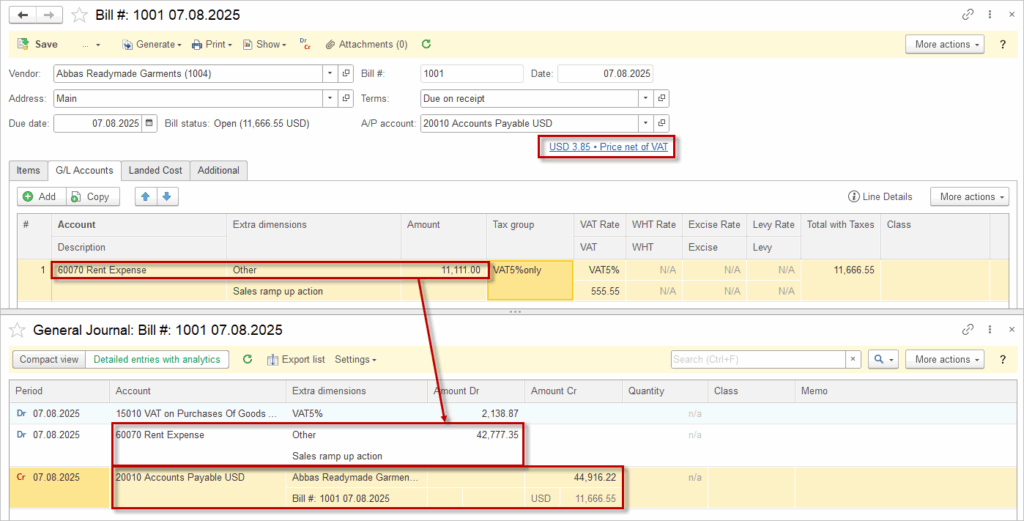

For example, when a Bill is entered with an expense purchase in a foreign currency such as USD, the expense is recognized in the default system currency (e.g., AED). The liability for the transaction, however, can be tracked in both the default currency and the foreign currency, allowing dual currency management at the balance sheet level. The same principle applies to income transactions, such as sales invoices, where income recorded in a foreign currency will be converted and recognized in the default currency.

In summary, income and expense items are recalculated once and recorded only in the default currency. This behavior ensures consistent financial reporting and simplifies profit and loss calculations, whereas multi-currency tracking is reserved for balance sheet items.

Multiple Currencies in one Document #

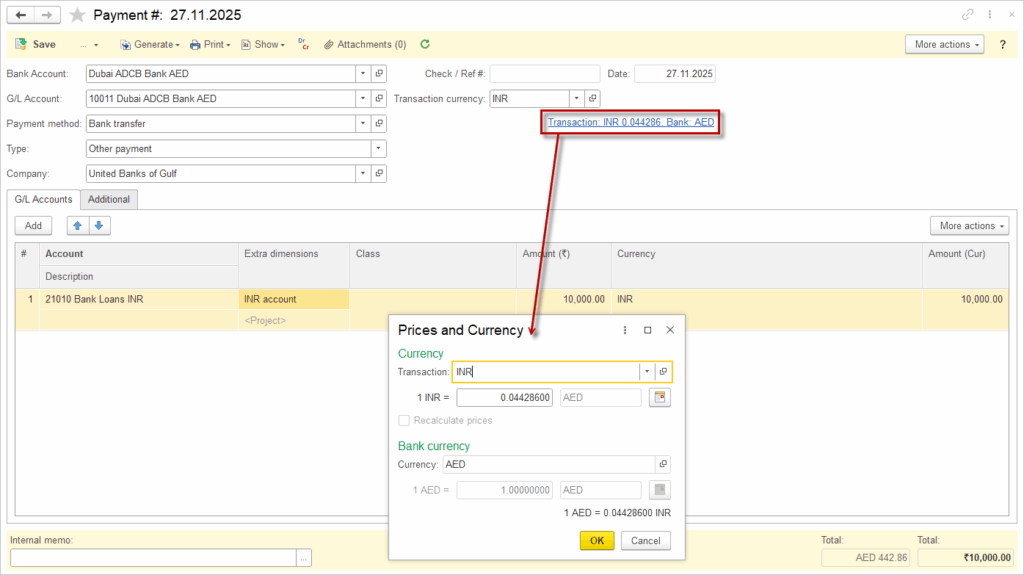

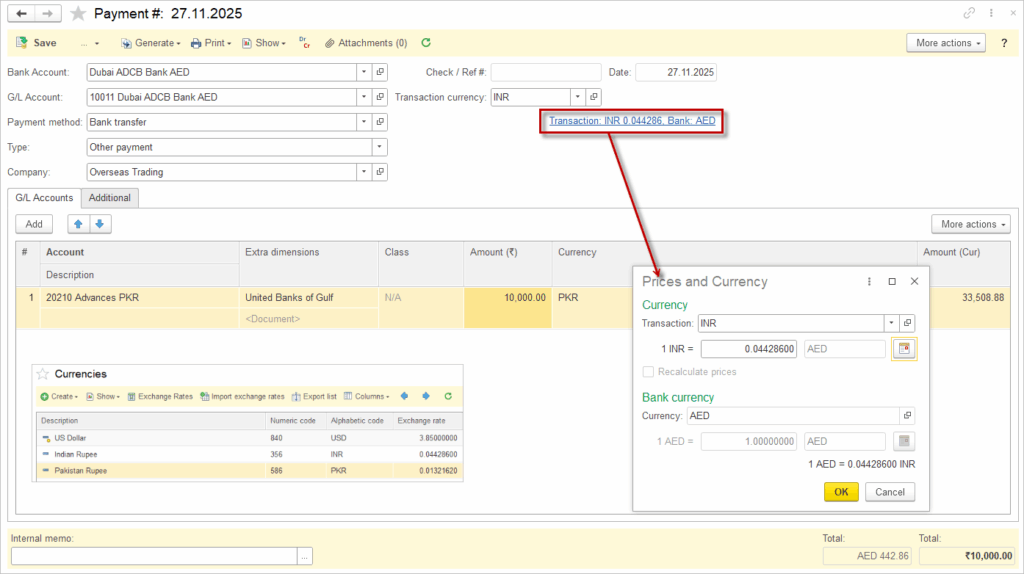

This multi-currency capability is crucial for businesses operating in international environments, enabling them to handle transactions in various currencies seamlessly, maintain precise financial reports, and conform to accounting standards related to currency conversions and exchange rate differences. The system automatically applies the necessary calculations for cross rates, eliminating potential errors and simplifying the accounting process in multi-currency scenarios.Each document in the system can contain up to three currencies:

- The system’s default currency (set in the General settings);

- The currency from the general ledger account involved in postings other than the system default currency,

- Any currency from the bank account involved in postings other than the system default currency.

AccountingSuite provides smooth and error-free posting by leveraging exchange rates and calculating cross exchange rates automatically when required. This ensures that currency conversions and financial postings involving multiple currencies happen accurately without manual intervention or risk of miscalculations.

Three currencies in one document:

Cross rate calculation