Bank accounting in AccountingSuite primarily is the suite of tools to account your cash and non-cash funds, reconcile, and manage your business bank and credit card accounts directly. It’s the operational hub for your day-to-day cash & bank accounts management.

It effectively bridges the gap between your real-world bank activity and your company’s formal accounting records (the General Ledger), making the entire process of bookkeeping and month-end closing much faster and more reliable.

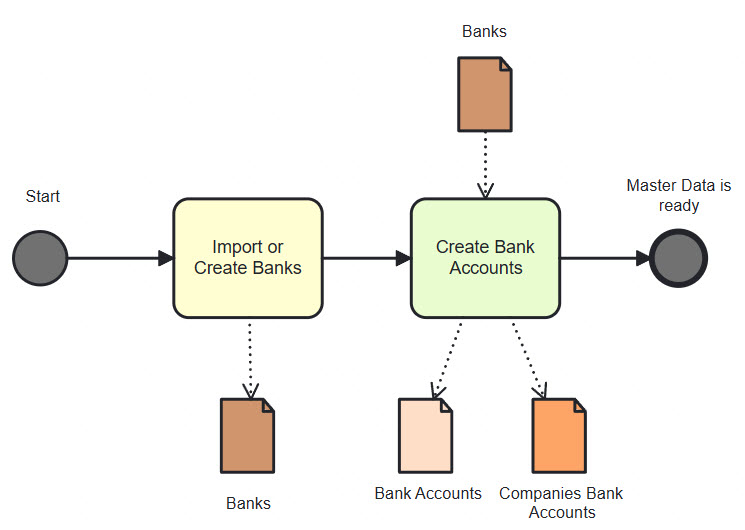

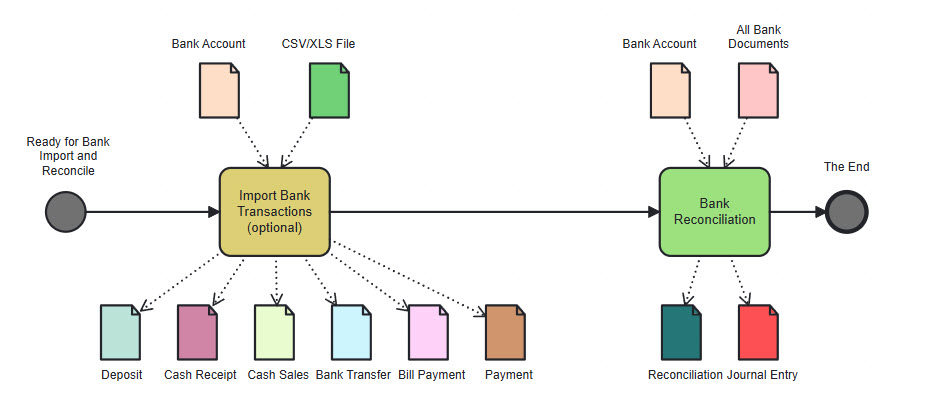

Let’s look at the process of working with the banking module in the diagrams.

First, start with checking Bank settings.

Initialization of master data for lists:

- Banks – the list of banks that you are using

- Bank Accounts – your bank accounts

- Companies’ Bank Accounts – bank accounts for your customers and vendors

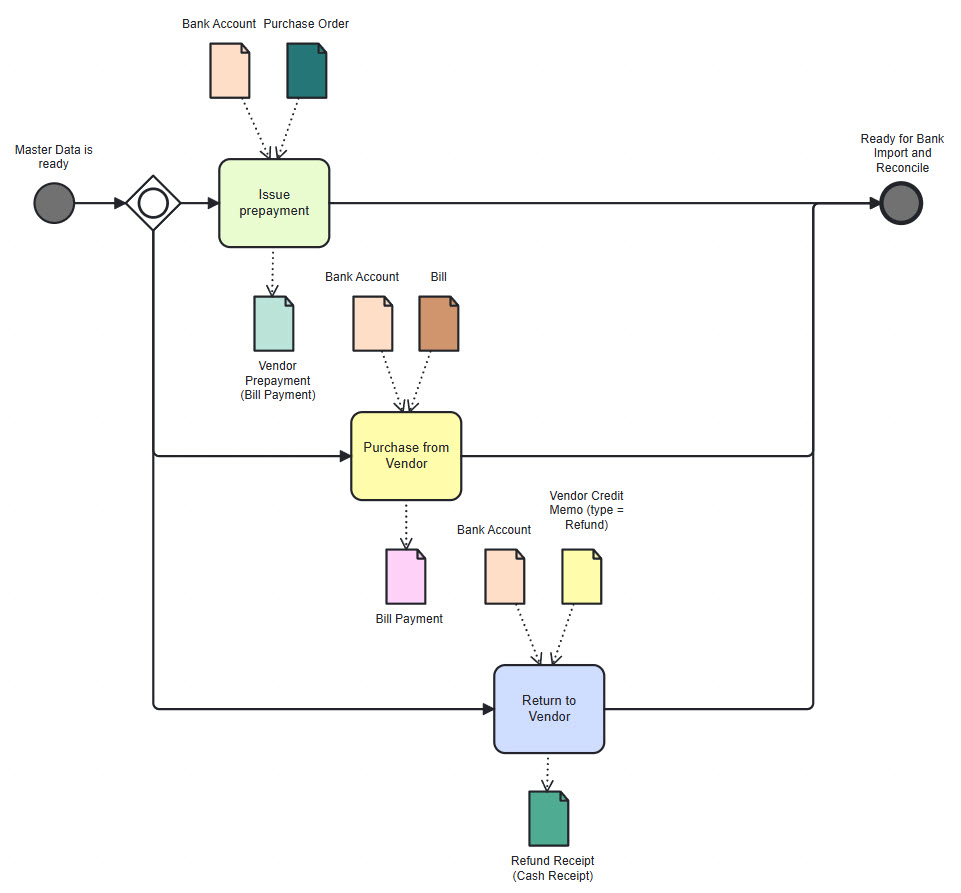

The purchase process on the part of bank documents

- Vendor Prepayment (Bill payment) – it is based on Purchase Order document (Dr Vendor Prepayments Cr Bank Accounts or Post Dated Checks)

- Bill payment – a regular invoice payment, it is based on Bill (Purchase Invoice) document (Dr Account Payable Cr Bank Accounts or Post Dated Checks)

- Refund Receipt (Cash Receipt) – you can generate a refund receipt directly from your Vendor credit memo if you have selected the Refund type (Dr Bank Accounts or Undeposited Funds Cr Account Receivable)

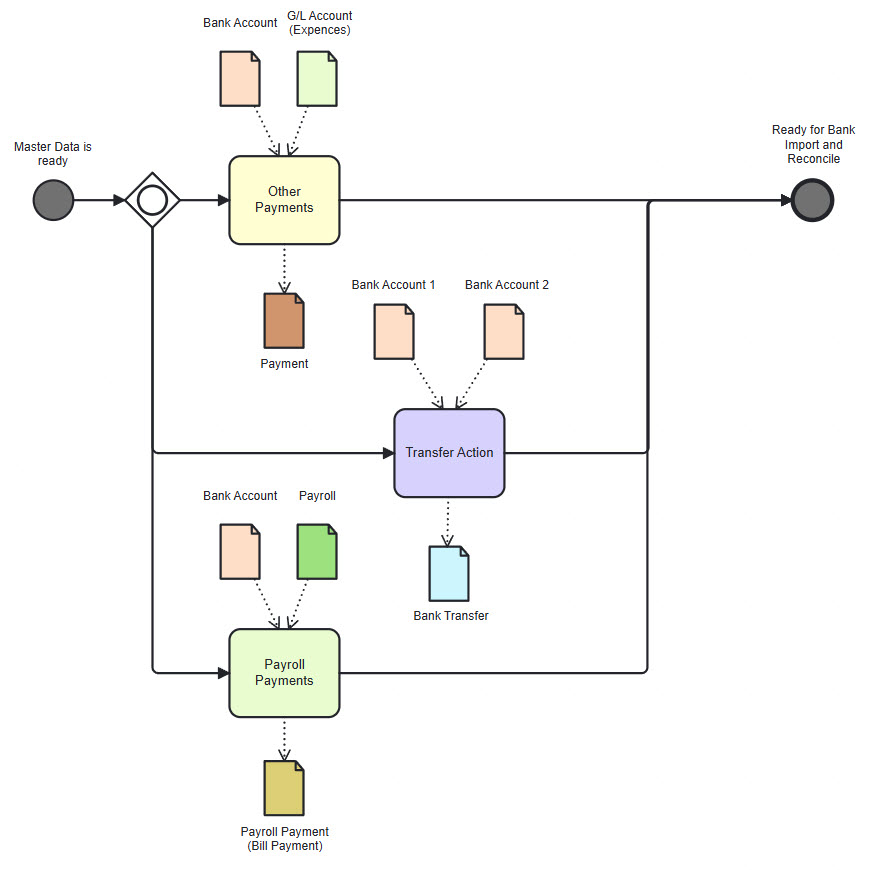

Other operations:

- Payment – payment to other G/L Accounts, for expenses and bank fees (Dr Expenses Cr Bank Accounts or Post Dated Checks)

- Bank transfer – cash transfer from one bank account to another or Post Dated Checks (PDC) debt closure (Dr Bank Account #2 or Post Dated Checks Cr Bank Account #1)

- Payroll Prepayment (Bill payment) – it is based on Payroll document (Dr Payroll Liabilities Cr Bank Accounts)

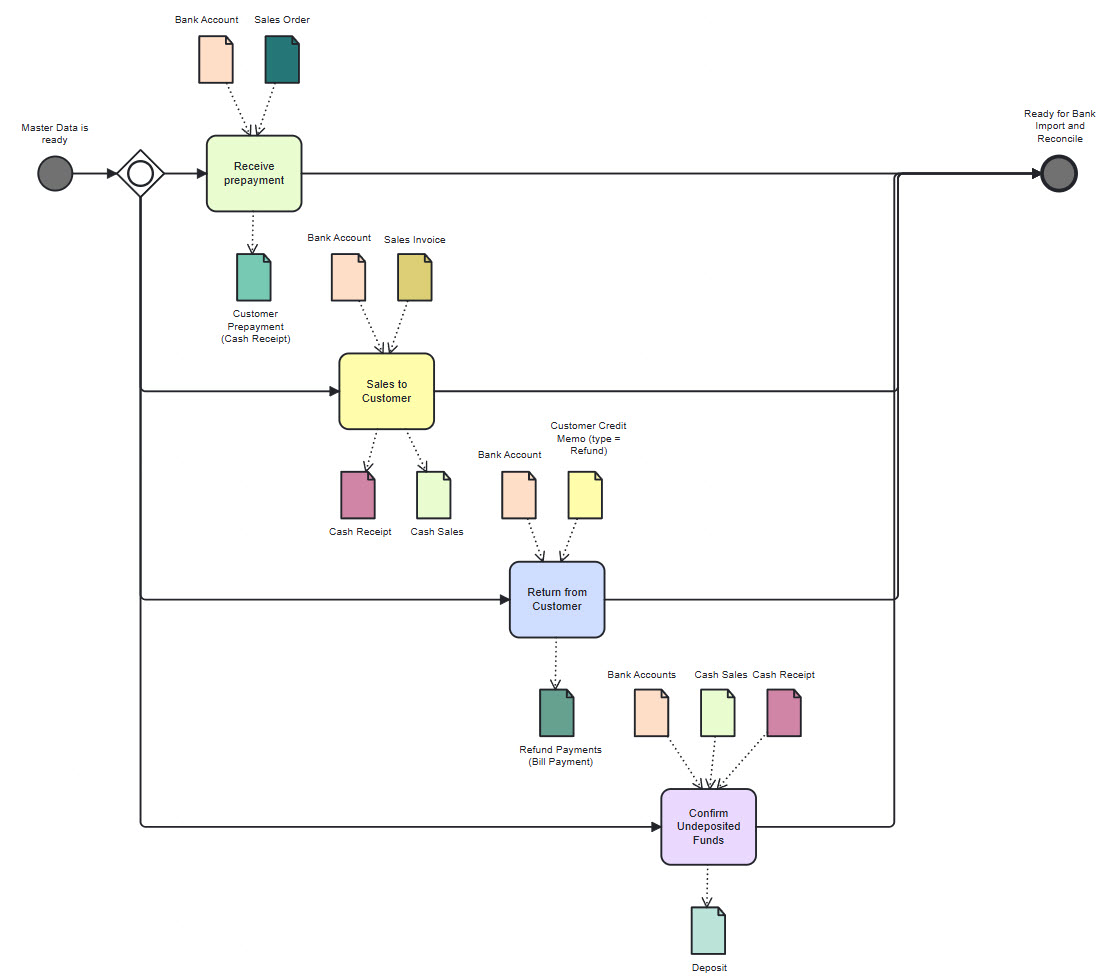

The sale process on the part of bank documents:

- Customer Prepayment (Cash Receipt) – it is based on Sales Order document (Dr Bank Accounts or Undeposited Funds Cr Customer Prepayments)

- Cash Receipt – a regular invoice payment, it is based on Sales Invoice document (Dr Bank Accounts or Undeposited Funds Cr Account Receivable)

- Cash Sales – combine the functionality of Sales Invoices and Cash Receipts in one step (Dr Bank Accounts or Undeposited Funds and other Dr/Cr)

- Refund Payment (Bill payment) – you can generate a refund payment directly from your Customer credit memo if you have selected the Refund type (Dr Account Payable Cr Bank Accounts or Post Dated Checks)

- Deposit – confirm undeposited funds from Cash Sales and Cash Receipt documents (Dr Bank Accounts Cr Undeposited Funds)

Bank statement import process and bank reconciliation at the and of period:

- Import Bank Transactions – If your bank supports uploading bank statements to a file, you can import them daily or weekly.

- Bank Reconciliations – Bank reconciliation ensures financial accuracy by aligning accounting records with bank statements to detect discrepancies, prevent fraud, and maintain compliance. Do this at the end of the reporting period. If you use regular import of bank statements and do not make manual G/L bank entries, then there should be no discrepancies. You can skip this step in this case.

You can find all your bank documents in All Bank Transactions list and you can use these reports to monitor and view bank transactions: