An Apply Vendor Credits document is used to record and apply credits from a Vendor to reduce the amount the company needs to pay in the future. Instead of receiving cash back, these credits can be used to offset upcoming bills or adjust outstanding payments.

This document is important in several accounting cases:

- When credits arise from warranty claims, product defects, or service issues, reducing accounts payable accordingly.

- When the company returns goods or rejects services from a Vendor, requiring a reduction in the amount owed.

- When errors are found in the original invoice, such as overcharging or billing mistakes.

- If the company has overpaid the Vendor and the excess amount needs to be credited for future use.

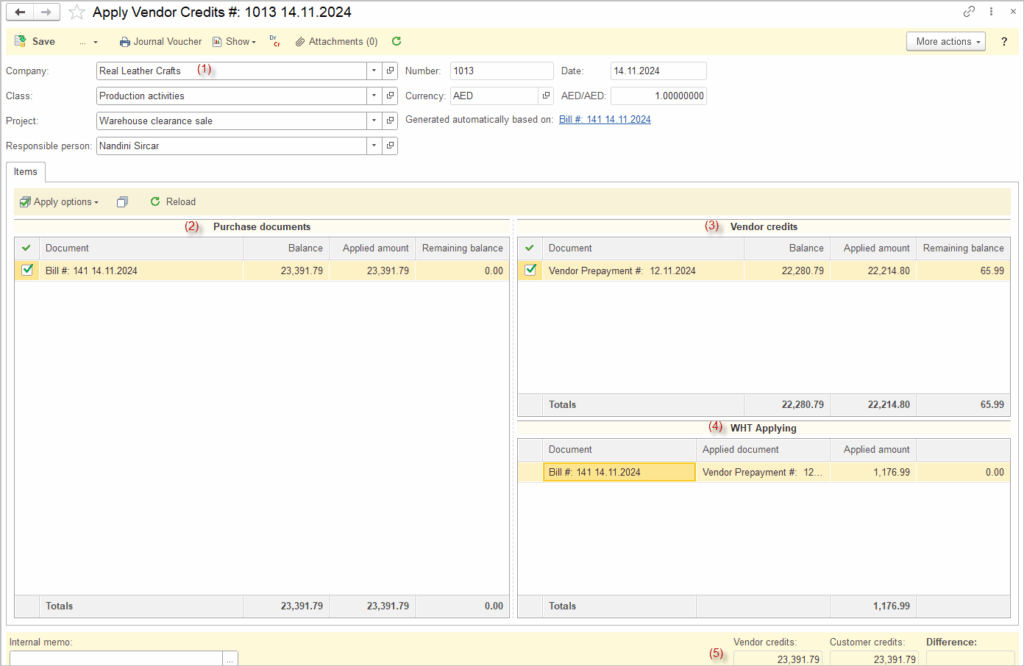

Apply Vendor Credits #

Apply Vendor Credits can be generated automatically if the setting is enabled under the Additional tab in the Bill.

- From the Apply Vendor Credits list screen, Click Create / New.

- Enter the Vendor name (1)

- In the lower half of the screen will be two lists: Outstanding Purchase Documents (2) and Outstanding Vendor Credits (3). If Withholding tax should be applied, WHT Applying (4) list will be displayed.

- Check the checkboxes next to the bills and the credits you would like to apply to the balance.

- Totals of checked bills and checked credits will appear at the bottom on the list (5).

- The difference between the amount applied of the checked credits and the amount applied of checked Purchase Documents will be listed near the top. The difference must be zero before saving. To balance, adjust the amount applied on the bills until the amount applied equals the amount of the credit (or the amount of the credit to apply).

- Enter any additional information needed like the Date, Project, Class or Memo.

- Click Save and Close.

For manually created Apply Vendor Credits documents, restrictions exclude Prepayments and refunds tied to specific Purchase Orders from the available open Vendor credits list. To apply these restricted credits, generate the Apply Vendor Credits document directly from the associated Bill by enabling the relevant setting on the Additional tab.