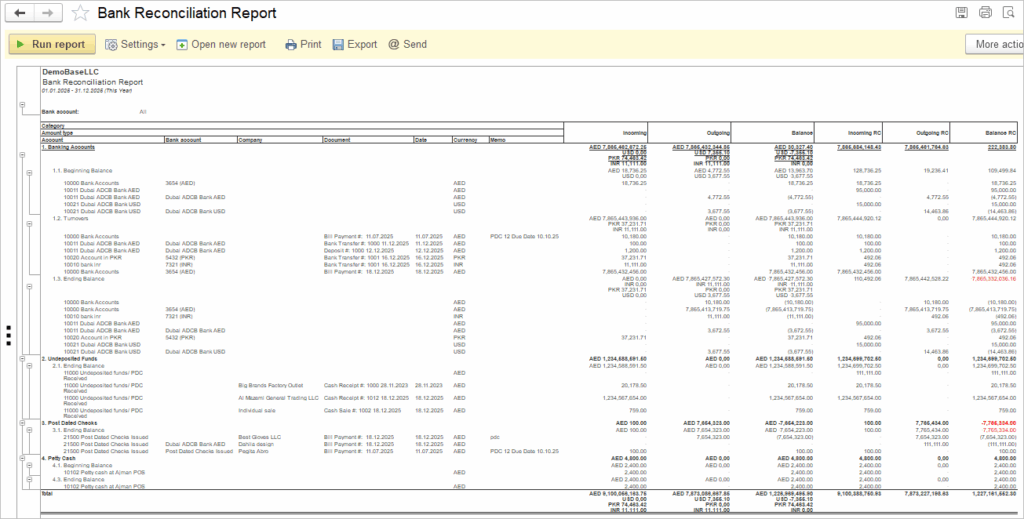

The Bank Reconciliation Report provides a detailed reconciliation of bank-related accounts for the selected period, showing beginning balances, movements, and ending balances in both transaction currency and reporting currency (reporting currency is referred to as RC and is the currency set in the General Settings).

The report is designed to reconcile the balances of bank and cash-related accounts between the General Ledger and external bank records over the specified date range. It presents data in a grouped format where the split is made based on the Account subcategory (for example, Banking accounts, Undeposited funds, Post dated checks, Petty cash).

- Banking Accounts: includes individual bank accounts, with beginning balance, turnovers (incoming and outgoing), and calculated ending balance.

- Undeposited Funds: shows receipts recorded in the system but not yet deposited to a Bank account, with reference to Companies, documents and dates.

- Post Dated Checks: details checks issued or received that are dated after the reporting period, affecting future cash flows rather than current bank balances. Please refer to this article to learn more about PDC treatment.

- Petty Cash: summarizes movements and balances of petty cash accounts, typically representing minor cash expenditures.

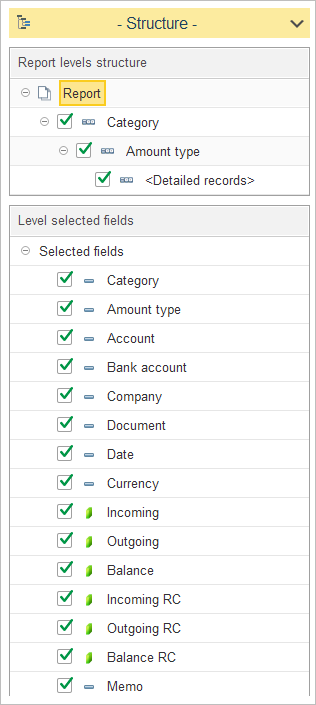

The report structure defines a two-level grouping and the list of fields shown in the detailed lines.

- The top level of the report groups data by Category, which separates main sections such as banking accounts, undeposited funds, post‑dated checks, petty cash, etc.

- Within each Category, data is further grouped by Amount type (for example, beginning balance, turnovers, ending balance), and then detailed records are displayed inside this level.

- The detailed records level includes the following fields: Category, Amount type, Account, Bank account, Company, Document, Date, Currency, Incoming, Outgoing, Balance, Incoming RC, Outgoing RC, Balance RC, and Memo.

- These fields ensure that for every line the user can see the analytical breakdown (account and bank account), document attributes (company, document, date, memo), and monetary indicators in both transaction currency and reporting currency.