Credit memos are issued when customers return goods or you issue credit to them for any reason. They can be added at the end of any of Sales workflows. A credit memo reduces the amount owed to your company and can be issued because the customer has returned all or part of a product on an invoice.

A Customer credit memo may be created based on a Sales Invoice. In this case most of the purchase return fields are automatically filled from the Sales Invoice. However, a Customer credit memo may also be created from scratch.

Return, Refund, and Credit Memo are distinct accounting adjustments for handling customer returns, overpayments, or billing errors. Each serves a specific purpose in recording transactions accurately while managing cash flow and customer balances.

Key Definitions

- A Return typically documents the physical return of goods, adjusting inventory levels and reversing the original sale revenue without immediate cash movement.

- A Refund issues actual money back to the customer, often after payment receipt, for reasons like dissatisfaction or cancellations.

- A Credit Memo reduces the customer’s outstanding balance as a credit for future invoices, rather than returning cash.

When to Use Each

Use Returns for updating stock after physical goods come back, preserving records for audits. Opt for Refunds when immediate cash reimbursement is required to resolve disputes quickly. Choose Credit Memos for loyal customers to encourage repeat business without depleting cash reserves.

Create Customer credit memo from a Sales invoice #

- Navigate to the Sales Invoice.

- Click the Generate button and choose Customer credit memo.

- Enter Ref # (optional).

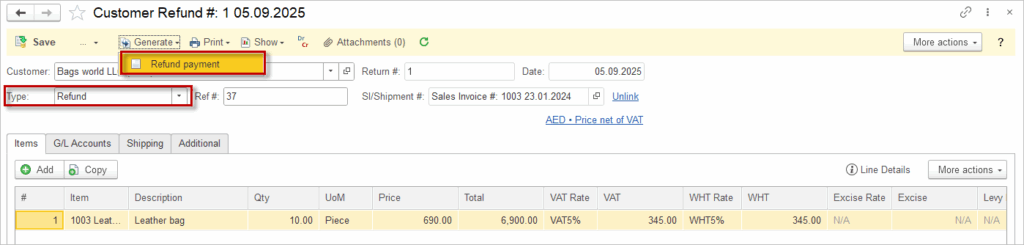

- Select the type of return – Return (just return the product when there was no payment) or Refund (if Customer wants the payment back) or Credit memo (if you want the refund amount to be credited to Customer’s account).

- If returning a partial order, change the quantity being returned.

- Click Save to Save a draft or Post and Close to finish the Sales Return.

Accounting #

Recording a Sales return creates the following transactions in the General Journal:

- Debits: Inventory

- Debits: VAT on sales

- Debits: Sales returns

- Credits: Accounts receivable

- Credits: Cost of goods sold

Refund Payments #

You can generate a Customer refund payment directly from your Customer credit memo if you have selected the Refund type.

Accounting #

Recording a Refund payment makes the following transactions in the General Journal:

- Debits: Accounts payable

- Credits: Bank account

Visual status indicators #

The status indicators in AccountingSuite help users gain a clear overview of the order processing stages within both sales and purchase cycles. By simply glancing at these indicators, users can instantly determine the status of an order without the need to check each one individually. The combination of colors and fill provides a quick and efficient way to understand where each order stands.

In AccountingSuite, there are three distinct colors used to represent status: red, yellow, and green. Each color carries a specific meaning:

- Red indicates that the order is experiencing issues, delays, or is marked as critical.

- Yellow suggests that the order is in progress but might require attention or is awaiting further action

- Green signifies that the order is completed or moving smoothly through the cycle.

The type of indicator depends on the status:

- Empty Circle

- Partially Filled Circle

- Filled Circle

However, the color of the indicator is not solely determined by the status, but rather by the date and whether the document is being completed on time or late. For example, Partially Shipped will always be represented as a partially filled circle, while the color will depend on the deadline:

- Green for on time

- Yellow for approaching the deadline

- Red for overdue

This visual system streamlines monitoring and enhances efficiency by enabling quick decisions and prioritization, ensuring that all orders are managed effectively.

| Icon | Description |

| The return process has started, but no further actions have been taken. | |

| The return is partially processed, indicating that some items have been reviewed or approved. | |

| The return is fully processed, and the customer credit or refund has been successfully issued. | |

| The return is pending, waiting for additional information or approval. | |

| The return is under review, with some items approved, but others need further evaluation. | |

| There is a problem or delay, preventing the return from being completed. | |

| Partial rejection or issue, where some items were rejected or need to be resolved. |