Apply Customer Credits document applies credits to reduce the amount the customer needs to pay in the future. Instead of giving cash back, the credit can be used for next purchases or to clear outstanding bills.

Applying a credit document may be required in the following accounting cases:

- When a customer returns goods or rejects services, requiring a reduction in the amount owed.

- When errors are found in the original invoice, such as clerical mistakes or overcharging.

- If the Customer has overpaid the invoice and the excess amount needs crediting.

- To adjust billing errors or grant discounts after the invoice is issued.

- When sales returns or allowances occur, reducing sales revenue and accounts receivable.

Create Apply Customer credits #

There will be times when you need to apply a credit created for a customer to a related or unrelated invoice. This is done using the Apply Customer Credits function.

Apply Customer Credits can be generated automatically if the setting is enabled under the Additional tab in the Sales invoice.

- Navigate to Sales – Apply Customer Credits and create a new one.

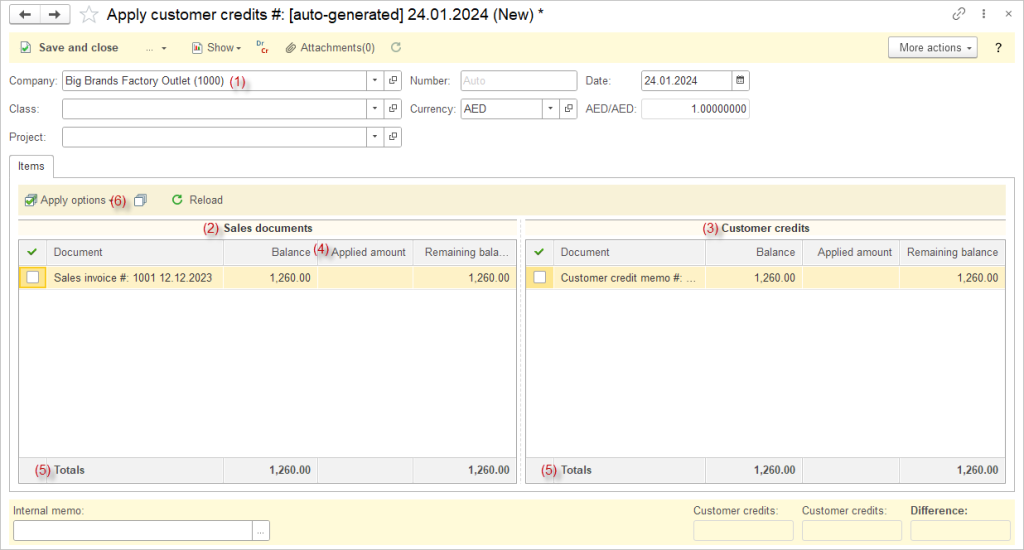

- Choose the Customer (1) and any open sales documents (2) and credits (3) will load.

- Check the checkboxes next to invoices to apply credits to or credits that you’d like to apply.

- Once you have selected all of the invoices or credit memos you’d like to work with, begin selecting items from the opposite column. The amount applied (4) columns will fill in automatically, but can be changed to meet your specific needs. The totals (5) will need to end with a difference of 0. Alternatively, you may use the Apply Options dropdown (6) to automatically fill in the amounts for you.

- Enter any additional information needed like the Date, Project, Class or Memo.

- Save the document.

Accounting #

Recording an Apply customer credits creates the following transactions in the General Journal:

- Debits: Accounts receivable

- Credits: Accounts receivable

For manually created Apply Customer Credits documents, restrictions exclude Prepayments and refunds tied to specific Sales Orders from the available open Customer credits list. To apply these restricted credits, generate the Apply Customer Credits document directly from the associated Sales invoice by enabling the relevant setting on the Additional tab.