Bank Transactions is a central feature for monitoring and managing all financial activities linked to a company’s Bank account. It serves as a comprehensive ledger for all monetary movements, essential for:

- Cash Flow Analysis: Understanding inflows and outflows over time.

- Financial Reporting: Sourcing data for profit/loss statements and balance sheets.

- Audit Trail: Maintaining a clear, searchable record of all transactions for compliance.

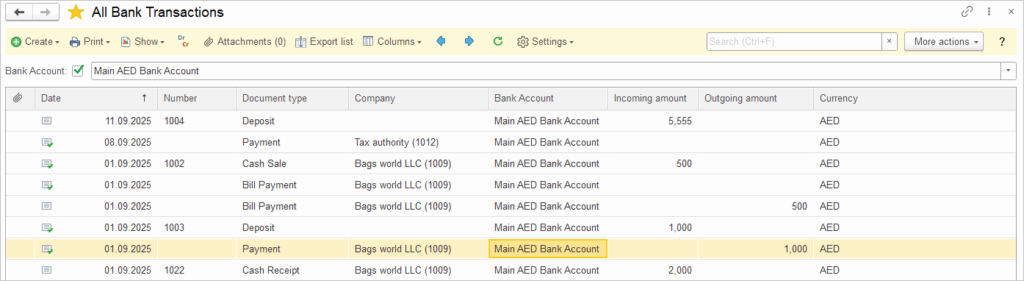

Dropdown filter allows users to switch between different Bank accounts registered in the list.

Transactions are listed in chronological order. Columns can be managed. Each column provides specific information:

- Date: The date the transaction was recorded.

- Number: The reference number from the bank or the internal document number (e.g., Deposit #915). Blank entries are common for electronic payments.

- Document type: Categorizes the transaction (Deposit, Payment, Bill Payment, Cash Receipt etc.). This helps users quickly understand the nature of the activity.

- Company: Identifies the other party involved in the transaction, from the Companies list.

- Bank Account: Specifies which own bank account was affected.

- Incoming/Outgoing Amount: These two columns are crucial for tracking cash flow. Incoming amounts (deposits) increase the account balance, while Outgoing amounts (payments) decrease it.

- Currency: Displays the currency of the transaction.