Tax invoice issued #

Create Tax invoice issued for sales invoice #

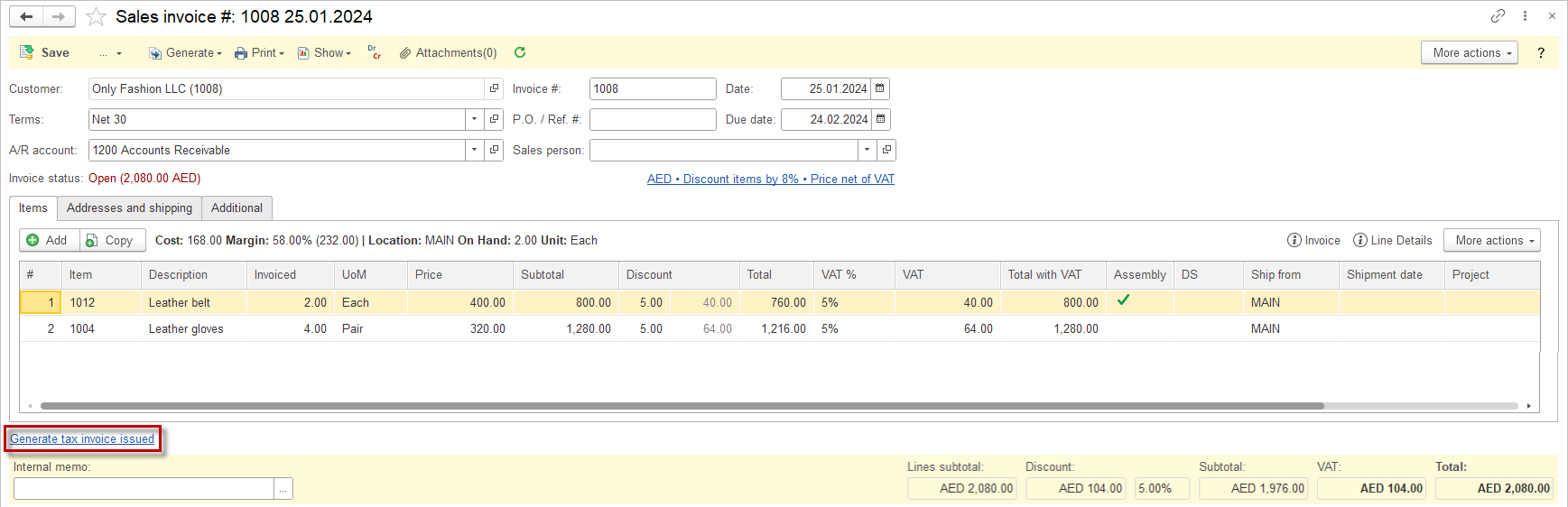

- Open the respective Sales invoice

- Once the Sales invoice is posted, the Generate Tax Invoice Issued panel below becomes active.

- Click Generate Tax Invoice Issued

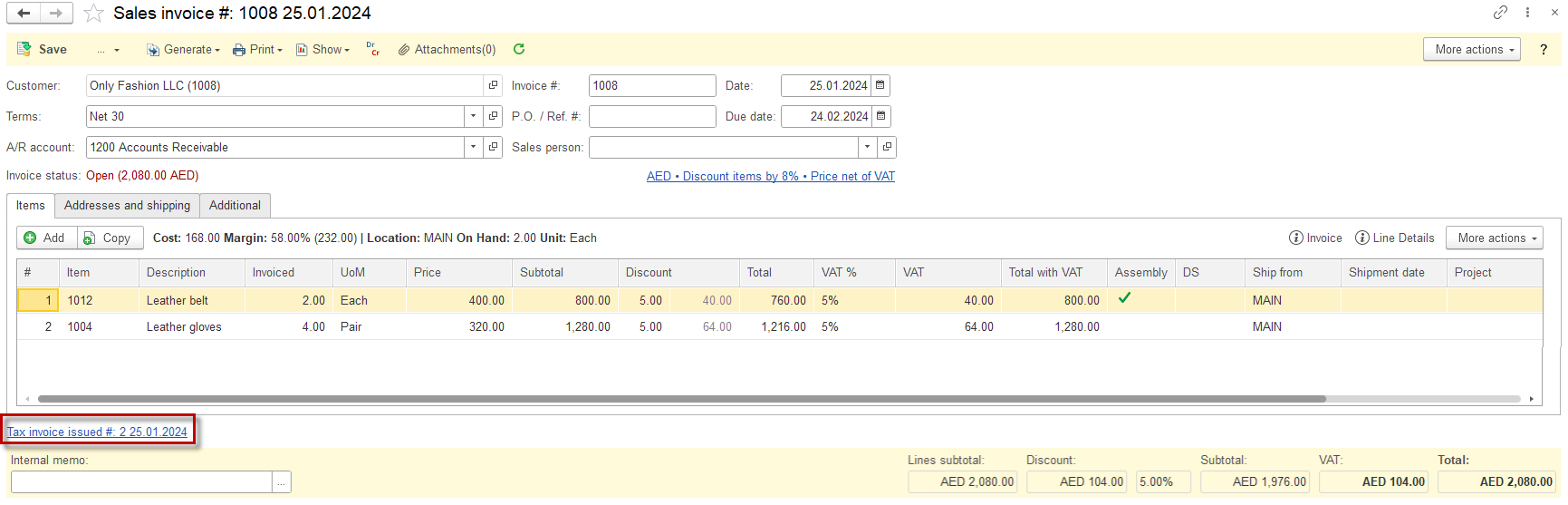

- Generated invoice is accessible via Sales invoice

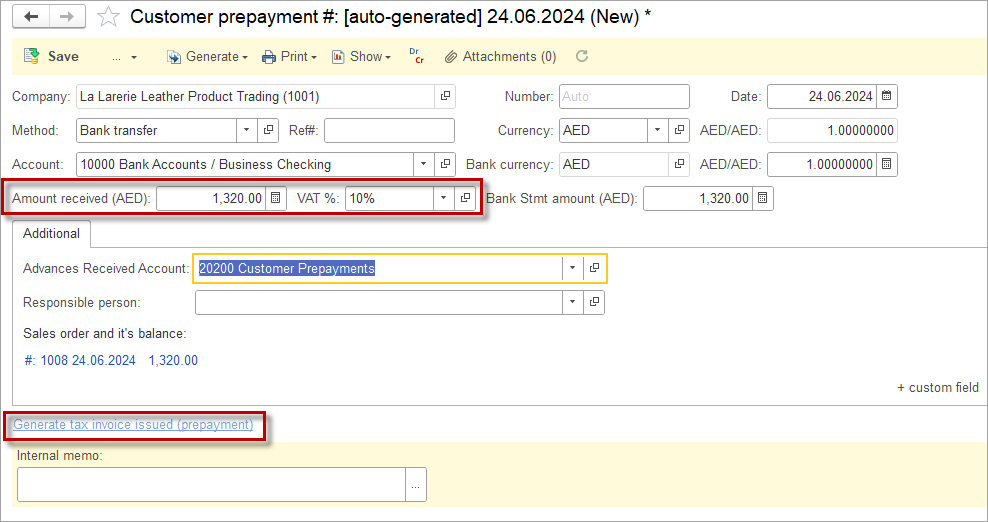

Create Tax invoice issued for prepayment received #

- Open the respective Sales order.

- Click Generate – Prepayment received.

- Specify the amount received and the applicable VAT rate.

- Once the Prepayment is posted, the Generate Tax Invoice Issued panel below becomes active.

- Click Generate Tax Invoice Issued (prepayment).

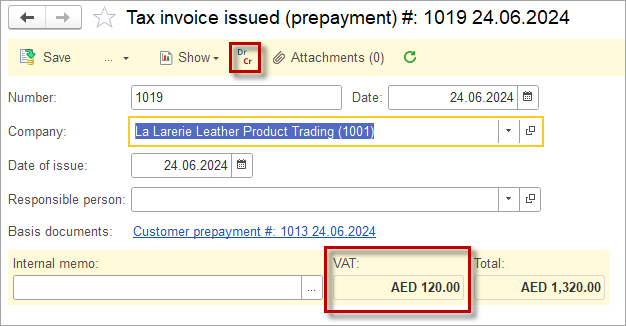

- Tax invoice will open, showing the VAT and the total amount.

- Under Dr Cr button you will find the respective postings. Please note, that the account effected by tax invoice are set in the VAT accounts.

- Save the Tax invoice.

- Generated invoice is accessible via Sales order

Accounting #

Recording a Tax invoice issued creates the following transactions in the General Journal:

- Debits: Outgoing VAT account (from the Accounting settings)

- Credits: VAT calculation account (from the Accounting settings)

Note: If the accounts set in the Accounting settings for Outgoing VAT and VAT calculation are the same, no posting will be made, as Dr equals Cr.

Tax credit note #

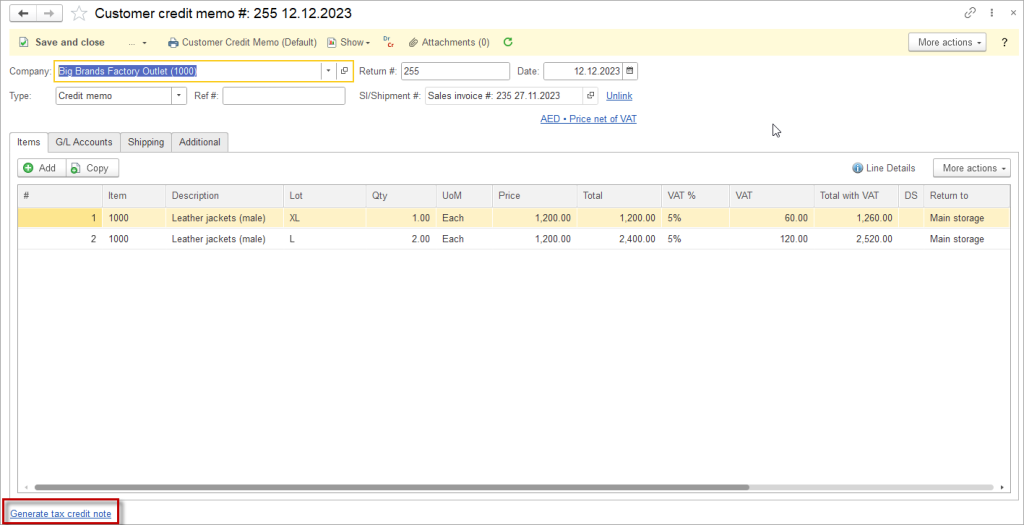

Create Tax credit note #

- Open the respective Customer credit memo

- Once the Customer credit memo is posted, the Generate Tax Credit note panel below becomes active.

- Click Generate Tax Credit note.

- Generated Tax Credit note is accessible via Customer credit memo or under Sales – Tax invoices issued and Tax Credit notes.

Print forms for Tax invoice issued and Tax credit note #

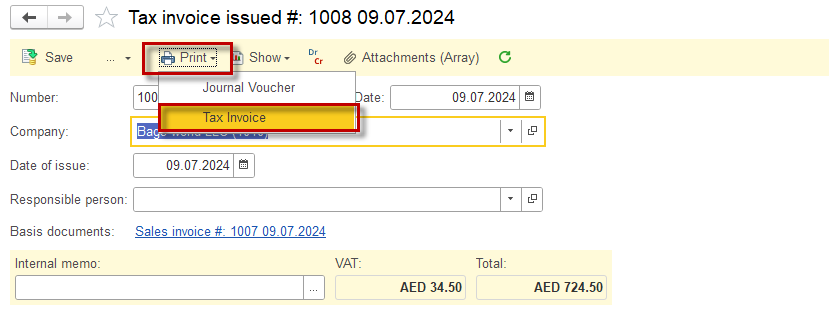

Open Tax invoice print form #

- Open the respective Tax invoice or Tax credit note

- Click Print – Tax invoice (or Credit note for Tax Credit note)

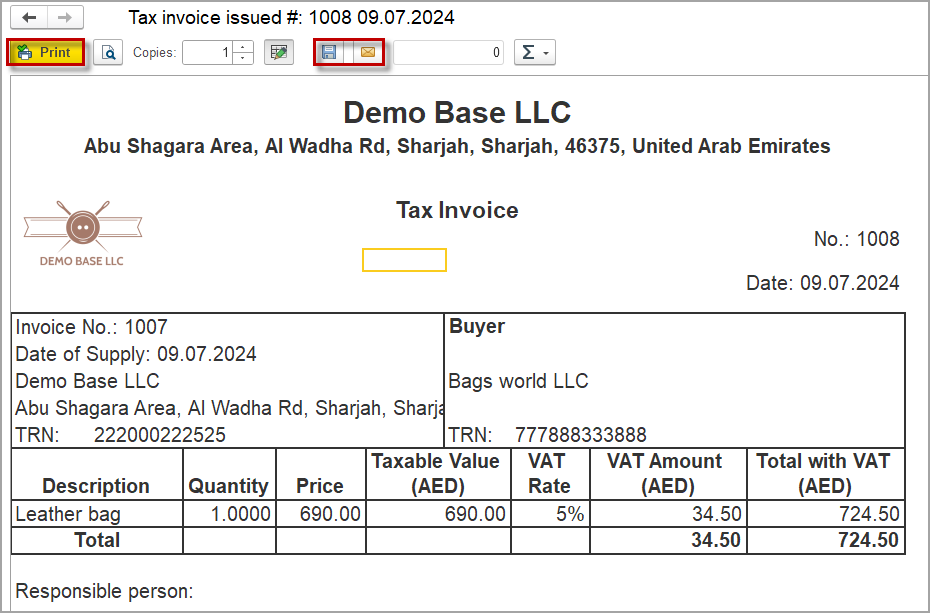

- Print form will open. You can Print, Save or E-mail the Tax invoice.

- To edit the print from according to your business needs please refer to a video tutorial.