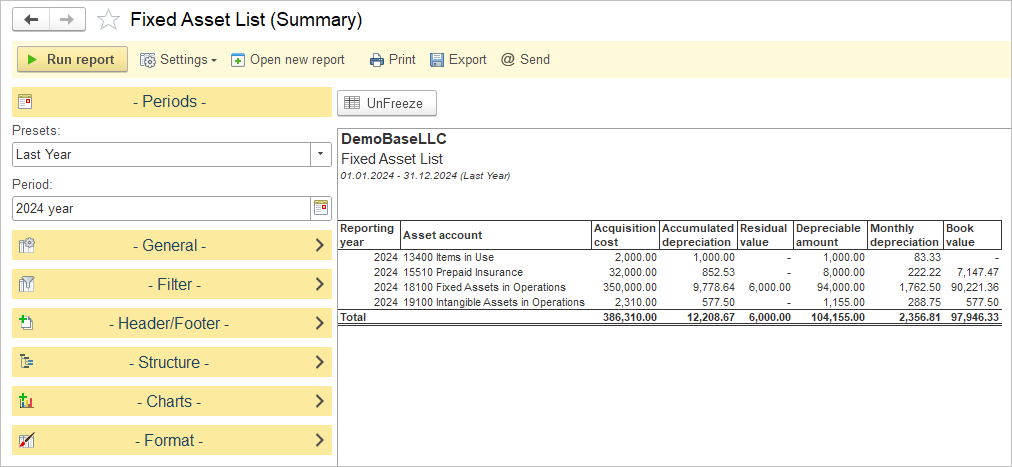

The Fixed Asset List (Summary) report provides a comprehensive overview of an organization’s fixed assets for a specified reporting period. The report allows users to select or define the period for which they want to view the asset data.

The main content of the report includes a detailed breakdown of each asset account with key information such as acquisition cost, accumulated depreciation, residual value, depreciable amount, monthly depreciation, and book value.

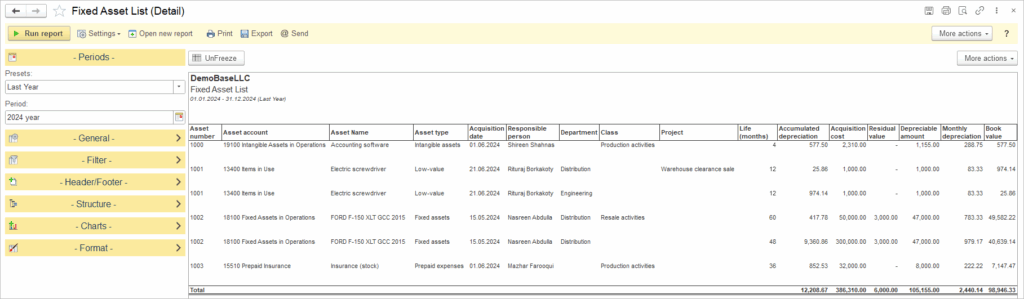

Fixed Asset List (Detail) #

This Fixed Asset List (Detail) report provides a detailed view of the company’s fixed assets for a specified period. The report lists the following information for each asset:

- Asset number: A unique identifier for each asset.

- Asset account: The G/L account to which the asset belongs, which is set in the Asset type.

- Asset Name: Descriptive name of the asset.

- Asset type: Classification such as intangible assets, low-value items, fixed assets, or prepaid expenses.

- Acquisition date: The date when the asset was acquired.

- Responsible person: The individual accountable for the asset.

- Department: The organizational unit in charge of the asset.

- Class: An additional classification related to the asset’s function or category.

- Project: Association with any specific project, if applicable.

- Life (months): The estimated useful life of the asset in months.

- Accumulated depreciation: Total depreciation charged to the asset to date.

- Acquisition cost: The original purchase cost of the asset.

- Residual value: The estimated value remaining after full depreciation.

- Depreciable amount: Value subject to depreciation.

- Monthly depreciation: The depreciation expense allocated monthly.

- Book value: The current net value of the asset after depreciation.