Implementing credit limits and credit statuses for both Customers and Vendors provides a comprehensive financial control framework that supports sustainable business operations and reduces exposure to risk.

For customers, the credit limit is the maximum amount of outstanding debt within which a client may place new orders or receive services without settling existing obligations.

For vendors, a similar mechanism is used to control outstanding payables. The vendor limit sets the maximum allowable liability toward a specific supplier, preventing over-commitment and ensuring that purchases align withany constraints.

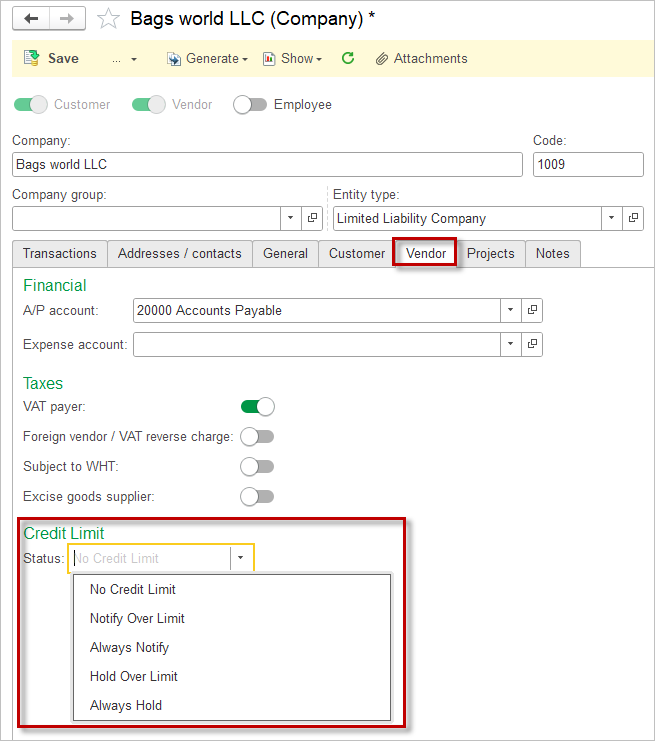

Settings should be made in the Customer/Vendor card:

The system provides for five levels of credit status, which will be assigned to each customer and vendor:

- No Credit Limit: All transactions (sales or purchase) can be saved regardless of credit limit.

- Notify Over Limit: When saving a transaction that will exceed the credit limit, the system issues a warning message. The message can be acknowledged, and the transaction can still be saved.

- Always Notify: A custom warning message will appear for every transaction with a positive balance, regardless of the credit limit. The user can close the message and proceed.

- Hold Over Limit: If a transaction exceeds the credit limit, the system prevents saving it and displays an error. The user must resolve the credit issue before proceeding.

- Always Hold: The system blocks all transactions with a positive balance, regardless of the credit limit, until the credit status is changed.

Currently, the Credit Limit applies to the overall liability of the entire Customer or Vendor. Future releases of AccountingSuite will introduce the option to set credit limits by individual contract or agreement and a separate Credit Limit Report.

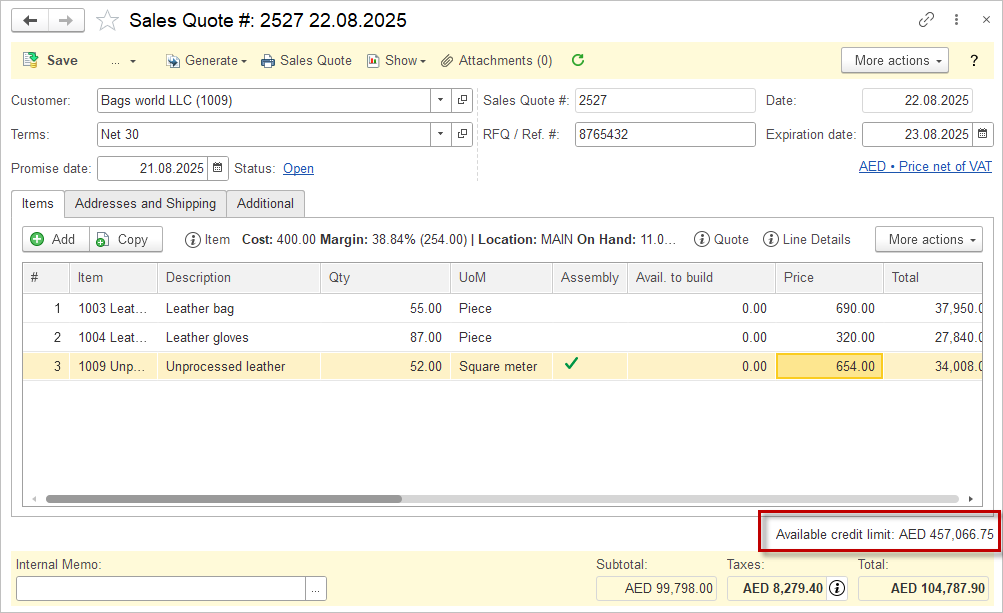

If a Credit Limit is set, it will be displayed in the sales and purchase documents. As the documents are posted, the limit is automatically recalculated based on changes in the liability.

Management accounting documents do not affect the available credit limits, as they reflect intentions to buy or sell rather than actual purchase or sales transactions. The following documents display the Credit Limit, are checked against the limit, but not affect it: Sales Quote, Sales Order, Purchase Order,

Avaialable Credit Limit is recalculated by the following documents: Sales Invoice, Sales Return, Bill, Purchase Return.