Charts of Accounts Overview #

The Chart of Accounts is a listing of all the accounts in the General ledger.

To set up a chart of accounts, one first needs to define the various accounts to be used by the business. It is worthwhile to put thought into assigning the account numbers in a logical way, and to follow specific industry standards, if there are any in place (for example IFRS or GAAP).

Different types of businesses will have different accounts. For example, to report the cost of goods sold a manufacturing business will have accounts for its various manufacturing costs whereas a retailer will have accounts for the purchase of its stock merchandise.

Many industry associations publish recommended charts of accounts for their respective industries in order to establish a consistent standard of comparison among firms in their industry.

Working with the Chart of Accounts #

No two businesses are exactly alike – each business needs a very specific chart of accounts that meets their needs. Because of this, AccountingSuite does not come with a full pre-installed Chart of Accounts, but instead a very minimal required set of accounts to get you started.

There are options to create new accounts, edit the existing ones or inactivate those accounts that are not supposed to be used in the transactions.

Account Categories #

In order to avoid any restrictions and to make the chart of accounts completely flexible, it is necessary to assign a Category to each account within the chart of accounts. This is a mandatory field, which will later help you to easily create the standard financial reports (Balance Sheet, Profit and Loss Statement and Cash Flow Statement).

There are five account categories:

- Assets

- Liabilities

- Equity

- Income

- Expenses

Categories are pre-installed and cannot be changed by the user.

Account subcategories #

Account Subcategory is a further break-down of the Account Category. The list of Subcategories is designed to suit all possible options, however a user may create new Subcategories.

The following account subcategories are available in AccountingSuite:

For the Account Category “Assets”

- Accounts receivable

- Accumulated depreciation

- Advances paid

- Banking accounts

- Creditable taxes

- Incoming VAT

- Incoming VAT (prepayment)

- Inventory

- Inventory not invoiced

- Non-current assets

- Other current assets

- Other long-term assets

- Petty cash

- Prepaid expenses

- Undeposited funds

For the Account Category “Liabilities”

- Accounts payable

- Advances received

- Bank loans

- Credit cards

- Inventory not billed

- Other current liability

- Other long-term liability

- Outgoing VAT

- Outgoing VAT (prepayment)

- Overdraft

- Taxes payable

- Wages payable

For the Account Category “Equity”

- Current year earnings

- Drawings

- Opening balance equity

- Owners’ capital

- Retained earnings

- Stocks

For the Account Category “Income”

- Other income

- Sales

- Sales discounts

- Sales returns and allowances

For the Account Category “Expenses”

- Cost of goods sold

- Expense

- Income tax expense

- Other Expense

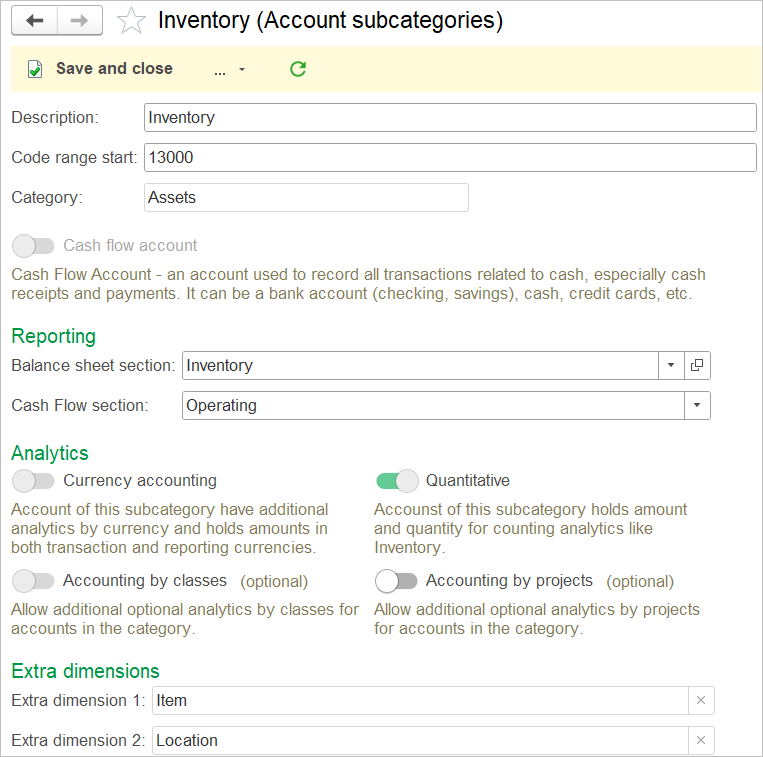

Account Subcategory stores the following information, which is common for the accounts under this Subcategory:

- Currency option (Whether the account is in a currency other than the default currency set in the General Settings)

- Quantitative accounting option

- Cash flow account option

- Two Extra Dimensions

Each Subcategory has a certain standard Extra Dimensions. Extra Dimension is analytic on accounts for which ledger entries are additionally detailed. Analytics can be of various types: inventory items, company, document, and others.

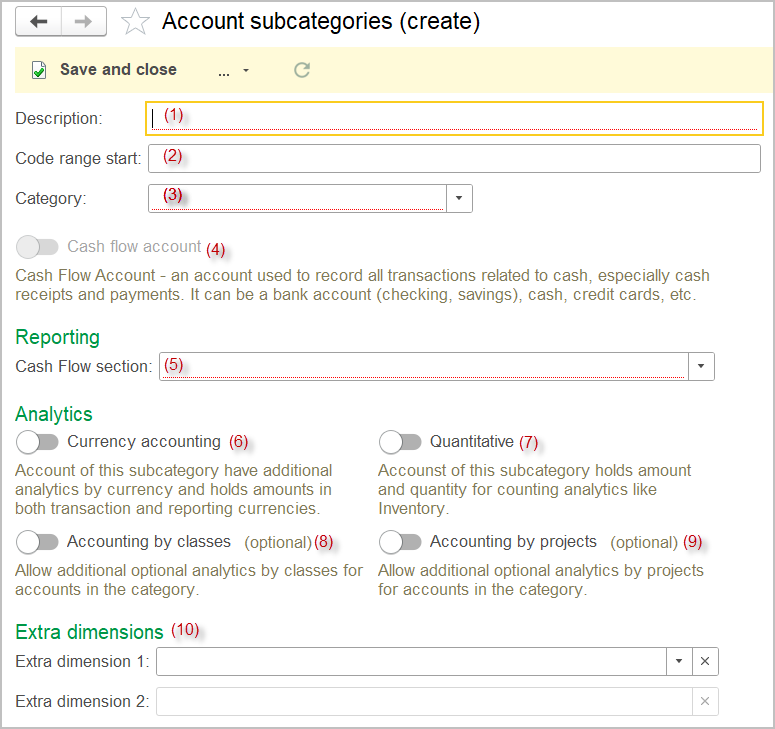

Create Account subcategory #

- Navigate Accounting – Lists – Account Subcategories

2. Select Create new account subcategory and fill in the required information:

- Enter the Description for the Subcategory (1)

- Select the Code range start (2)

- Select the Category (3), there are five available: Assets, Liabilities, Equity, Income and Expenses

- Tick the toggle Cash flow account (4), if accounts under this Subcategory account for cash

- Select the Cash flow section (5) (operating, investing, financing) for the cash flow report

- If the accounts under the Subcategory should contain amount in another currency, than the currency specified in the General settings as a default currency, tick the toggle Currency accounting (6)

- If the accounts under the Subcategory should contain quantitites along with the amounts (for Inventory accounts, for example), tick the toggle Quantitative (7)

- To allow for accounting by Classes, tick the toggle Accounting by classes (8). However, you will be able to change this setting for single account within the Subcategory

- To allow for accounting by Projects, tick the toggle Accounting by projects (8). However, you will be able to change this setting for single account within the Subcategory

- Select the Extra dimensions (10) for the Subcategory

- Save and close the Subcategory

Account Subcategory and Extra Dimension #

Each account within the Chart of Accounts has to be assigned with an Account Subcategory – this is a must. Each Subcategory may have Extra Dimensions – this is an option.

For accounts in the standard AccountingSuite Chart of Accounts, we provide Extra Dimensions that are carefully selected to be the most common and logically relevant for standard business transactions. These Extra Dimensions serve as classification labels or tags that help organize, sort, and analyze transaction data more effectively. They are chosen based on typical business needs to ensure comprehensive yet streamlined tracking and reporting.

Users may create their own Extra Dimensions and assign them the Account Subcategory to suite the specific business needs.

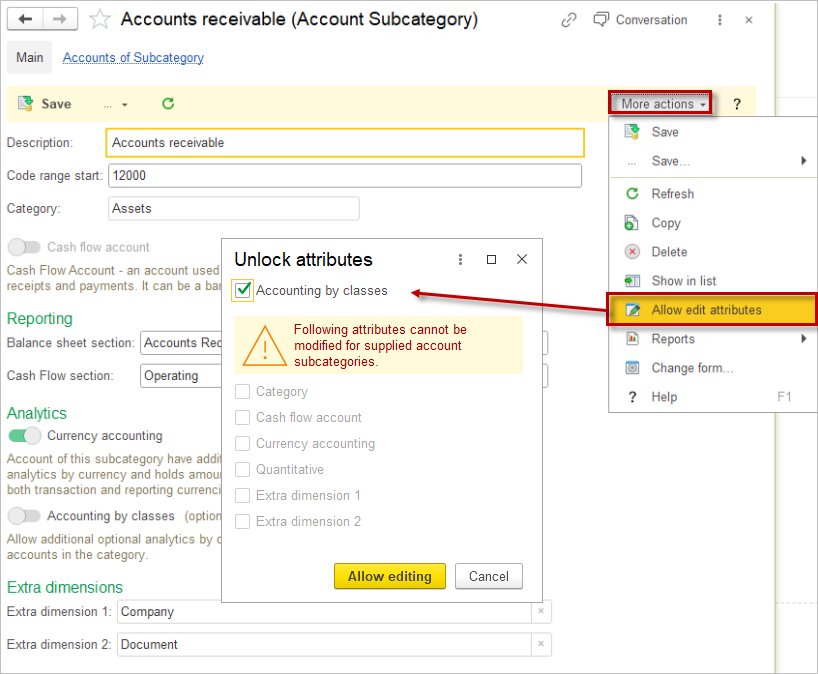

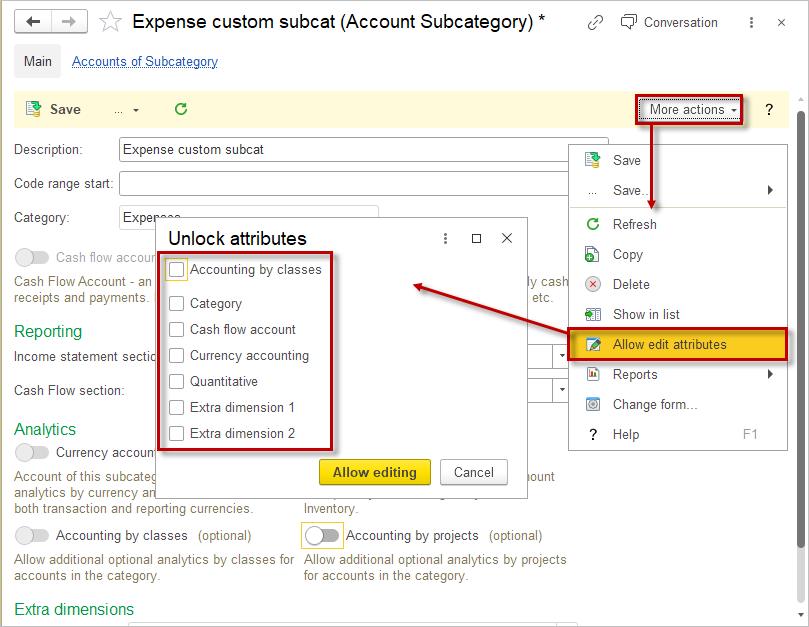

Editing Account Subcategory #

Please note that editing an Account Subcategory assigned to the accounts used in posting may result in data inconsistencies.

- Navigate Accounting – Lists – Account Subcategories.

- Open the Account Subcategory.

- Click More actions – Allow edit attributes.

- For the default Account Subcategories, the only editable setting is Accounting by classes:

5. For the custom Account Subcategories, more options can be changed:

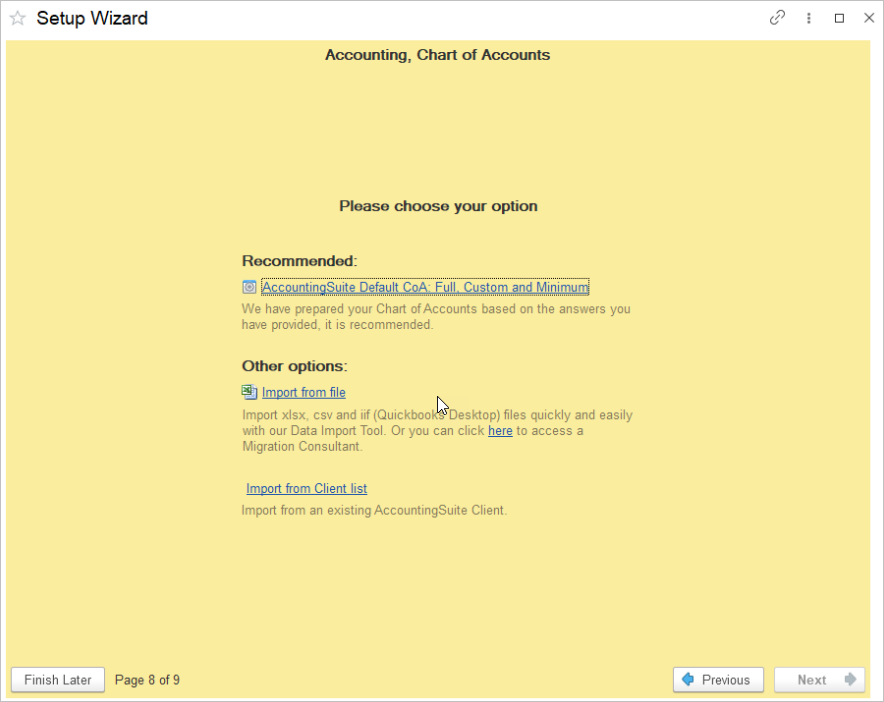

Create Chart of Accounts #

The Setup Wizard provides following options for Chart of Accounts:

- use the default AccountingSuite Chart of Accounts (adjust the default CoA by adding the required accounts or deleting the unnecessary accounts)

- import your own CoA (import at least one account to complete the Setup Wizard)

Default Chart of Accounts #

Click to view the full default AccountingSuite Chart of Accounts

|

Name |

Category |

Subcategory |

Parent |

|

|

10000 |

Bank Accounts / Business Checking |

Assets |

Banking accounts |

|

|

10011 |

Dubai ADCB Bank AED |

Assets |

Banking accounts |

|

|

10021 |

Dubai ADCB Bank USD |

Assets |

Banking accounts |

|

|

10100 |

Cash on Hands / Petty Cash |

Assets |

Petty cash |

|

|

10102 |

Petty cash at Ajman POS |

Assets |

Petty cash |

|

|

10900 |

Other Cash and Cash Equivalents |

Assets |

Banking accounts |

|

|

11100 |

Short-term Bank Deposits / Business Savings |

Assets |

Banking accounts |

|

|

11000 |

Undeposited Funds |

Assets |

Undeposited funds |

|

|

12000 |

Accounts Receivable |

Assets |

Accounts receivable |

|

|

12100 |

Allowance for Doubtful Accounts |

Assets |

Accounts receivable |

|

|

12200 |

Vendor Prepayments |

Assets |

Advances paid |

|

|

13000 |

Inventory |

Assets |

Inventory |

|

|

13100 |

Merchandise |

Assets |

Inventory |

13000 Inventory |

|

13200 |

Raw Materials |

Assets |

Inventory |

13000 Inventory |

|

13300 |

Finished Products |

Assets |

Inventory |

13000 Inventory |

|

13500 |

Other Inventory / Supplies |

Assets |

Inventory |

13000 Inventory |

|

13400 |

Items in Use |

Assets |

Non-current Assets |

13000 Inventory |

|

11200 |

Short-term Investments |

Assets |

Other current asset |

|

|

14000 |

Work in Progress |

Assets |

Other current asset |

|

|

14100 |

Dropship Clearing |

Assets |

Other current asset |

|

|

14900 |

Other Current Assets |

Assets |

Other current asset |

|

|

14400 |

Inventory Shipped Not Yet Invoiced |

Assets |

Inventory not invoiced |

|

|

15000 |

VAT on Purchases |

Assets |

Incoming VAT |

|

|

15010 |

VAT on Purchases Of Goods And Services |

Assets |

Incoming VAT |

15000 VAT on Purchases |

|

15020 |

VAT on Purchases Of Fixed Assets |

Assets |

Incoming VAT |

15000 VAT on Purchases |

|

15030 |

VAT on Prepayments Paid Out |

Assets |

Incoming VAT (Prepayment) |

15000 VAT on Purchases |

|

15400 |

Creditable WHT |

Assets |

Creditable taxes |

|

|

15500 |

Prepaid Expenses |

Assets |

Prepaid expenses |

|

|

15510 |

Prepaid Insurance |

Assets |

Prepaid expenses |

15500 Prepaid Expenses |

|

15520 |

Prepaid Wages |

Assets |

Prepaid expenses |

15500 Prepaid Expenses |

|

15530 |

Prepaid Rent |

Assets |

Prepaid expenses |

15500 Prepaid Expenses |

|

16000 |

Loans Issued |

Assets |

Other long-term assets |

|

|

16100 |

Interest Receivable |

Assets |

Other long-term assets |

|

|

16200 |

Notes Receivable |

Assets |

Other long-term assets |

|

|

16300 |

Employee Loans |

Assets |

Other long-term assets |

|

|

17000 |

Long-term Loans Issued |

Assets |

Other long-term assets |

|

|

17100 |

Long-term Interest Receivable |

Assets |

Other long-term assets |

|

|

17200 |

Long-term Investments |

Assets |

Other long-term assets |

|

|

17500 |

Long-term Receivables |

Assets |

Other long-term assets |

|

|

17900 |

Other Non-current Assets |

Assets |

Other long-term assets |

|

|

18000 |

Fixed Assets |

Assets |

Non-current Assets |

|

|

18100 |

Fixed Assets in Operations |

Assets |

Non-current Assets |

18000 Fixed Assets |

|

18200 |

Accumulated Depreciation |

Assets |

Accumulated depreciation |

18000 Fixed Assets |

|

18300 |

Acquisition and Creation of Fixed Assets |

Assets |

Non-current Assets |

18000 Fixed Assets |

|

18400 |

Asset Disposal |

Assets |

Non-current Assets |

18000 Fixed Assets |

|

19000 |

Intangible Assets |

Assets |

Non-current Assets |

|

|

19100 |

Intangible Assets in Operations |

Assets |

Non-current Assets |

19000 Intangible Assets |

|

19200 |

Accumulated Amortization |

Assets |

Accumulated depreciation |

19000 Intangible Assets |

|

19300 |

Acquisition and Creation of Intangible Assets |

Assets |

Non-current Assets |

19000 Intangible Assets |

|

20000 |

Accounts Payable |

Liabilities |

Accounts payable |

|

|

20010 |

Accounts Payable USD |

Liabilities |

Accounts payable |

|

|

20200 |

Customer Prepayments |

Liabilities |

Advances received |

|

|

21000 |

Loans Payable |

Liabilities |

Bank loans |

|

|

21300 |

Credit Card Payable |

Liabilities |

Credit cards |

|

|

21400 |

Inventory Received Not Yet Billed |

Liabilities |

Inventory not billed |

|

|

22000 |

Payroll Liabilities |

Liabilities |

Wages payable |

|

|

24000 |

Taxes And Other Payables To Authorities |

Liabilities |

Taxes payable |

|

|

24100 |

VAT Calculation |

Liabilities |

Taxes payable |

24000 Taxes And Other Payables To Authorities |

|

24200 |

Payroll Taxes Payable |

Liabilities |

Taxes payable |

24000 Taxes And Other Payables To Authorities |

|

24300 |

Social Security Payable |

Liabilities |

Taxes payable |

24000 Taxes And Other Payables To Authorities |

|

24400 |

WHT liability |

Liabilities |

Taxes payable |

24000 Taxes And Other Payables To Authorities |

|

24500 |

Levies / duties / fees |

Liabilities |

Taxes payable |

24000 Taxes And Other Payables To Authorities |

|

24600 |

Excises |

Liabilities |

Taxes payable |

24000 Taxes And Other Payables To Authorities |

|

24900 |

Income Tax Payable |

Liabilities |

Taxes payable |

24000 Taxes And Other Payables To Authorities |

|

25000 |

Outgoing VAT |

Liabilities |

Outgoing VAT |

|

|

25010 |

VAT on Sales |

Liabilities |

Outgoing VAT |

25000 Outgoing VAT |

|

25020 |

VAT on Imported Goods |

Liabilities |

Outgoing VAT |

25000 Outgoing VAT |

|

25030 |

VAT on Prepayment Received |

Liabilities |

Outgoing VAT (Prepayment) |

25000 Outgoing VAT |

|

21100 |

Interest Payable |

Liabilities |

Other current liability |

|

|

21200 |

Notes Payable |

Liabilities |

Other current liability |

|

|

23500 |

Unearned Revenue |

Liabilities |

Other current liability |

|

|

26000 |

Landed Cost Clearing |

Liabilities |

Other current liability |

|

|

30000 |

Opening Balance Equity |

Equity |

Opening balance equity |

|

|

31000 |

Owners Capital |

Equity |

Owners capital |

|

|

32000 |

Members Capital |

Equity |

Owners capital |

|

|

33000 |

Partners Capital |

Equity |

Owners capital |

|

|

33100 |

Partners Distribution |

Equity |

Owners capital |

|

|

34500 |

Paid-in Capital |

Equity |

Owners capital |

|

|

31100 |

Owners Drawing |

Equity |

Drawings |

|

|

32100 |

Members Drawing |

Equity |

Drawings |

|

|

34200 |

Dividents Paid |

Equity |

Drawings |

|

|

34000 |

Capital Stocks |

Equity |

Stocks |

|

|

34100 |

Preferred Stocks |

Equity |

Stocks |

|

|

39000 |

Retained Earnings |

Equity |

Retained earnings |

|

|

40000 |

Sales |

Income |

Sales |

|

|

42000 |

Discounts and Allowances |

Income |

Sales discounts |

|

|

43000 |

Refunds and Credits |

Income |

Sales returns and allowances |

|

|

44000 |

Sales Returns and Customer Credits |

Income |

Sales returns and allowances |

|

|

50000 |

Cost of Goods Sold |

Expenses |

Cost of goods sold |

|

|

50100 |

Merchant Account Fees |

Expenses |

Cost of goods sold |

|

|

50200 |

Consignment Fees |

Expenses |

Cost of goods sold |

|

|

50600 |

Disassembly Expenses |

Expenses |

Cost of goods sold |

|

|

50700 |

Production Waste |

Expenses |

Cost of goods sold |

|

|

50900 |

Inventory Purchase Variance |

Expenses |

Cost of goods sold |

|

|

51000 |

Shipping and Delivery Expense |

Expenses |

Cost of goods sold |

|

|

55000 |

Discounts Received |

Expenses |

Cost of goods sold |

|

|

56000 |

Purchase Returns and Vendor Credits |

Expenses |

Cost of goods sold |

|

|

60000 |

Operating Expenses |

Expenses |

Expense |

|

|

60010 |

Automobile Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60020 |

Bank Fees |

Expenses |

Expense |

60000 Operating Expenses |

|

60030 |

Computer and Internet Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60040 |

Insurance Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60050 |

Utilities Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60060 |

Telephone Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60070 |

Rent Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60080 |

Postage & Delivery |

Expenses |

Expense |

60000 Operating Expenses |

|

60100 |

Office Supplies |

Expenses |

Expense |

60000 Operating Expenses |

|

60110 |

Licenses and Fees |

Expenses |

Expense |

60000 Operating Expenses |

|

60120 |

Employee Training |

Expenses |

Expense |

60000 Operating Expenses |

|

60130 |

Dues and Subscriptions |

Expenses |

Expense |

60000 Operating Expenses |

|

60140 |

Facility Maintenance |

Expenses |

Expense |

60000 Operating Expenses |

|

60150 |

Cash Over/Short |

Expenses |

Expense |

60000 Operating Expenses |

|

60200 |

Property Taxes |

Expenses |

Expense |

60000 Operating Expenses |

|

60500 |

Payroll Expense – Operating |

Expenses |

Expense |

60000 Operating Expenses |

|

60510 |

Payroll Expense – Operating |

Expenses |

Expense |

60500 Payroll Expense – Operating |

|

60520 |

Payroll Tax Expense – Operating |

Expenses |

Expense |

60500 Payroll Expense – Operating |

|

60530 |

Payroll Service Fee – Operating |

Expenses |

Expense |

60500 Payroll Expense – Operating |

|

60540 |

Paid Time Off – Operating |

Expenses |

Expense |

60500 Payroll Expense – Operating |

|

60550 |

Employee Benefit Expense – Operating |

Expenses |

Expense |

60500 Payroll Expense – Operating |

|

60600 |

Depreciation Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60700 |

Amortization Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

60800 |

Bad Debt |

Expenses |

Expense |

60000 Operating Expenses |

|

60900 |

Miscellaneous Expense |

Expenses |

Expense |

60000 Operating Expenses |

|

70000 |

Selling, General & Administrative Expenses |

Expenses |

Expense |

|

|

70010 |

Advertising and Marketing |

Expenses |

Expense |

70000 Selling, General & Administrative Expenses |

|

70020 |

Commissions Paid |

Expenses |

Expense |

70000 Selling, General & Administrative Expenses |

|

70030 |

Professional Fees |

Expenses |

Expense |

70000 Selling, General & Administrative Expenses |

|

70040 |

Meals and Entertainment |

Expenses |

Expense |

70000 Selling, General & Administrative Expenses |

|

70050 |

Travel |

Expenses |

Expense |

70000 Selling, General & Administrative Expenses |

|

70500 |

Payroll Expense – Administrative Expenses |

Expenses |

Expense |

70000 Selling, General & Administrative Expenses |

|

70510 |

Payroll Expense – Administrative Expenses |

Expenses |

Expense |

70500 Payroll Expense – Administrative Expenses |

|

70520 |

Payroll Tax Expense – S,G&A |

Expenses |

Expense |

70500 Payroll Expense – Administrative Expenses |

|

70530 |

Payroll Service Fee – S,G&A |

Expenses |

Expense |

70500 Payroll Expense – Administrative Expenses |

|

70540 |

Paid Time Off – S,G&A |

Expenses |

Expense |

70500 Payroll Expense – Administrative Expenses |

|

70550 |

Employee Benefit Expense – S,G&A |

Expenses |

Expense |

70500 Payroll Expense – Administrative Expenses |

|

41000 |

Shipping and Delivery Income |

Income |

Other income |

|

|

80000 |

Other Income |

Income |

Other income |

|

|

80100 |

Interest Income |

Income |

Other income |

80000 Other Income |

|

80200 |

Investment Income |

Income |

Other income |

80000 Other Income |

|

80700 |

Unrealized Gain |

Income |

Other income |

80000 Other Income |

|

80800 |

Exchange gain |

Income |

Other income |

80000 Other Income |

|

80900 |

Other Non-operating income |

Income |

Other income |

80000 Other Income |

|

90000 |

Other Expense |

Expenses |

Other Expense |

|

|

90100 |

Interest Expense |

Expenses |

Other Expense |

90000 Other Expense |

|

90200 |

Investment Expense |

Expenses |

Other Expense |

90000 Other Expense |

|

90500 |

Income Tax Expenses |

Expenses |

Other Expense |

90000 Other Expense |

|

90700 |

Unrealized Loss |

Expenses |

Other Expense |

90000 Other Expense |

|

90800 |

Exchange Loss |

Expenses |

Other Expense |

90000 Other Expense |

|

90900 |

Other Non-operating Expense |

Expenses |

Other Expense |

90000 Other Expense |

|

90999 |

Ask Accounting Professional |

Expenses |

Other Expense |

90000 Other Expense |

Numbering in the Chart of Accounts #

Numbering rules for the accounts including the code length, special characters options and other are set in the Account codes.

For very small businesses, three digits may suffice for the account number, though more digits are highly desirable in order to allow for new accounts to be added as the business grows. With more digits, new accounts can be added while maintaining the logical order. For using the default Chart of accounts, the number of digits should be at least 5.

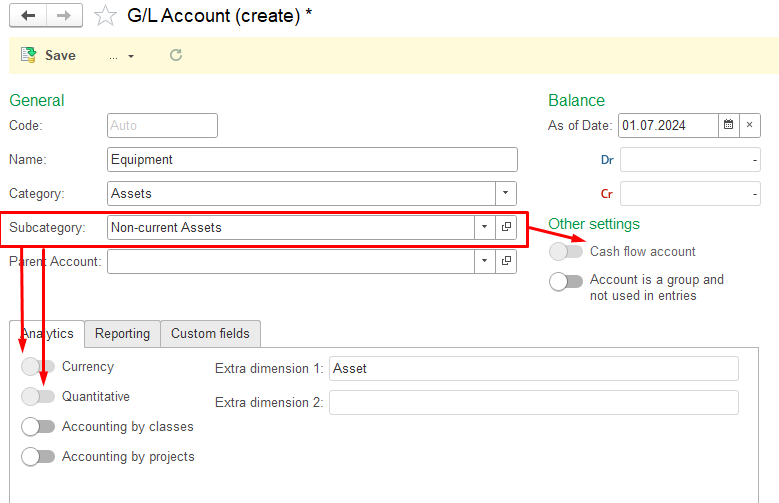

Create new account #

- Navigate to Accounting → Chart of Accounts.

- Click Create.

- Enter an Account Code or leave this field blank to have the system assign a code for you (The code will be assigned in accordance with setting in Account codes).

- Enter a Name for the new account.

- Choose an Account category and Subcategory.

- After the Subcategory is chosen, the toggles Currency, Quantitative, Cash flow account and the Extra dimensions will be adjusted in accordance with the settings within the Subcategory.

- Add the Parent account, if required.

- Tick the toggle Account is a group and not used in entries if you want the account to be just a grouping account with no postings or remaining balances.

- Tick the toggles Accounting by Classes and Accounting by Projects, if required.

- Click Save and Close to finish.

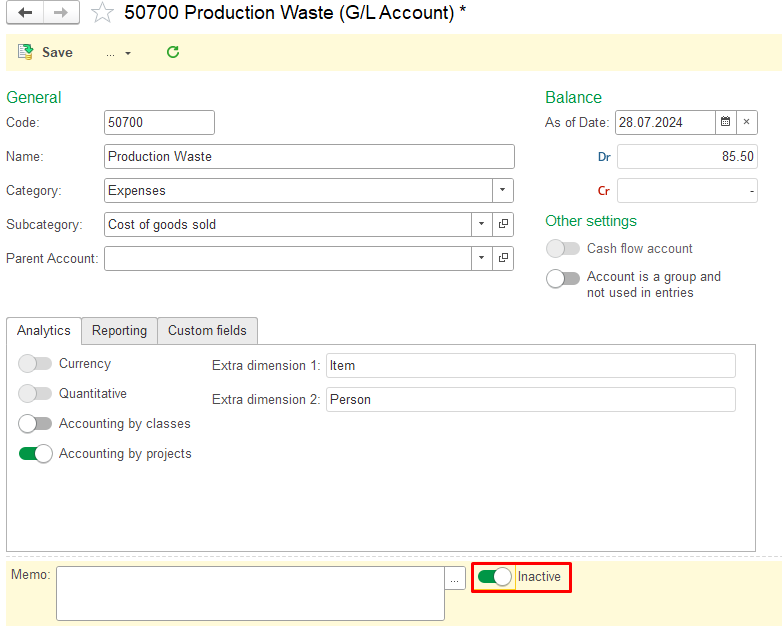

Make the existing account inactive #

Before making the account inactive, make sure to remove it from the default posting accounts in the Accounting settings and from Items / Vendors settings.

- Navigate to Accounting → Chart of Accounts.

- Open the account.

- Tick the toggle Inactivate.

- Save the entry.

You can make the account inactive, even if there is a remaining balance on the account.

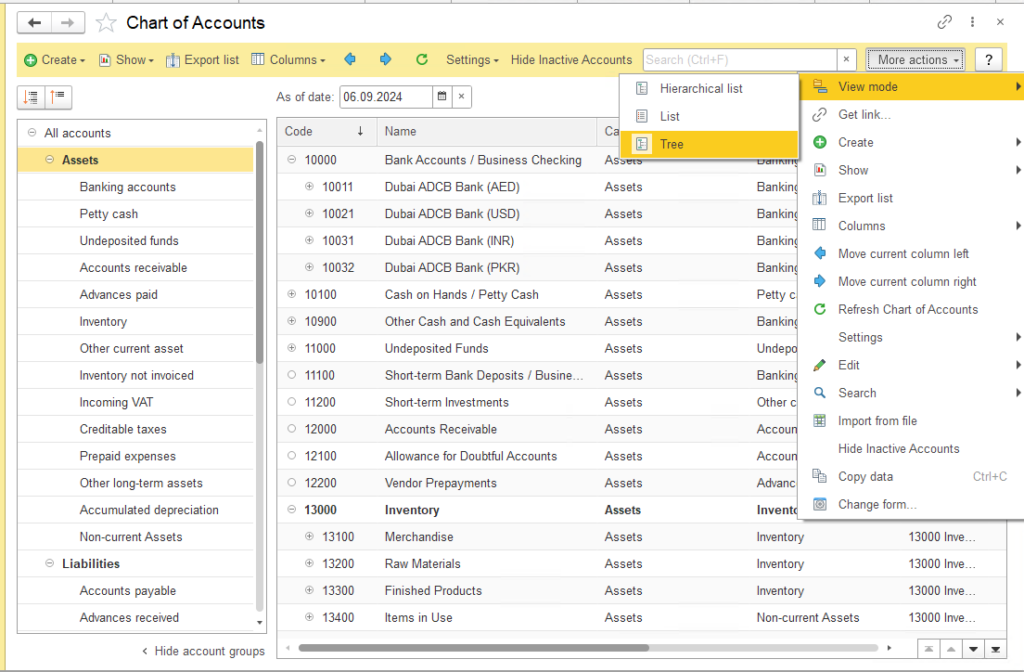

Tree view mode #

Use More actions – View mode for switching between view modes:

- Hierarchical list

- List

- Tree

The Tree mode will help you with structured Chart of accounts.