VAT Details report (and its extended version called VAT Details with Items) is crucial for businesses in VAT jurisdictions, as it provides an overview of the VAT-related transactions and can help to:

- obtain a detailed breakdown of transactions and provide an audit trail;

- identify transaction where no VAT invoice has been posted;

- transparently represent the VAT payable / deductible balance.

Financial columns include: Net Amount, Discount, Taxable Amount, VAT Zero Base, VAT Exempt Base, VAT Amount, and Gross Amount for transparency in tax calculation and reporting.

The report structure includes: transaction date, type and number; Region/State (from the Vendor/Customer Address); Company and Address; Foreign vendor / VAT reverse charge (attribute from the Vendor card); Tax invoice date and number; Asset tax class; VAT Code and Rate; Item and Lot.

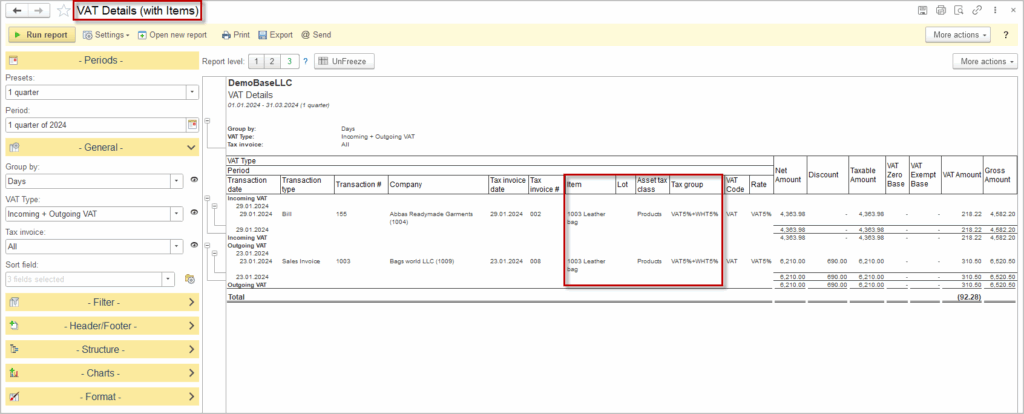

“VAT Details (with Items)” report provides low-level information by displaying columns “Item”, “Lot”, “Asset tax class” and the Item “Tax group”, whereas the “VAT Details” report supresses this information.

Please note: Apply vendor credits and Apply customer credits document are now displayed in the VAT Detail report, as they do not directly influence the VAT payable / deductible balance.

In addition to the common setting that all of the reports have such as time period settings of filtering options, VAT Detail report also has some specific features.

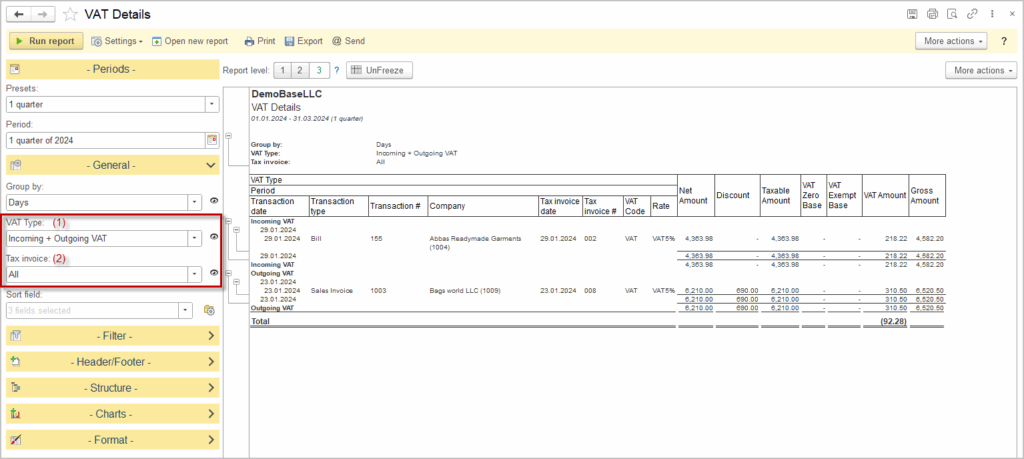

1.The VAT Type (1) selection field allows to select either Incoming VAT or Outgoing VAT or both.

2. In order to identify the documents where no VAT invoice has been posted, the Tax Invoice (2) selection field allows to display the documents where the VAT invoice has been posted (“Not Issued / Not Received” option).

A drill-down is available in the VAT Details report, allowing the user to quickly access the data and, for example, issue the VAT invoice.

Please note: If VAT type is both Incoming and Outgoing, then the Total line represent the difference between them (Incoming less Outgoing). Positive Total is VAT claim against the tax authority, whereas the negative total is the payable to the tax authority.

Using VAT Details Report for VAT Return Preparation #

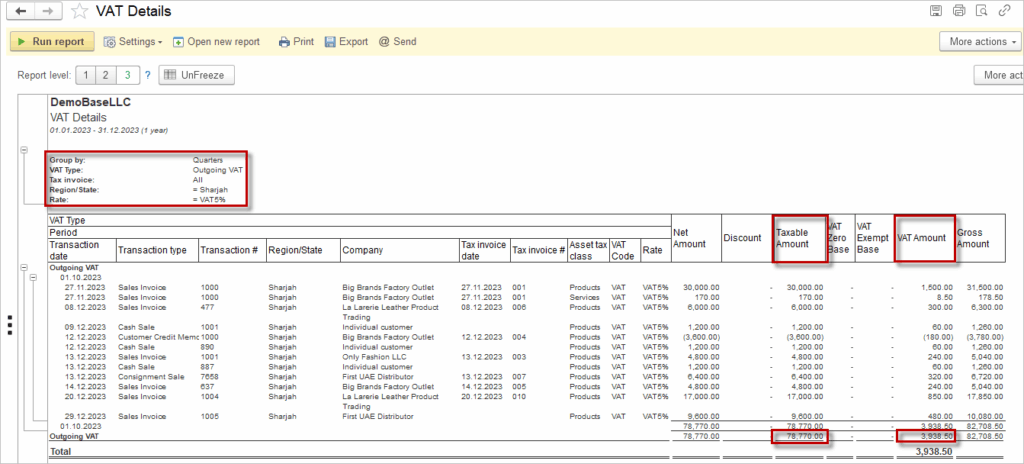

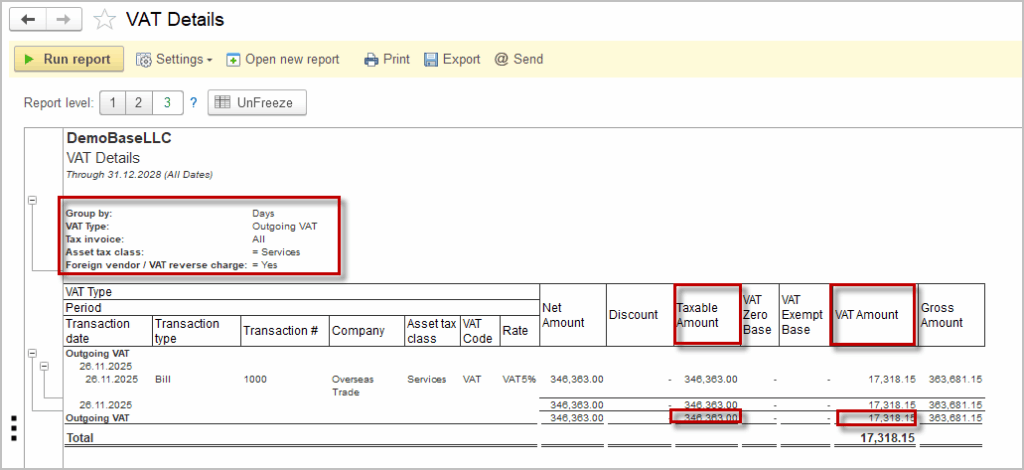

By changing report structure and/or applying filters users can extract specific VAT-related data for reporting purposes. Below are typical scenarios illustrating the required settings:

• Domestic standard rated supplies in a particular State: VAT Type = Outgoing, Select the VAT rate considered standard in your country and filter the State by the desired value;

See the settings

•Supplies subject to reverse charge (services): VAT Type = Outgoing, Foreign Vendor = Yes and Asset Tax Class set to “Services”;

See the settings

•Supplies subject to reverse charge (items): VAT Type = Outgoing, Foreign Vendor = Yes and Asset Tax Class set to “Products”;

•Zero rated supplies: VAT Type = Outgoing, Rate = 0%;

•Exempt supplies: VAT Type = Outgoing,

•Standard rated expenses: VAT Type = Input and apply the relevant standard VAT rate (if required, also set Tax invoice = Issued)

VAT rules vary widely by country and region, so users must ensure their report filters and VAT rates comply with local laws. The examples shown are for guidance only and may not fit every jurisdiction. Always consult your local tax professional to ensure correct application and compliance.