The VAT Adjustment document manages adjustments related to Value Added Tax (VAT) transactions. This document outlines the procedures for correcting discrepancies in VAT calculations, handling adjustments for sales and purchase invoices, and ensuring compliance with tax regulations.

This document not only effects the VAT accounts, but also makes the required entries in the VAT registers and is traceable in the VAT Details report.

Use the VAT Adjustent document to:

- handle the non-deductible VAT;

- separate VAT for capital asset scheme;

- post the opening VAT balances;

VAT Adjustment document is not designed to allocate VAT to the booking value of the inventory.

For this purpose, use the Cost Allocation document instead.

For Reverse charge VAT booking, please refer to this article.

Create VAT Adjustment #

- Navigate to Accounting – VAT Adjustmens.

- Click Create.

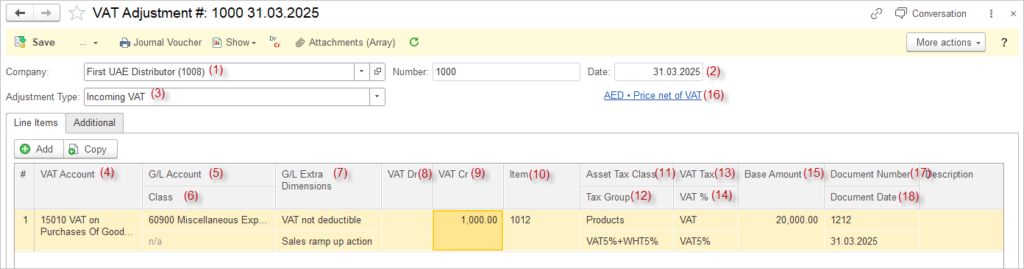

- Select the Company (1). It is not a mandatory field, however, it may be completed in order to provide additional information for inclusion in the VAT Details report.

- Verify or enter the Date (2).

- Select the Entry Type (3) – only accounts with a subcategory matching the entry type will be available for selection in the table section.

- Click the Add button to add a line.

- Select VAT account (4) (only accounts with a subcategory matching the entry type will be available for selection) and corresponding G/L account (5) (no restriction for selections, any can be chosen). If the selected GL account is ticked to Class (6), fill it.

- Enter the Extra dimensions (7) for the selected G/L account.

- Enter either the VAT Dr amount (8) or the VAT Cr amount (9). Only one of these columns may contain numbers.

- Item (10) is not a mandatory field, however, it may be completed in order to provide additional information for inclusion in the VAT Details report.

- Asset Tax Class (11), Tax Group (12), VAT Tax (13) and VAT % (14) are mandatory fields required for VAT register. They will be filled in automatically, if an Item has been entered in the Item (10) column. If an Asset has been selected in the Item column, or if the Item column is left blanc, please fill the mentioned columns by selecting from a drop-down list.

- Base Amount (15) is a mandatory field required for VAT register. It will be calculated automatically after the posting amount in VAT Dr (9) or VAT Cr (10) has been entered. Click the blue hyperlink (16) in the header to change the setting to include VAT in the base amount.

- Document Number (17) and Document Date (18) are not mandatory fields. They man contain the information about the related Tax credit / debit note.

- Additional tab contains Responsilbe person, Class and Project field. Class and Project from this tab may overwrite any Class and Project in the line items.

- Save the document.

Please refer to the following article describing accounting cases where VAT should be adjusted:

Accounting #

Recording a VAT adjustment document creates the following transactions in the General Journal:

- Debits: any specified account

- Credits: any specified account