Required settings #

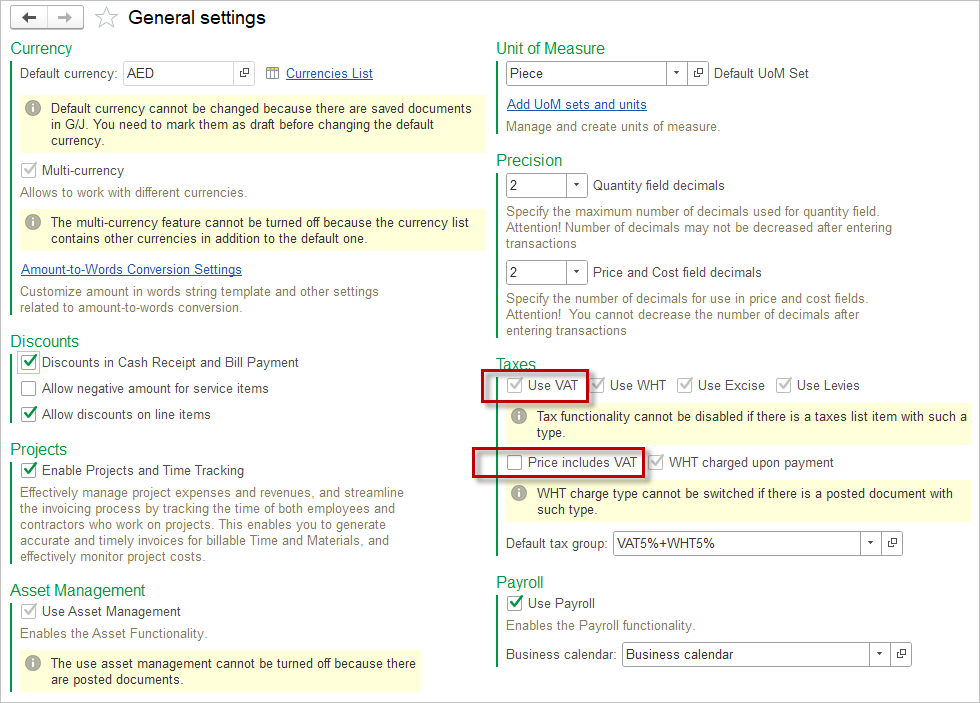

VAT functionality can be enabled in the General settings, along with the default VAT rate. The default rate can be changed in the Sales documents.

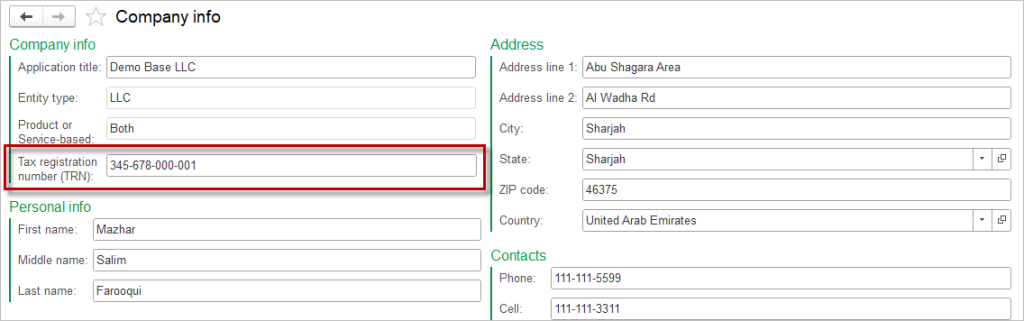

Enter your company’s tax registration number in the Company info.

VAT accounts #

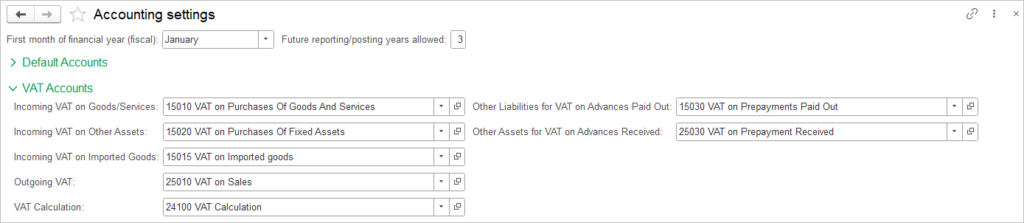

As with any other account, the default VAT accounts are specified in the Accounting settings. However, there are seven different accounts to set:

- VAT on purchase of goods and services – effected by purchases of inventory and services;

- VAT on purchase of other assets – effected by purchases of assets other than inventory and services (e.g. fixed assets);

- VAT on imported goods – effected by purchases made from foreign vendor;

- Output VAT – effected by sales of goods and services;

- VAT calculation – designed to represent the VAT balance claimable (Debit balance) or VAT liability against the authority (Credit balance);

- VAT on prepayments paid out – effected by outgoing upfront payment;

- VAT on prepayments received – effected by incoming upfront payment .

AccountingSuite strongly recommends isolating the VAT on prepayments accounts from the Incoming/Outgoing VAT accounts for the following reasons:

- By isolating VAT on prepayments in a separate account, businesses can ensure that their VAT calculations are precise. This separation helps in tracking the VAT associated with prepayments distinctly from other transactions.

- When it comes time to reconcile VAT returns, having a dedicated account for prepayments simplifies the process. It allows for easier identification of amounts that need to be reported or reclaimed.

- Maintaining separate accounts for VAT on prepayments can facilitate compliance with tax regulations. In the event of an audit, having distinct records makes it easier to demonstrate accurate reporting and adherence to tax laws.

- By clearly delineating VAT on prepayments, businesses reduce the risk of errors that could lead to underreporting or overreporting of VAT, thus minimizing potential penalties from tax authorities.

AccountingSuite offers the following different options to account for VAT:

Option 1 #

Sales: separate accounts for primarily accounting for VAT (VAT on purchase of goods and services, VAT on prepayments paid out) and for VAT Calculation.

Purchases: separate accounts for primarily accounting for VAT (VAT on sales, VAT on prepayments received) and for VAT Calculation.

The balance of the VAT calculation account is therefore relevant on any day during the tax period and no additional action is required as part of the tax period close. VAT is not deductible until a supporting document is received from the supplier, minimising the risk of over-deductible VAT.

Purchase with a prepayment:

Prepayment paid out → Tax invoice received → VAT Calculation

Bill → VAT on purchases of goods and services → Tax invoice received → VAT Calculation

Apply vendor credit → -VAT Calculation

Purchase with no prepayment:

Bill → VAT on purchases of goods and services → Tax invoice received → VAT CalculationSales with prepayment received:

Prepayment received→ Tax invoice issued → VAT Calculation

Sales invoice → VAT on sales → Tax invoice issued → VAT Calculation

Apply customer credit → -VAT Calculation

Purchase with no prepayment received:

Sales invoice → VAT on sales → Tax invoice issued → VAT CalculationOption 2 #

Sales: one common account for primarily accounting for VAT (VAT on purchase of goods and services, VAT on prepayments paid out) and for VAT Calculation.

Purchases: one common account for primarily accounting for VAT (VAT on sales, VAT on prepayments received) and for VAT Calculation.

All VAT entries are made directly to the VAT calculation account (VAT calculation). Tax accounting documents (tax invoice issued/received, tax credit note, tax debit note) do not make any entries as the debit and credit are the same (Dt VAT calculation, Ct VAT calculation) and are only created for the purpose of generating print forms. VAT on advances received/issued is not taken into account.

The disadvantages of this option can be considered as the risk of overstating the deductible VAT, since the debit balance on the VAT calculation account (VAT calculation) can be created even in the absence of supporting tax accounting documents (tax invoice received and tax debit note), as well as the lack of correct accounting of VAT on advances paid/received.

Sales:

Sales invoice → VAT Calculation

Purchase:

Bill → VAT Calculation

Option 3 #

Sales: separate accounts for primarily accounting for VAT (VAT on purchase of goods and services, VAT on prepayments paid out) and for VAT Calculation (as in Option 1).

Purchases: one common account for primarily accounting for VAT (VAT on sales, VAT on prepayments received) and for VAT Calculation (as in Option 2).

Assuming that the issuance of the document confirming the outgoing VAT (tax invoice issued or tax credit note) can be fully controlled by the company, the sales documents charge the VAT directly to the VAT calculation account, bypassing the VAT on sales account and the VAT on prepayments received accounts.

Tax Invoice Issued & Tax Credit Note #

Please refer to the Tax Invoice Issued & Tax Credit Note article of the knowledge base.

Tax Invoice Received & Tax Debit Note #

Please refer to the Tax Invoice Received & Tax Debit Note article of the knowledge base.

VAT return #

Please refer to the VAT return article of the knowledge base.

Comprehensive example of VAT document flow #

The tables below show the accounting postings for all documents in the particular document flow, including the VAT-related postings.

Sale with a total of 8000, a prepayment received in the amount of 3000, and a customer credit memo posted in the amount of 1500 after the customer credits have been applied. VAT applied at 5% rate.

| Document | Debit side | Amount | Credit side | Amount |

| Sales order prepayment | Dr Bank account | 3000 | Cr Prepayments received | 3000 |

| Tax invoice issued (from sales order prepayment) | Dr VAT on prepayments received | 143 | Cr VAT Calculation | 143 |

| Sales invoice | Dr COGS Dr Accounts receivable | 7000 8000 | Cr Inventory Cr Sales Cr VAT on sales | 7000 7691 381 |

| Tax invoice issued (from sales invoice) | Dr VAT on sales | 381 | Cr VAT Calculation | 381 |

| Apply customer credits | Dr Prepayments received Dr VAT Calculation | 3000 143 | Cr Accounts receivable Cr VAT on prepayments received | 3000 143 |

| Customer credit memo | Dr Inventory Dr VAT on sales Dr Sales | 1000 71 1429 | Cr COGS Cr Accounts receivable | 1000 1500 |

| Tax credit note (from Customer credit memo) | Dr VAT Calculation | 71 | Cr VAT on sales | 71 |

| Tax payment | Dr VAT Calculation | 310 | Cr Bank account | 310 |

Purchase with a total of 4000, a prepayment paid in the amount of 2000, and a vendor credit memo posted in the amount of 500 after the vendor credits have been applied. VAT applied at 5% rate.

| Document | Debit side | Amount | Credit side | Amount |

| Prepayment paid out | Dr Prepayments paid out | 2000 | Cr Bank account | 2000 |

| Tax invoice received (from purchase order prepayment) | Dr VAT Calculation | 95 | Cr VAT on prepayments paid out | 95 |

| Bill | Dr VAT on purchases of goods and services Dr Inventory | 190 3810 | Cr Accounts payable | 4000 |

| Tax invoice received (from bill) | Dr VAT Calculation | 190 | Cr VAT on purchases of goods and services | 190 |

| Apply vendor credits | Dr Accounts payable Dr VAT on prepayments paid out | 2000 95 | Сr Prepayments paid out Cr VAT Calculation | 2000 95 |

| Vendor credit memo | Dr Accounts payable | 500 | Сr Inventory Cr VAT on purchases of goods and services | 476 24 |

| Tax debit note (from vendor credit memo) | Dr VAT on purchases of goods and services | 24 | Cr VAT Calculation | 24 |

| Cash receipt | Dr Bank account | 156 | Cr VAT Calculation | 156 |