Required settings #

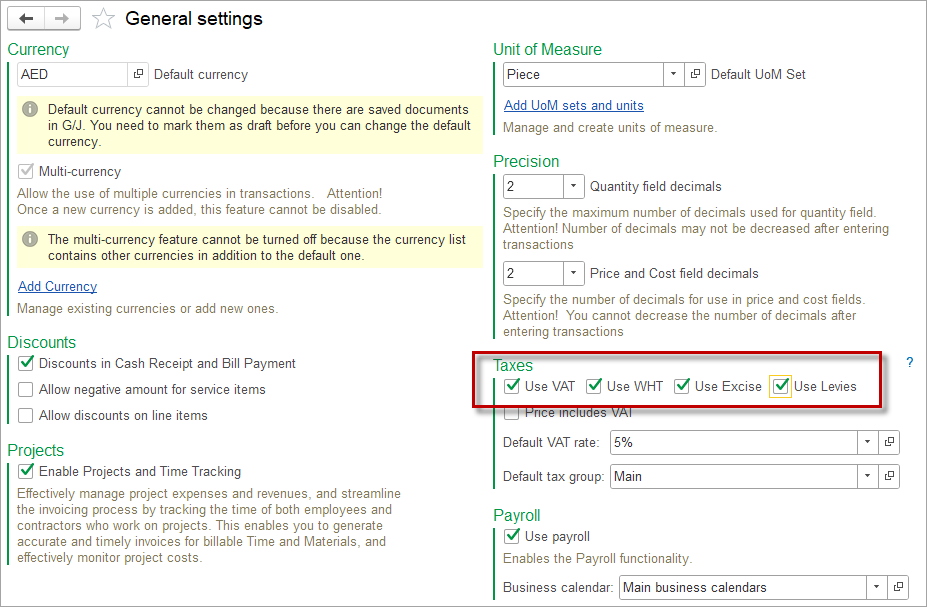

Levies can be enabled under Admin Panel – General settings – Taxes.

How to start accounting for Levies #

1. Create the Levy. Please refer to the Create a Tax and Tax rates articles. Tick the toggle Fixed amount if the Levy is expressed as a fixed amount rather than a relative value. If you have both fixed amounts and as relative value Levies, then set up two taxes with the Levy type in the Taxes list.

2. Maintain tax setting in the Customer — specify whether to charge Levies on sales to the Customer. Please refer to the article.

3. Set the default accounts for Levies liability in the Accounting settings.

4. Set up a Tax group with the required Levies.

Accounting #

Recording a Sales invoice or a Cash Sale, which contains Items due for a Levy, creates the following transactions in the General Journal:

- Debits: Accounts receivable (set in the Customer)

- Credits: Levies liability account (set in the Accounting settings)

When Items are purchased that are subject to a Levy, no specific Levy postings are made as it is assumed that the levy amounts are included in the purchase value of the items.

However, if for some reason the Vendor has shown the Levy amount as a separate line item(s) on the Bill, simply use the Landed Cost option to account for these amounts.