The Item Receipt is an optional document that records items, their quantities, and time of arrival with goods that were ordered using a purchase order. In AccountingSuite Item Receipts are generally created when a shipment of items ordered from a vendor arrives. The creation and posting of this document adds the items to inventory and makes them available for sale, manufacturing activities, or other inventory related actions. If Item Receipts are not used, the inventory transactions occur when the Bill for the Purchase Order is created and posted.

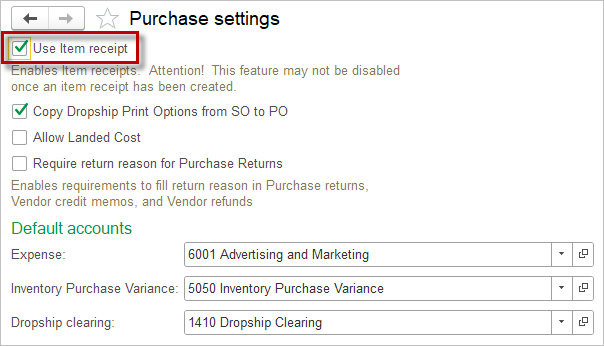

Enabling Item Receipts #

Item Receipts need to be enabled in Settings. To enable them, navigate to Purchases → Purchase Settings. Check the Use Item Receipts checkbox.

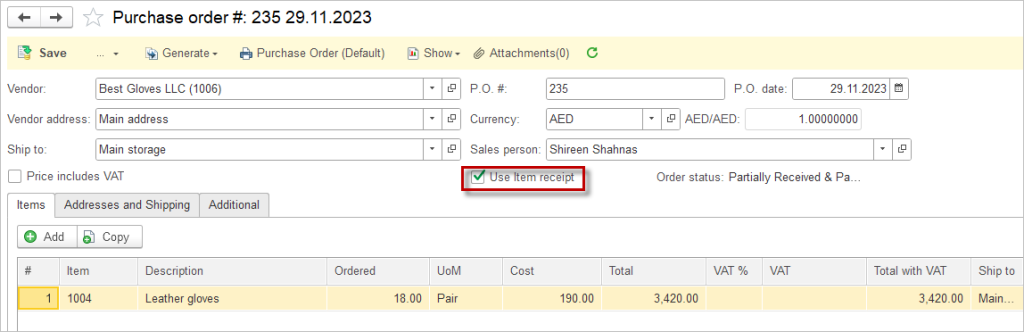

Using Item Receipts for a specific Purchase order #

To use Item Receipts, click the checkbox next to Use Item Receipts on the Purchase Order. If you do not wish to use an item receipt for a PO, uncheck the box before posting the PO.

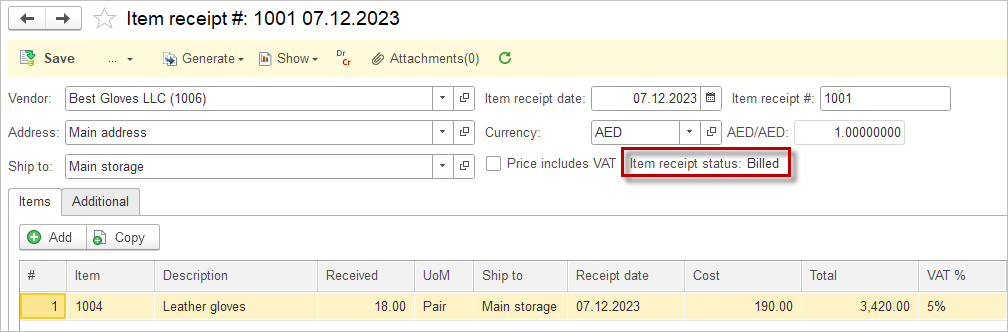

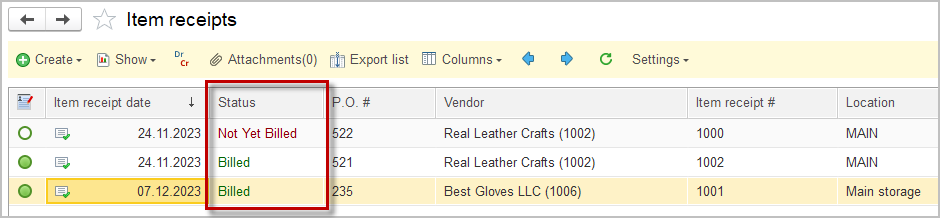

Item Receipt Status #

Item receipt status can be viewed in the list view or in an individual item receipt.

Status is used to mean the following:

Draft : Item Receipt has been created and saved, but is not complete.

Not Yet Billed : No items from the item receipt have been billed.

Partially Billed: Some items have been billed all items have been received.

Billed : All items have been billed.

Accounting #

Recording an Item receipt creates the following transactions in the General Journal:

- Debits: Inventory

- Credits: Inventory received not yet billed