An Excise (Excise duty) is a type of tax imposed on specific goods, such as alcohol, tobacco, carbonated drinks, products with added sugar and fuel. The list of excisable goods varies from one country to another, but AccountingSuite offers an flexible and transparent accounting treatment for it.

Required settings #

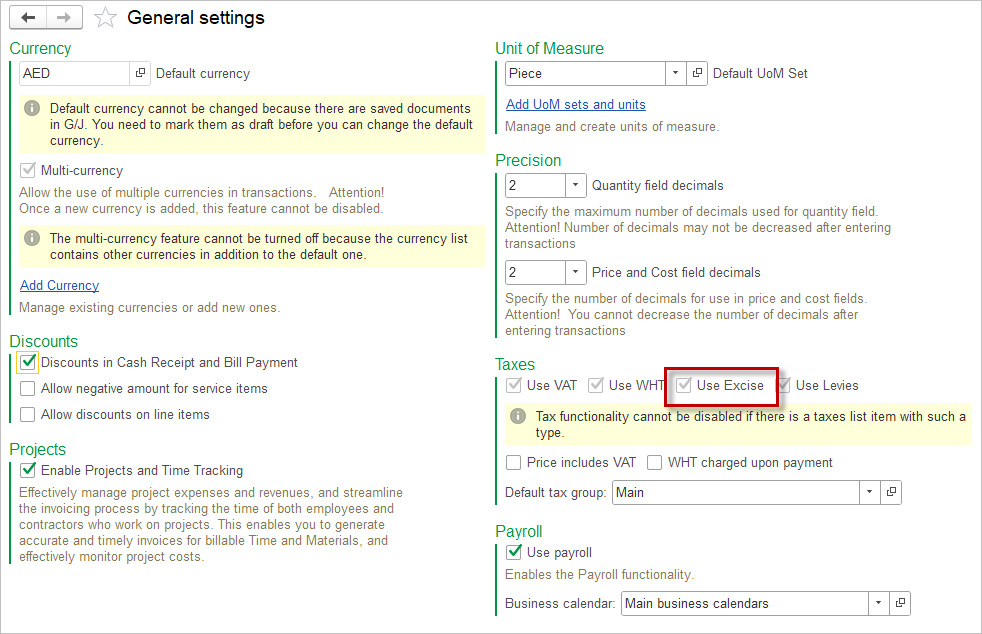

Excise duty functionality can be enabled under Admin Panel – General settings – Taxes.

How to start accounting for Excise #

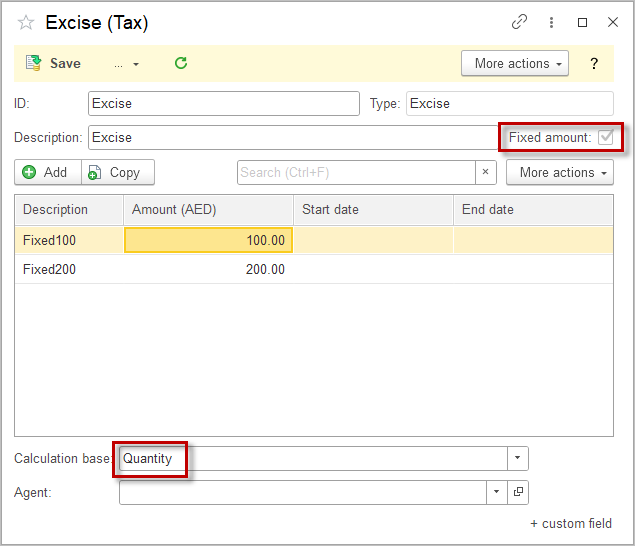

1. Create the Excise Tax. Please refer to the Create a Tax and Tax rates articles. Tick the toggle Fixed amount if the excise duty is expressed as a fixed amount rather than a relative value. If you have both fixed amounts and as relative value Excise duties, then set up two taxes with the Excise type in the Taxes list.

For the Excise tax type, Quantity Calculation base is available.

2. Maintain tax setting in the Vendor — specify if the Vendor is supplies excisable goods. Please refer to the article.

3. Set the default accounts for Excise liability in the Accounting settings.

4. Set up a Tax group with the required Excise rates.

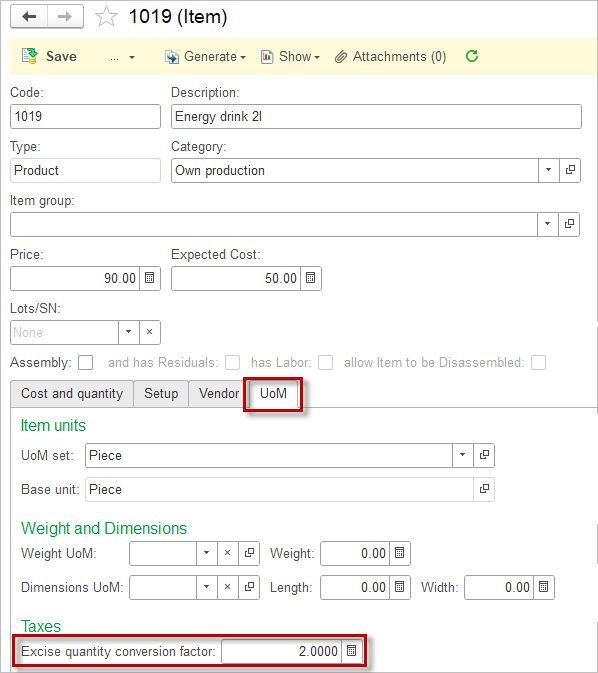

5. In the excisable Items on the UoM tab, set the Excise conversion factor.

Excise Quantity Conversion Factor #

An excise quantity conversion factor is a numerical value used to convert quantities of goods or products into a standard measurement for the purpose of calculating excise duties or taxes. This factor is particularly important in industries where products are sold in different units of measurement (e.g., liters, gallons, kilograms, etc.) but need to be standardized for tax assessment.

For example, if an excise duty is applied per liter of a beverage, but the product is sold in gallons, the conversion factor would be used to convert gallons to liters so that the correct excise duty can be calculated based on the volume sold.

The Excise conversion factor is set on the UoM tab in the Item.

Accounting #

Recording a Sales invoice or a Cash sale, which contains Items due for an Excise, creates the following transactions in the General Journal:

- Debits: Accounts receivable (set in the Customer)

- Credits: Excise liability account (set in the Accounting settings)

Recording a Bill, which contains Items due for an Excise, creates the following transactions in the General Journal:

- Debits: Inventory (set in the Item)

- Credits: Excise liability account (set in the Accounting settings)