The Capital Asset Scheme is a VAT scheme that allows businesses to reclaim VAT on capital assets (like equipment or vehicles) based on their actual usage for taxable and exempt purposes. If the use of the asset changes over time, businesses must adjust their VAT claims accordingly, ensuring compliance with VAT regulations. This scheme helps businesses manage VAT deductions effectively for assets that have mixed-use. Different countries may have their own rules, so remember to check local tax legislation to ensure compliance.

Here is an example of accounting for VAT Deduction for a Capital Asset with Mixed Use.

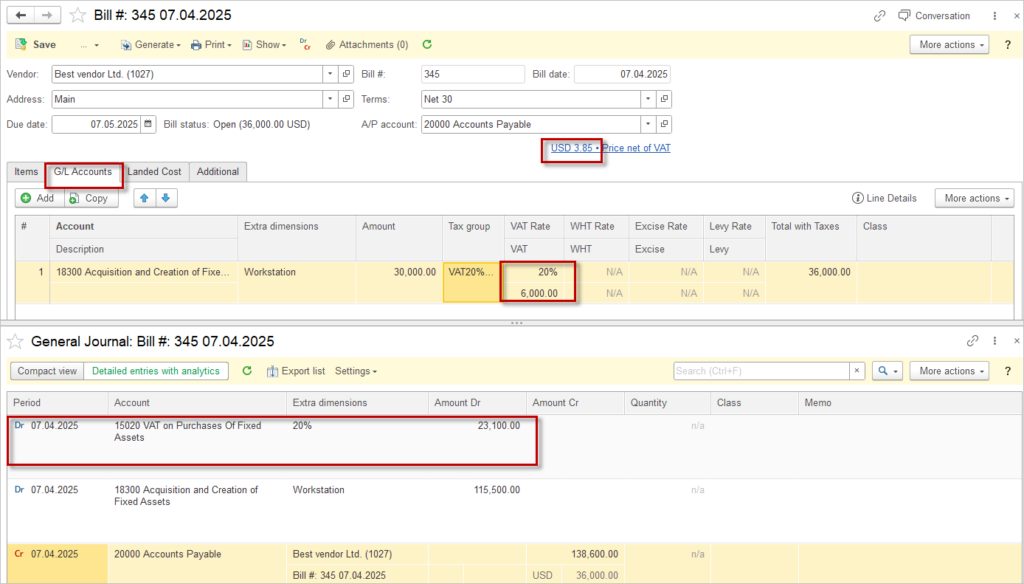

A company purchases a machinery for USD 30,000 plus VAT at 20%. The vehicle is used 60% of the time for taxable supplies and 40% for exempt activities. VAT needs to be apportioned based on this usage.

Step 1 is to book the Bill for machinery purchase.

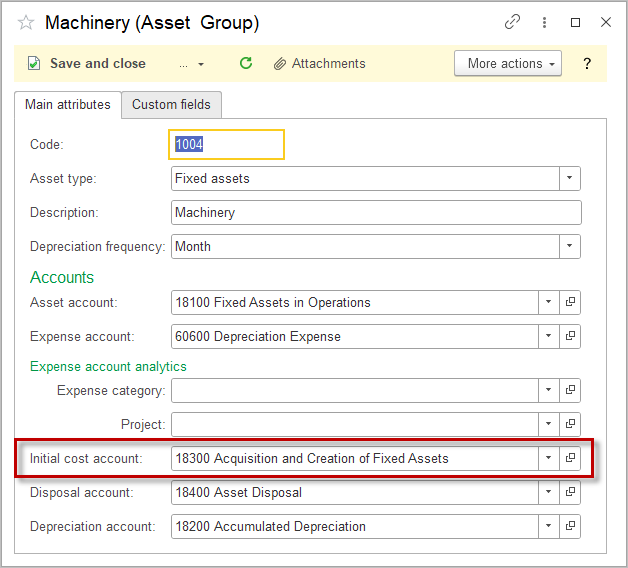

On the G/L tab, select the appropriate account which is set as Initial cost account in the Asset group where the acquired asset belongs.

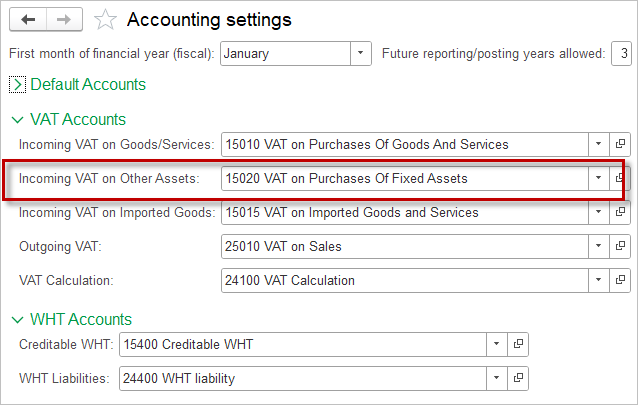

Input VAT shall be booked to the G/L account Incoming VAT on other assets set in Accounting settings.

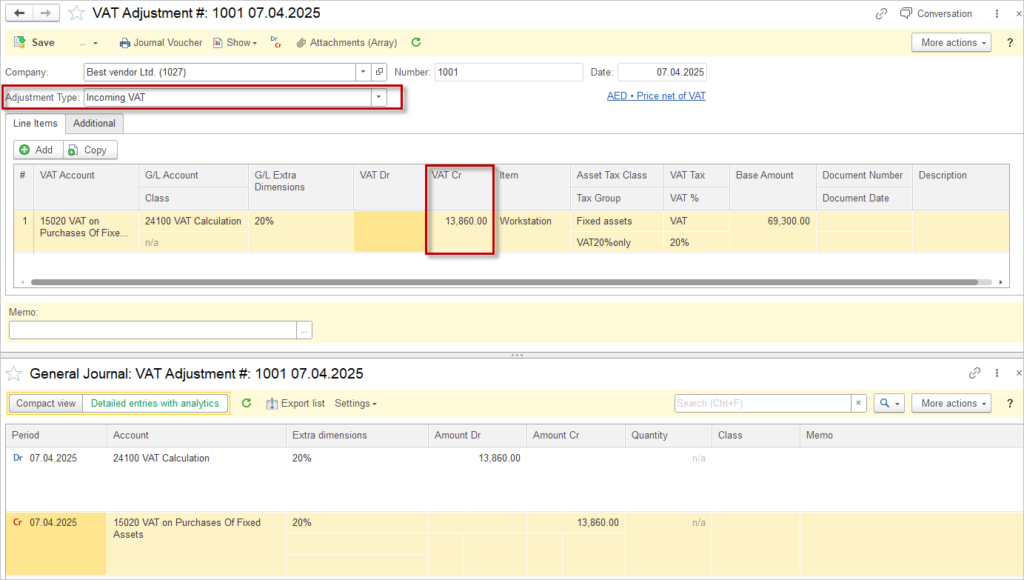

Step 2. Since the vehicle is used 60% for taxable purposes, the company can reclaim 60% of the VAT (60%*AED 23.100=AED 13.860)

This is made by the VAT Adjustment document. Adjustment type is set to Incoming VAT, amount entered in the Cr column, as the aim is to credit the VAT account.

Since the vehicle has mixed use, the company must review its usage annually and make adjustments if necessary. Assuming the workstation has a useful life of 5 years, so the compnay will need to assess its usage each year and adjust the VAT claim accordingly.

Assuming that in Year 2, the usage remains at 60% for taxable purposes, no adjustment is needed. However, if in Year 3, the usage changes to 50% for taxable purposes:

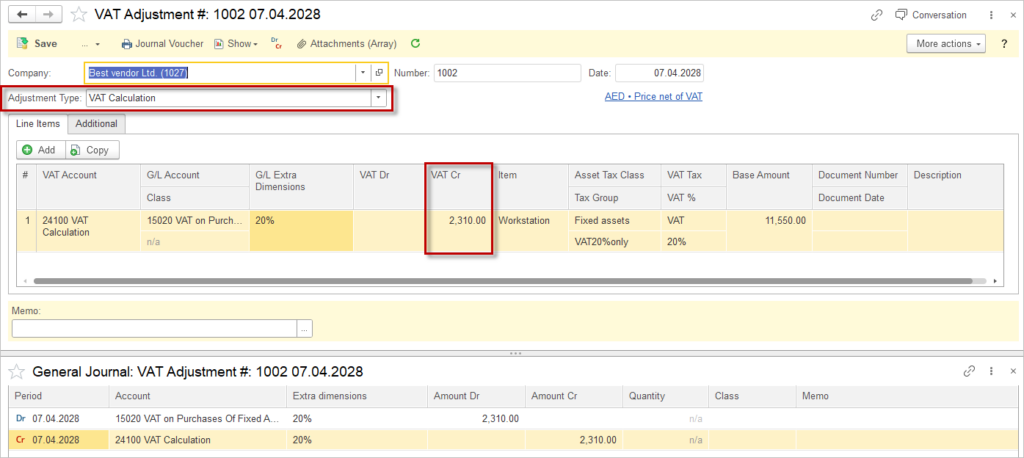

- Revised VAT Claimable: AED 23.100 × 50% = AED 11.550

- Adjustment Needed: AED 11.550 (new claim) – AED 13.860 (previous claim) = -2.310 (overclaimed)

In this case, it is neccessary to adjust the VAT return to account for the overclaim: