The Asset management module is designed to account for those assets, that are expensed over the time – this includes the fixed assets, but is not limited to them.

Asset types #

AccountingSuite has the following types of assets:

- non-current tangible assets

- intangible assets

- prepaid expenses – Expenses that have been paid for in advance and will be incurred over time. An example of a prepaid expense is insurance.

- low value assets – Assets that have a relatively low monetary value, but which cannot be written off on a one-off basis and which need to be kept track of. AccountingSuite does not set a threshold for an asset to be recognised as low value – each business decides for itself, based on its business needs and the applicable accounting framework. An example of a low value asset are tools.

Each Asset has to be assigned with an Asset group. Before you start recording any assets, create Asset groups first.

Asset group #

An asset group is defined as a grouping of assets that share following characteristics:

- asset type (fixed assets / intangible assets / prepaid expenses / low value assets);

- general ledger accounts;

- depreciation frequency.

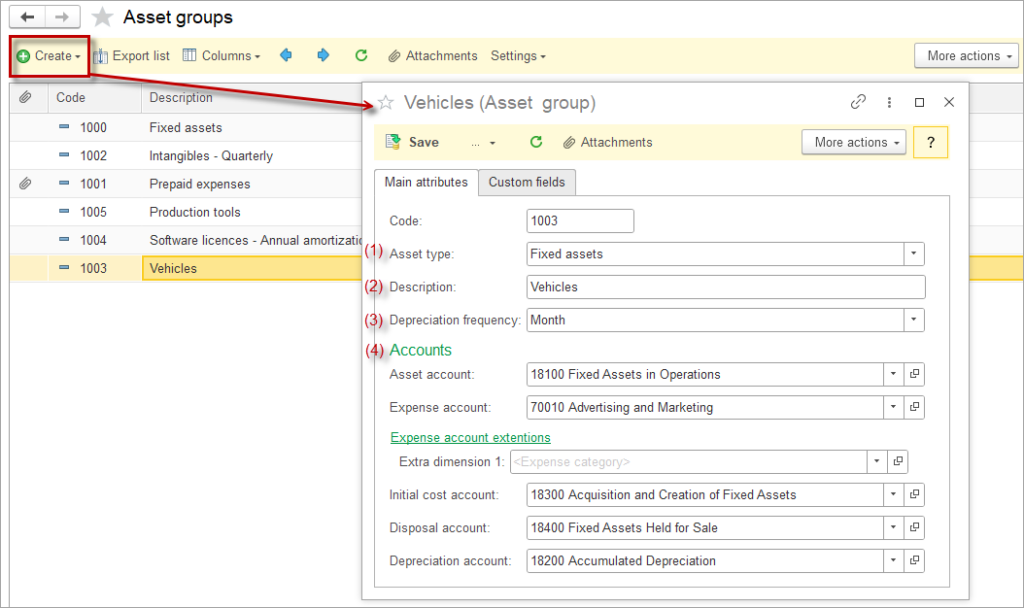

Create Asset group #

- Navigate to Asset management – Asset groups

- Click Create

- Choose the Asset type. Please note, that Asset type is a fixed list, that can not be adjusted by the user.

- Add the description.

- Select the Depreciation frequency. Depending on the frequency, depreciation will be charged at the end of the period. E.g., for Quarter the depreciation will be charged on Mar 31st, Jun 30th, Sep 30th and Dec 31st.

- Select the default accounts.

- For the types Fixed assets and Intangible assets the required default posting accounts are:

- Asset account

- Initial cost account

- Disposal account

- Depreciation account

- Expense account

8. For the types Prepaid Expenses and Low value assets the required default posting accounts are:

- Asset account

- Expense account

9. Click Save.

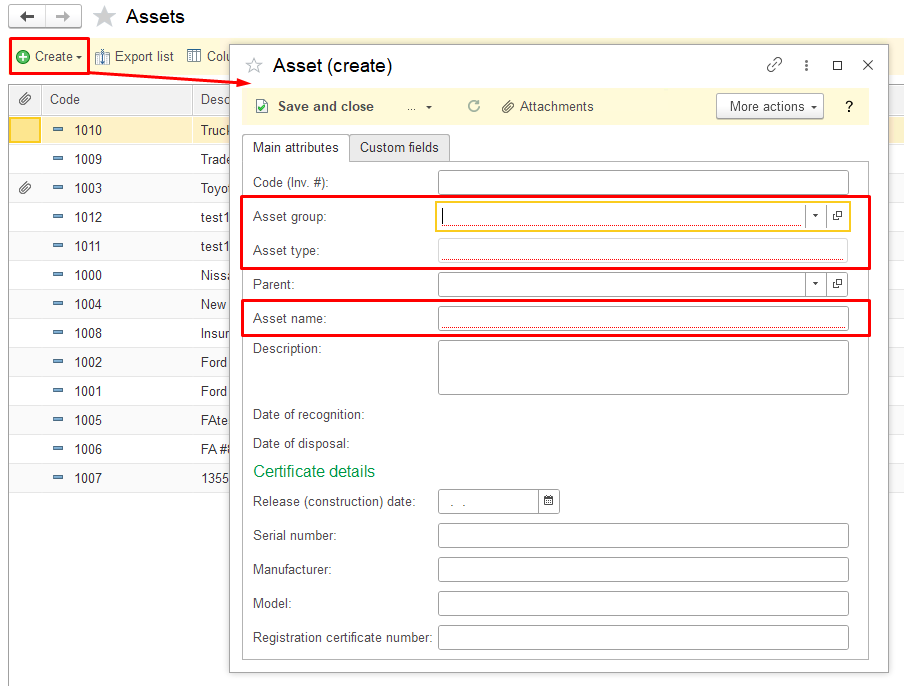

Create an Asset #

- Navigate to Asset management – Assets

- Click Create.

- Required fields are marked with a red dot line on the bottom.

- Choose the Asset group. Changing the Asset is disabled once the asset is recognized.

- Asset type field will be filled in automatically according to the settings in the Asset group. Please note, that Asset type is a fixed list, that can not be adjusted by the user.

- Specify the Asset name.

- Fill in the fields Parent, Description, Release date, Serial number, Manufacturer, Model and Registration certificate number. These fields are not required, but can help in tracking the assets later.

- Date of recognition and Date of disposal will be displayed automatically once the Initial recognition and Disposal documents for the respective asset are booked.

- Remember that you can create any Custom fields to track the assets.

- Use the Data Import Tool to create multiple assets.

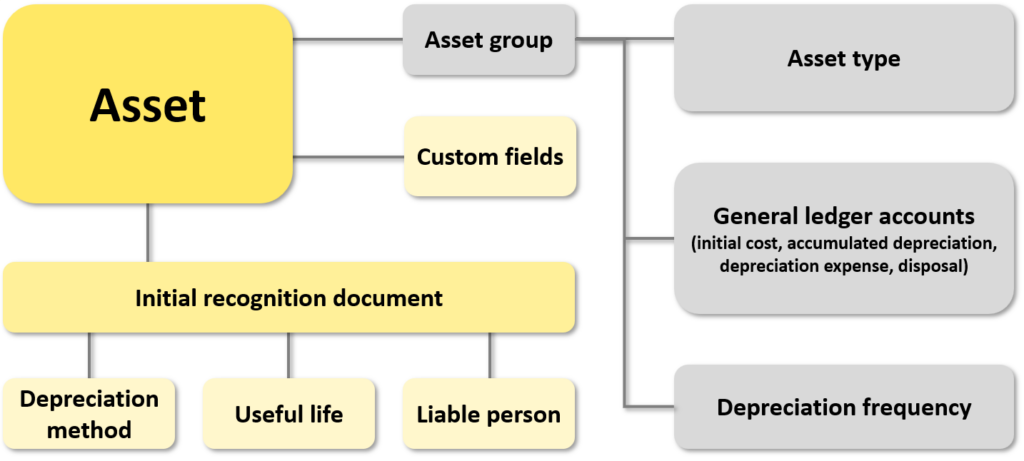

The Depreciation method, useful life and liable person for the Asset are set in the Initial recognition document.

The following diagram shows how the asset parameters are connected.

Depreciation methods #

AccountingSuite offers the following depreciation methods:

- straight-line depreciation (equal depreciation charge over the useful life of an asset)

- declining balance method (also known as reducing balance method with higher depreciation charge in the beginning of the useful life and lower depreciation charge in the end of useful life). Factor may be applied to this method. For instance, choose the factor of 2 to derive the double-declining depreciation method.

- units of production method (depreciation charged based on the actual usage or production output of an asset)

Depreciation frequency #

AccountingSuite offers the following depreciation frequency:

- month

- quarter

- half-year

- year