In accounting, an “agent” typically refers to an individual or entity that has the authority to act on behalf of another party, known as the principal. An Agent is someone who acts on behalf of a business in negotiations, contracts, or financial dealings.

In this scenario:

- Broker is an agent who acts on behalf of our company and orders transport, customs clearance, inspection, etc. for imported goods;

- The services are provided directly to our company, some of them should be accounted for as Landed Cost

- The broker provides information on the services ordered on our behalf. Finally, typically once a month, Broker will charge a service fee for this work.

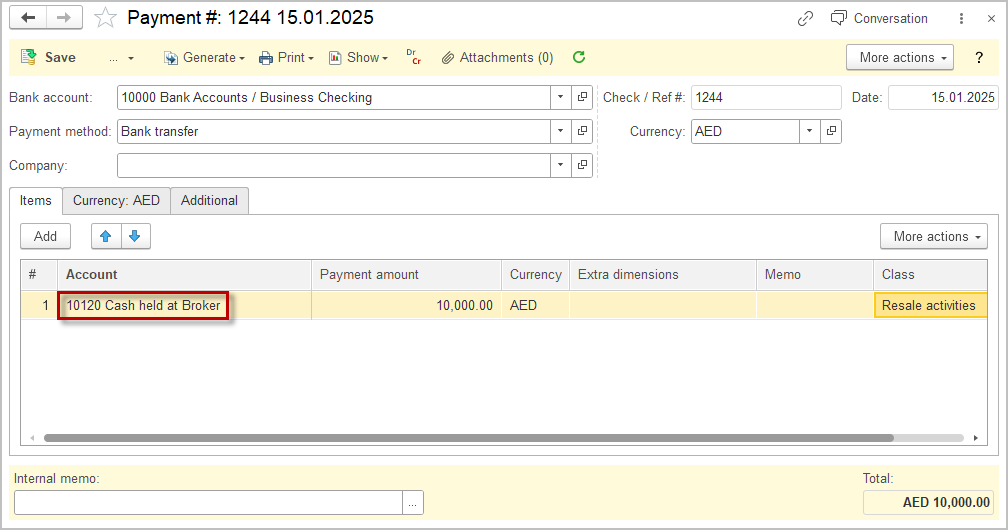

1. Payment paid out to Broker #

Create a new account with a subcategory Banking account, e.g. Cash held at Broker.

It is irrelevant if the Broker is paid in advance or only after providing the Agent report. The balance on this account shall represent the Advance (Dr balance) or Payable (Cr balance) to Broker.

Post a Payment document. The Payment document in AccountingSuite records payments that will not have a bill associated with the payment. Technically, this document is just money transfer between two accounts. It is crucial to post a Payment, not a Vendor prepayment document.

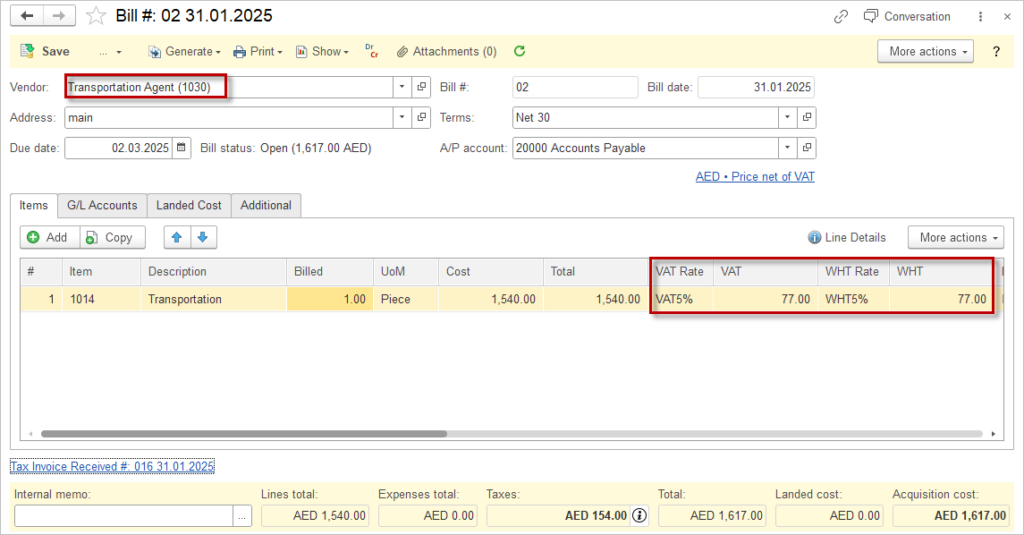

2. Report from Broker has been received #

The Agent will normally issue a document called an Agent Report or Broker Report, which lists the services ordered on behalf of the Principal. This report includes the description of the services and the amounts.

Under the agent-principal accounting scheme, the services are accounted for as if they were provided directly to the principal (Our Company) and not to the Broker. Depending on the nature of the service and local accounting requirements, these services may be accounted for as Landed cost. Please make the appropriate settings in the Item, if it is a Landed cost service and specify the allocation type.

Post a Bill document, recording the services that Broker has ordered on behalf of our company. Assuming that the Tax settings in the Item and in the Vendor are maintained properly, this Bill will post the applicable taxes.

3. Posting the Purchase of goods #

Finally, post the Bill for any purchased goods. On the Landed cost tab, link the required landed cost (which have been posted in Step 2).