The Inventory Adjustment Document serves as a critical tool for managing and maintaining accurate inventory records within an organization, offering the option book an increase (Debit adjustment) or decrease (Credit adjustment) of the inventory account resulting from various events.

For assembling or disassembling Items, there are separate document available: Assembly or Disassembly.

Use the Inventory Adjustment document for the following posting:

Debit adjustment (increase in Inventory) #

.

- Inventory levels are found to be higher than recorded (e.g., due to receiving unrecorded shipments or correcting previous errors) (recommended to create Inventory taking first).

- Changing Class for inventory

Credit adjustment (decrease in Inventory) #

Important is, that credit amount will be calculated according to the Costing Method set in the Item.

- Inventory levels are lower than recorded (e.g., due to theft, damage, or obsolescence) and have to be recognized as expense (recommended to create Inventory taking first);

- Item used to modify a Fixed asset;

- Material consumption/

Cost of goods sold is calculated without a breakdown to Warehouse or to Lot (Serial Number). These options will be available in next AccountingSuite releases.

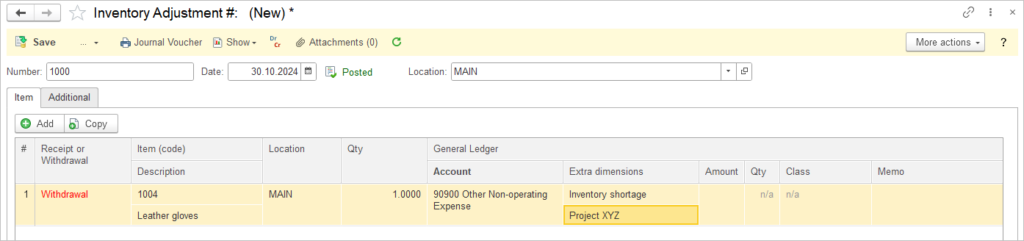

Create Inventory Adjustment #

To account for over or under stock, first create an Inventory Taking document and use it to generate the Inventory Adjustment document.

- Navigate to Inventory – Inventory Adjustmens.

- Click Create.

- Specify the Date and the Location.

- Click Add.

- Select Receipt (for increase on inventory) or Withdrawal (for decrease).

- Enter the Item and Quantity.

- Select the General ledger account and fill the Extra dimensions applicable for this account.

- For Receipt operation, enter the amount. For Withdrawal, no Amount should be entered (will be calculated according to the Costing Method set in the Item).

- If the selected GL account is ticked to account for Quantity or Class, fill these columns.

- Save the document.

Please note: to maintain data integrity, certain restrictions apply to the G/L accounts that can be selected here. Accounts with Items, Banking, and Undeposited Funds Extra Dimension cannot be chosen.