A Depreciation document in AccountingSuite is designed to charge the depreciation for fixed assets, amortization for intangible assets and expense recognition for prepaid expenses or low value assets – all in one document.

Depending on the Depreciation frequency (set in the Asset group), the depreciation (or expense recognition) will be calculated on the last day of the time period:

- For Month – on the last day of each month;

- For Quarter – on March 31st, June 30th, September 30th and December 31st;

- For Halfyear – on June 30th and December 31st;

- For Year – on December 31st.

To maintain correct expense recognition, remember to record depreciation in the appropriate period during the whole lifetime of the asset or until the asset is disposed of.

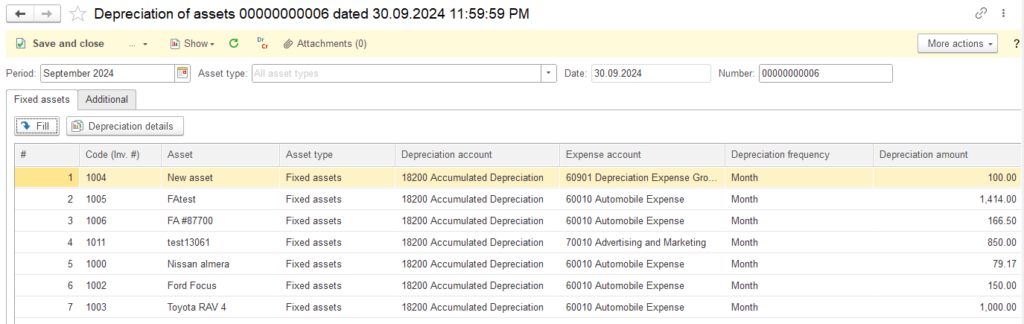

Book depreciation (or expense recognition) #

- Navigate to Asset management → Depreciation charge.

- Create a new document.

- Specify the time period of depreciation.

- Select the Asset type (only if you prefer to create separate documents for different Asset types).

- Select the date – it is important to select the date precisely, as the depreciation/ expense recognitions is calculated on the daily basis, regardless of the depreciation frequency set in the Asset group.

- Click Fill and the Depreciation document will be filled with the assets to be depreciated over the period selected in step 3. If you specified the asset type in step 4 – only the assets with the selected asset type will be filled in.

- The Depreciation details button opensa separate window with a detailed report of how Depreciation (or Amortization, or Expense recognition) charge was calculated.

- Save the document.

Accounting #

Recording a Depreciation document for asset with “Fixed assets” or “Intangible assets” types creates the following transactions in the General Journal:

- Debits: Expense account

- Credits: Accumulated depreciation account

Recording a Depreciation document for asset with “Prepaid expenses” or “Low-value assets” types creates the following transactions in the General Journal:

- Debits: Expense account

- Credits: Asset account

Please note: the general ledger accounts for these bookings are stored in the Asset group.