The Earning types list stores the types of income for calculation in Payroll document

Create Earning type #

- Navigate to Payroll → Lists → Earning types

- Click Create.

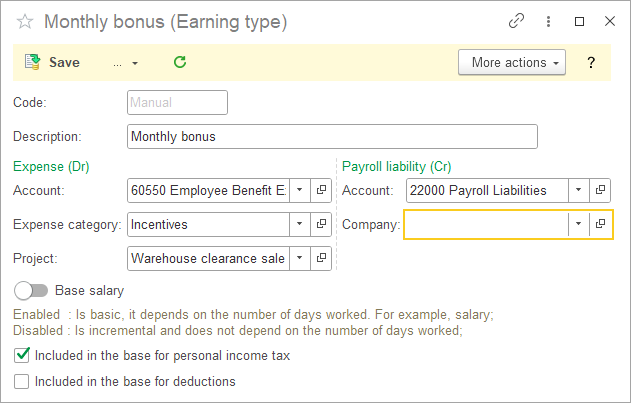

- Enter Code (optional)

- Enter the Description.

- Select the Expense (Dr) account and its Extra dimensions. When Payroll document will be posted, these Extra dimensions will be filled in automatically.

- Select the Liability (Cr) account and its Extra dimensions. If left blank, the default account from Accounting Settings will be used.

- Extra dimensions set at this step may be changed later manually in the Payroll document if needed.

- Choose if an earning is a Base salary and should be calculated on number of days actually worked or if it is a fixed amount independent on days actually worked.

- Tick the checkbox to include the earning in the personal income tax base.

- Tick the checkbox to include the earning in the deductions base.

- Click Save.