The Payment document in AccountingSuite records payments made to a Customer or a Vendor that will not have a bill associated with the payment. To record the payment of a bill that has been entered in AccountingSuite, please see Creating a Bill Payment. Payments documents may be used to record a cash payment that has been paid by printing a check from within AccountingSuite.

Create Payment #

- Navigate to Bank – Documents – Payments

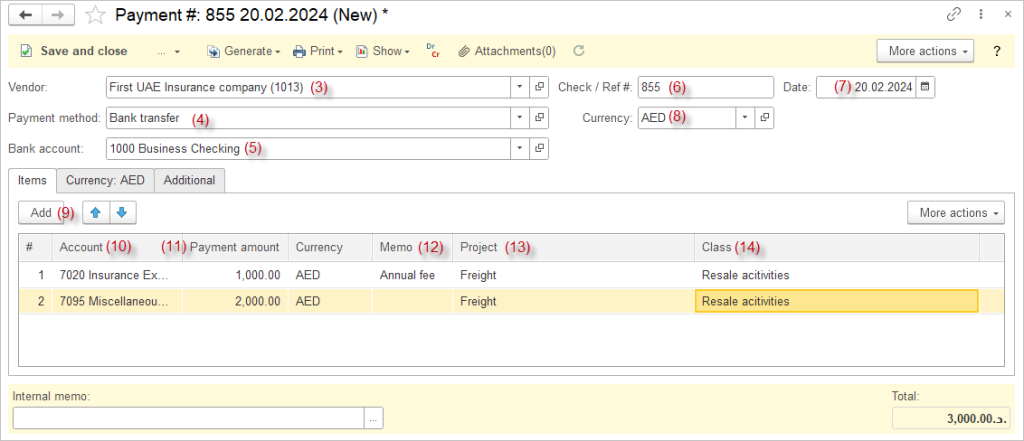

- From the payments list view, click the Create / New. A payment document is displayed.

- Choose the vendor from the Vendor drop-down list (may be a customer or a vendor). See Creating a Customer / Creating a Vendor to add a new company.

- Choose a Payment Method from the drop-down list.

- Choose a Bank Account from the drop down menu. This is the account from which the payment is made.

- Enter a Payment reference number in the Check / Ref field. (optional).

- The Posting Date defaults to today’s date. Change this if necessary to reflect the actual date of the payment.

- Enter payment Currency.

- On the Items tab, Click the Add button.

- Choose the appropriate General Ledger Account from the drop down list. If the account is not listed, you can add it on the spot. In the drop down list, click Show all, then click Create.

- Enter the amount of the line item expense in the Amount field.

- Enter a Memo. (optional)

- Enter a Project. (optional)

- Enter a Class. (optional)

- Repeat steps 9-14 for each expense on this payment.

- Save the document.

Accounting #

Recording a Payment creates the following transactions in the General Journal:

- Debits: Accounts chosen in document

- Credits: Bank account