Required settings #

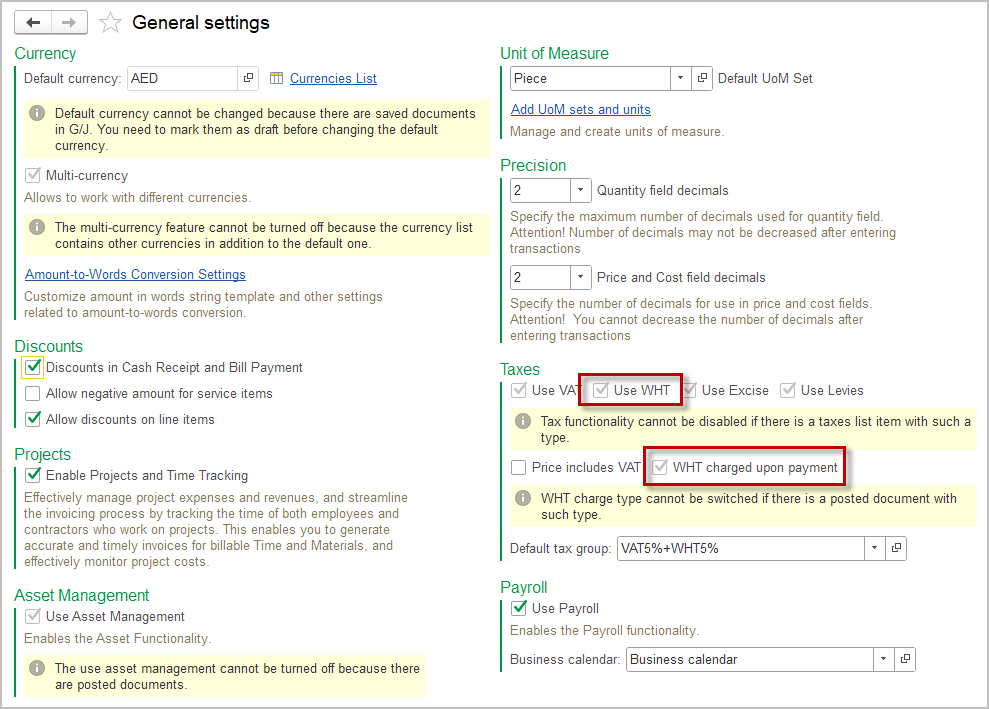

Withholding functionality can be enabled during the SetupWizard or under Admin Panel – General settings – Taxes.

As per local legislation requirements Withholding tax should be applied upon either invoicing or upon payment. The default setting is to apply the Withholding tax upon invoicing.

If the Withholding tax should be applied upon payment, tick the checkbox.

How to start accounting for Withholding tax #

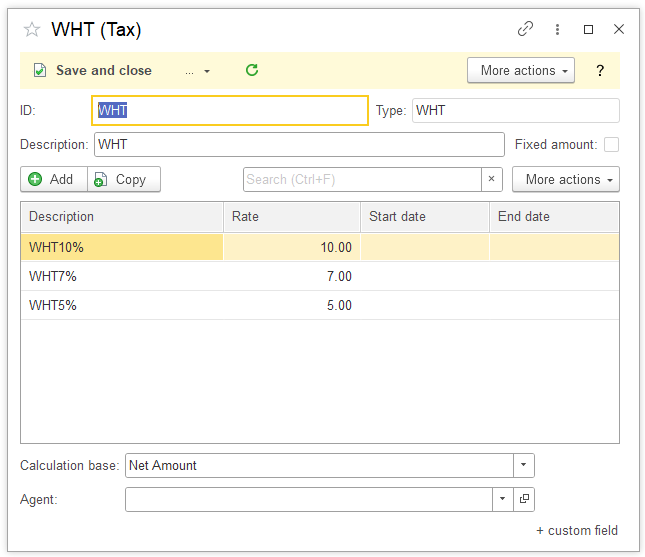

- Create a new Withholding tax. Please refer to the Create a Tax and Tax rates articles.

- Maintain tax setting in the Vendor. Please refer to the article.

- Set the default accounts for Creditable WHT and WHT liability in the Accounting settings.

After all steps of set up you will have Withholding Tax with different rates in it. Then you need to set up Tax group and Assign Tax group to an Item.

Accounting #

Depending on the setting in the General settings, on whether the Withholding tax should be applied upon payment or upon invocing, the following transactions in the General Journal shall be made.

Withholding applied upon invoicing #

Vendor side #

Document Debit side Amount Credit side Amount Sales invoice Dr Accounts receivable

Dr COGS

Dr Creditable WHT1000

800

100

Cr Sales

Cr Inventory

Dr Accounts receivable

(set WHT aside of AR)

1000

800

100Payment received

(no effect on WHT, as WHT

charged upon invoicing)Dr Bank 900

Cr Accounts receivable

900Customer side #

Document Debit side Amount Credit side Amount Bill

Dr Inventory

Dr Accounts payable

(set WHT aside of AP)1000

100

Cr Accounts payable

Cr WHT Liability

1000

100Bill payment

(no effect on WHT, as WHT

charged upon invoicing)Dr Accounts payable 900

Cr Bank

900WHT payment to tax authority Dr WHT Liability 100

Cr Bank

100Withholding applied upon payment #

Vendor side #

Document Debit side Amount Credit side Amount Sales invoice Dr Accounts receivable

Dr COGS1000

800

Cr Sales

Cr Inventory

1000

800Payment received Dr Bank account

Dr Creditable WHT900

100

Cr Accounts payable

1000Cash sale

(WHT liability recorded by Vendor,

as customer is not capable of

withdrawing)Dr Bank

Dr COGS1100

800

Cr Sales

Cr Inventory

Cr WHT Liability

1000

800

100Customer side #

Document Debit side Amount Credit side Amount Bill Dr Inventory 1000

Cr Accounts payable

1000Bill payment Dr Accounts payable 1000

Cr Bank

Cr WHT Liability

900

100WHT payment to tax authority Dr WHT Liability 100

Cr Bank

100