Monitoring the accounts receivable aging can help you assess the overall health of your business’s cash flow. By tracking the aging of outstanding Invoices, you can identify any potential cash flow issues early on and implement strategies to improve collections and maintain a positive cash flow position.

Analyzing the accounts receivable aging report can also provide you with a clearer picture of your customer credit policies and Payment terms. By reviewing the aging of receivables by Customer, you can evaluate the effectiveness of your credit policies, identify any patterns of late payments, and make informed decisions about adjusting credit terms or implementing stricter collection procedures where necessary.

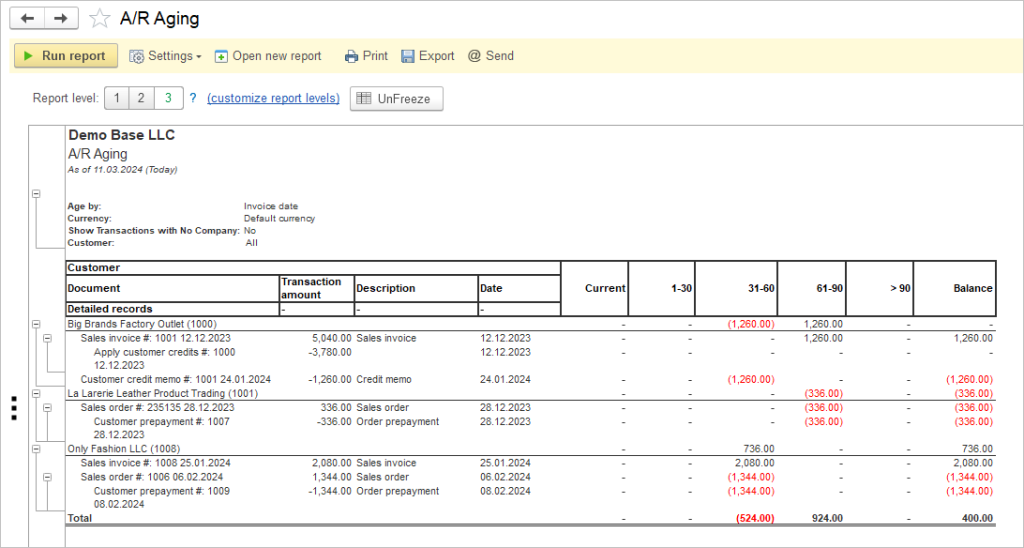

Navigate to: Reports → Sales → A/R Aging