The Landed Costs function allows you to automatically or manually allocate the costs associated with getting products to the cost of inventory for the products. Examples of these types of costs include freight, duties, insurance, custom duties.

Landed cost option can be enabled in Purchase settings.

Landed Cost in AccountingSuite is available as a separate tab in the documents:

The service itself, which is assigned to the inventory, is posted as a separate Bill that includes all applicable taxes. You can post this service Bill independently of the document, that contains Landed cost – before or after. One service Bill may be allocated to multiple documents.

Landed Cost Accounting #

- Enable the Landed cost option in Purchase settings.

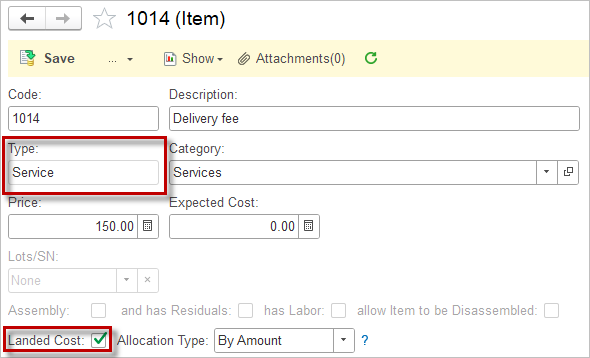

- Enter a new Item with Service type, tick the Landed cost checkbox and choose the Allocation type (by weight, by amount, by quantity)

- Generate an Item Receipt from the Purchase Order (or a Bill if not using Item Receipts, or a Warehouse Transfer document) and complete as per your process.

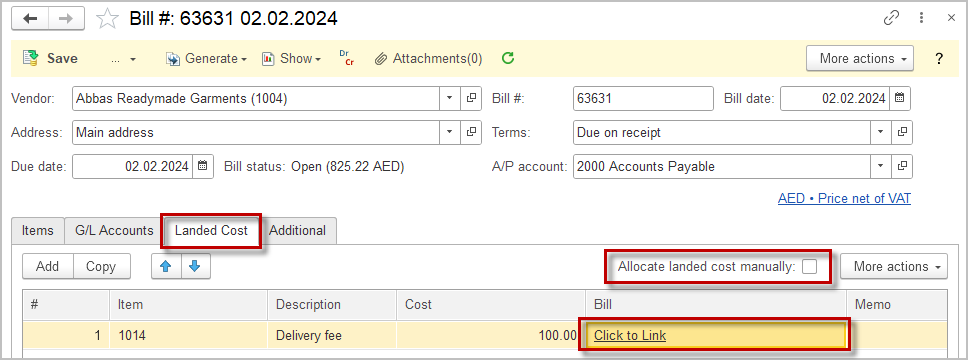

- Click the Landed Cost tab and enter the landed costs. Tick the checkbox Allocate landed cost manually, if you want to change the allocation

- Link an existing Bill for landed cost or create a new one (Click to link).

- The cost will be filled automatically from the Bill.

- Save the document.

Accounting #

Recording a Bill where Landed cost tab is filled in creates the following transactions in the General Journal:

- Debits: Inventory (for item cost + associated Landed cost amount)

- Debits: Input VAT

- Credits: Accounts payable

- Credits: Landed cost clearing account (set in Accounting settings)

Accounting #

Recording a Bill for Landed cost creates the following transactions in the General Journal:

- Debits: Landed cost clearing account (set in Accounting settings)

- Credits: Accounts payable

Accounting #

Recording a Warehouse transfer with Landed cost creates the following transactions in the General Journal:

- Debits: Inventory (for the associated Landed cost amount)

- Credits: Landed cost clearing account (set in Accounting settings)