The initial recognition of an asset is a critical process that not only involves recording the asset’s value but also signifies its activation and the start of its useful life. This process marks the point when an asset is put into operation and begins to contribute to the company’s operations, serving as the starting point for depreciation or amortization. This document confirms the asset’s readiness, specifies its initial cost, and sets its useful life parameters.

Book initial recognition of an asset #

- Create the Asset.

- Navigate to Asset management → Assets operations.

- Create a new Initial recognition document.

- Department is an optional field.

- Click Add and select the asset.

- Enter the Amount and Residual value.

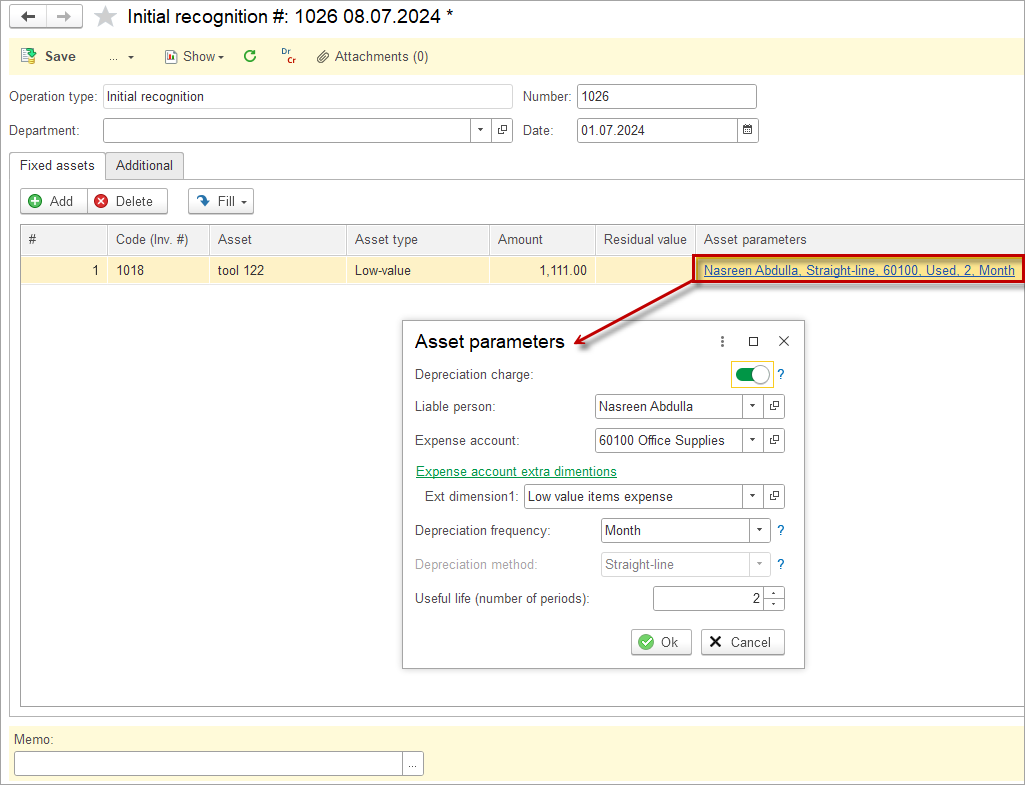

- Click the hyperlink in the Asset parameters column.

- The Asset parameters will be filled in from the Asset group, that was assigned to the Asset.

- Tick the toggle Depreciation charge to start the depreciation. For prepaid expenses and low value assets, the ticked toggle starts the expense recognition.

- Select the Liable person.

- Select the Depreciation method. For prepaid expenses and low value assets it is the method of cost recognition.

- Enter the Useful life (the number of time periods, the type of the time period – month, quarter, etc. is specified in the Depreciation frequency field).

- Add other assets if needed – one Initial recognition document can contain several assets, even with different types.

- Save the document.

In accounting, Residual value is another name for salvage value, the remaining value of an asset after it has been fully depreciated, or after deteriorating beyond further use. The residual value derives its calculation from a base price, calculated after depreciation.

Accounting #

Recording an Initial recognition document creates the following transactions in the General Journal:

- Debits: Asset account

- Credits: Initial cost account

Please note: the general ledger accounts for these bookings are stored in the Asset group.

For the asset types Prepaid Expenses and Low Value Assets, the initial recognition document does not create any postings, it just gives the start of expense recognition.