An expense report itemizes expenditures incurred by employees on behalf of their organization. Common examples include travel costs, meals, accommodation, and office supplies. Employees submit these reports to claim reimbursement for out-of-pocket spending, providing a detailed record for both managerial oversight and financial accountability.

Required settings #

An entry within Companies list with an Employee type is required. Bookings associated with Expense Reports are recorded outside of the Payroll module. These bookings should be managed through the general Purchases module, and not through payroll processing functionalities.

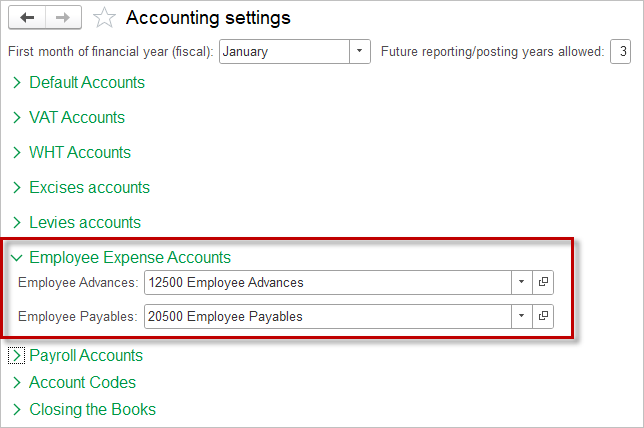

The following accounts have to be filled in Accounting Settings: Employee Advances and Employee Payables.

Create Expense Report #

Remember that the Bill can be generated from the preceding document from the Purchase workflow: Purchase Order.

- Navigate to Purchases → Expense Reports.

- Click Create.

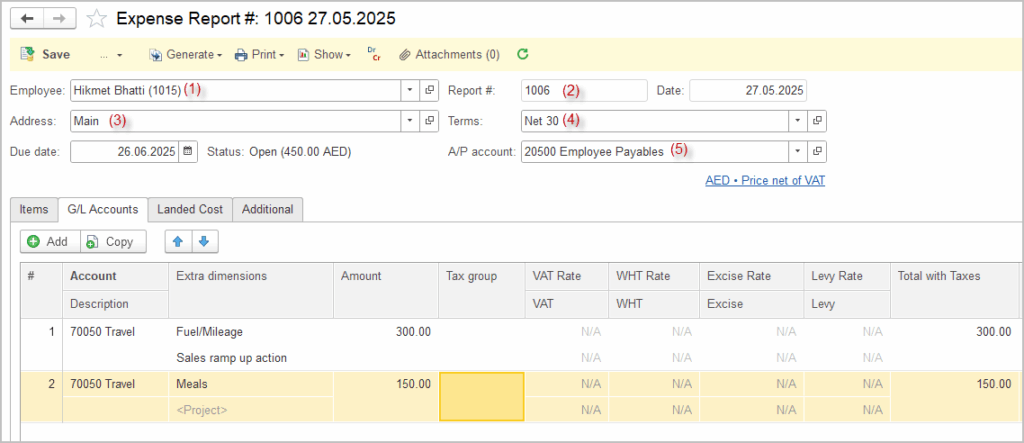

- Choose an Employee (1) from the list.

- Enter the Report # (2) (optional).

- Fields Address (3) and Terms (4) will be filled automatically from the Employee card. A/P account (5) will be filled automatically from the Accounting Settings.

- Click the Items tab and add items. Click the G/L accounts tab and add any purchases other than the items (services, assets or accounts payable settlement).

- Click Save, Save and Close or Save and New.

- Run the Print Form, if required (e.g. for signing by the Employee). The Expense Report has a standard Print Form, that can be edited.

To preserve data integity, the following restrictions are in effect within the Expense Report:

Items tab is designed for posting Items purchase, therefore, only Items (Products or Services that are entered in the Items list) can be selected.

G/L Accounts tab is designed for posting any purchases other than the items, thus the Subcategories of the accounts are limited to: Other current assets, Incoming VAT, plus any account under Expense Category can be selected.

On the G/L tab, you can post Accounts Payable settlement, for this purpose accounts under Account Payable Subcategory are available for selection.

Accounting #

Recording an Expense Report creates the following transactions in the General Journal:

- Debits: accounts selected on the Items or G/L accounts tab

- Credits: Employee Payables account (set in Accounting Settings)

Please refer to the Accounting Cases involving Expense Report to see detailed examples.