Book asset disposal #

It is time to book asset disposal when you have identified assets that are no longer needed or useful to your business. This could be due to equipment becoming outdated, damaged beyond repair, or simply no longer serving a purpose in your operations.

- Navigate to Asset management → Assets operations.

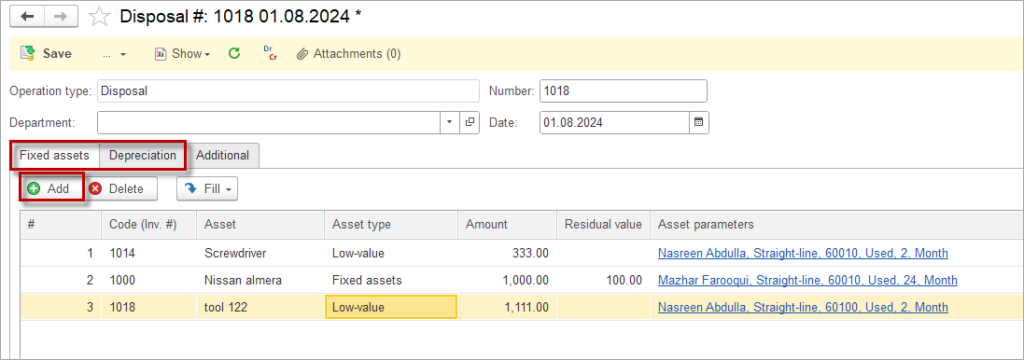

- Create a new Disposal document.

- Add the asset to dispose of on the Fixed assets tab.

- On the Depreciation tab, click Fill to calculate the outstanding depreciation charge for the time period between the last depreciation document date and disposal date. The tab will be filled for the asset with “Fixed assets” or “Intangible assets” types only.

- Save the document.

Accounting #

Recording a Depreciation document for asset with “Fixed assets” or “Intangible assets” types creates the following transactions in the General Journal:

- Debits: Expense account

- Credits: Accumulated depreciation account (this is the depreciation/ amotrization charge from the date of the last Depreciation document to the date of the Disposal document)

- Debits: Accumulated depreciation account

- Credits: Asset disposal account

- Debits: Asset disposal account

- Credits: Asset account

Recording a Depreciation document for asset with “Prepaid expenses” or “Low-value assets” types creates the following transactions in the General Journal:

- Debits: Expense account

- Credits: Asset account

Please note: the general ledger accounts for these bookings are stored in the Asset group.