The Deduction Types list stores the types of deductions that reduce payables to employees and employer contributions (which do not reduce payables to employees). Deduction types are used for payroll calculation in the Payroll document (columns “Company taxes” – for the employer contributions and “Deductions” – for employees contributions).

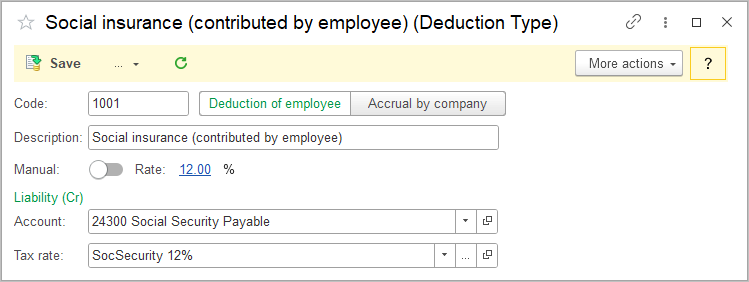

Create Deduction type (which reduces payables to employees) #

- Navigate to Payroll → Lists → Deduction types

- Click Create.

- Enter Code (optional)

- Choose the “Deduction of employee” next to Code.

- Enter the Description.

- Switch the Manual toggle or enter the Rate.

- For the Rate, specify the start date from which it should be applied.

- Select the Liability (Cr) account and its Extra dimensions. For the accounts that have Tax rate as the Extra dimension, create a new rate under Other tax type.

- For Expense (Dr), the Payroll liability account will be used, as this deduction makes the payable to Employee lower.

- Extra dimensions set at this step may be changed later manually in the Payroll document if needed.

- Click Save.

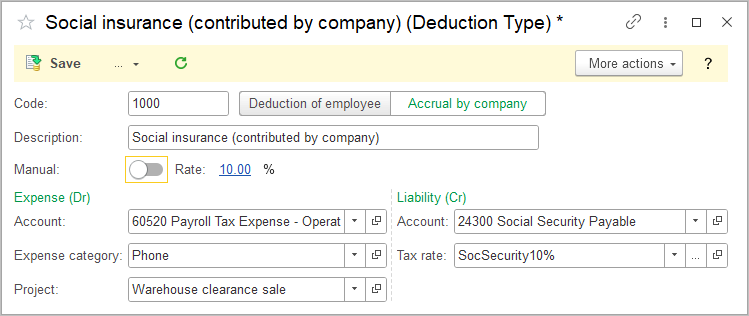

Create Deduction type (which does not reduce payables to employees and is accrued by employer) #

- Navigate to Payroll → Lists → Deduction types

- Click Create.

- Enter Code (optional)

- Choose the “Accrual by company” next to Code.

- Enter the Description.

- Switch the Manual toggle or enter the Rate.

- For the Rate, specify the start date, when it should be applied.

- Select the Expense (Dr) account and its Extra dimensions. When Payroll document will be posted, these Extra dimensions will be filled in automatically. If left blank, the default account from Accounting Settings will be used.

- Select the Liability (Cr) account and its Extra dimensions. For the accounts that have Tax rate as the Extra dimension, create a new rate under Other tax type.

- Extra dimensions set at this step may be changed later manually in the Payroll document if needed.

- Click Save.

——

Real-life example #

——Our client operates in a country where the following social security obligations apply:

Employee-contributed insurance:

- Pension 15%

- Medical 8,5%

- Unemployment 0,5%

Employer-contributed insurance:

- Pension 5,5%

- Medical 4,3%

- Unemployment 0,5%

AcccountingSuite offers the following solution:

- The respective Earning type (e.g., Salary) should be ticked as a calculation base for the deductions.

- For each of the insurance obligations, a Deduction has to be created.

- In the Deduction, user specifies if it is an employee-contributed or an employer-contributed deduction.

- The liability account for each insurance obligation is set in the Deduction and may be different for each insurance obligation type, if required.

- In the Payroll document all of the applicable insurance contributions will be calculated automatically.