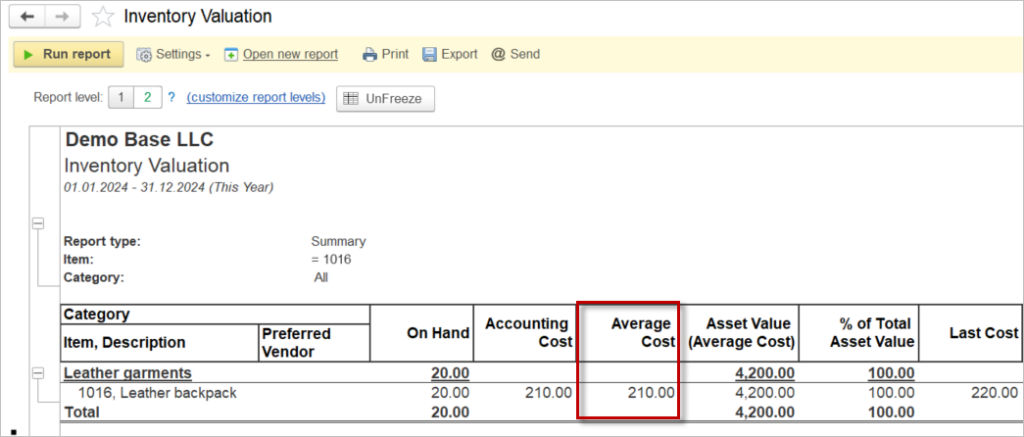

Two purchases for leather backpacks were made.

First purhase: 10 items at 200 AED per item (net of VAT)

Second purchase: 10 items at 220 AED per item (net of VAT)

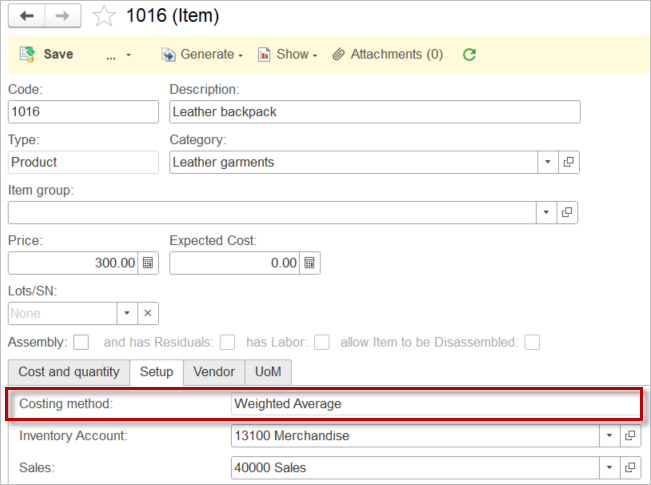

According to the costing method set in Item, any crediting will be calculated as a weighted average.

Thus, (2000 AED + 2200 AED) / (10 items + 10 items) = 210 AED per item is the weighted average. This can be displayed in the Inventory valuation report

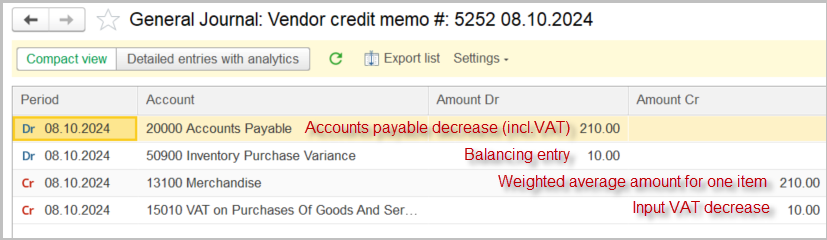

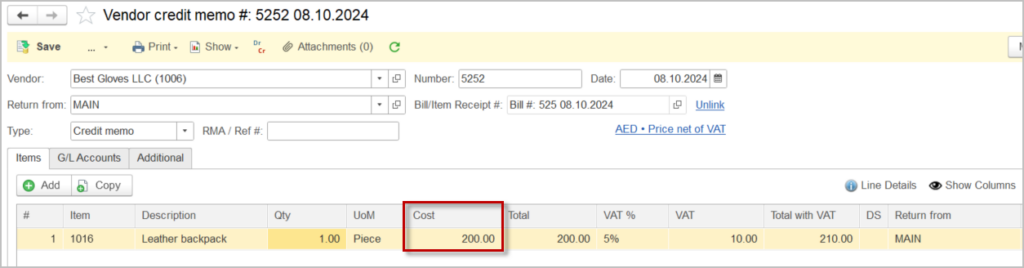

It has been found out that one item (from the first purchase) was damaged, and a Vendor credit memo was posted.

The cost in the Vendor credit memo is exactly the same as in the purchase document (200 AED per item). However, the inventory account has been credited with a weighted average amount for one item, and in order to balance the posting, the Inventory purchase price difference account (set in the Accounting settings) was debited.