To account for asset acquisition, follow the steps:

- Create a new Asset

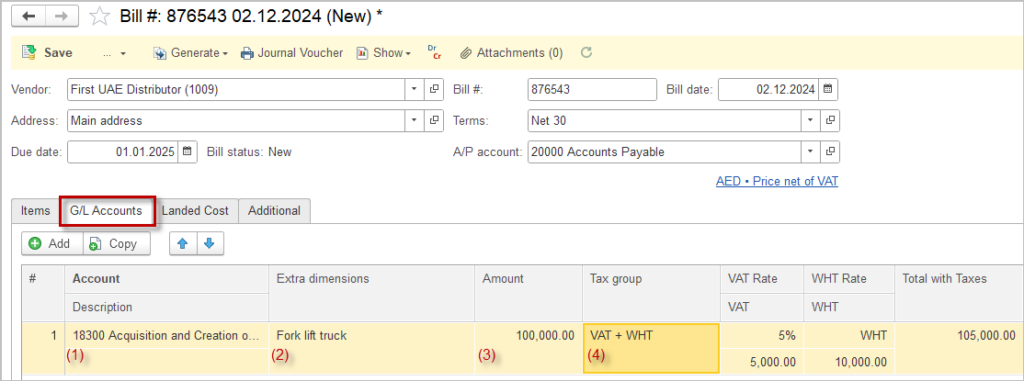

- Create a Bill and open the G/L accounts tab

- Select the account used for accumulation of initial cost of the asset (1). This account should have Asset as Extra dimension.

- Specify the Asset in the Extra dimension field (2).

- Enter the amount (3).

- If the purchased asset is subject to any taxes, specify the Tax group (4). The taxes will be calculated automatically (provided that the tax setting in the Vendor are maintained).

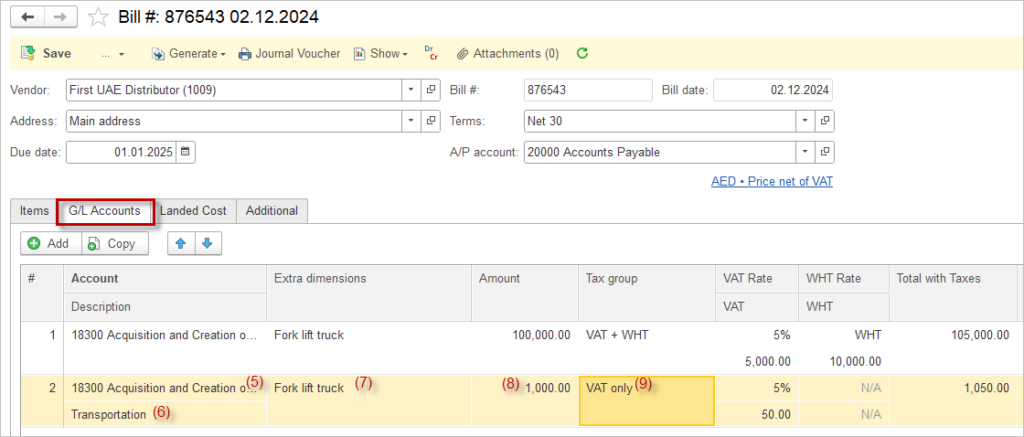

- If there are any costs associated with the purchase of the asset that should be included in the initial value, enter them on the same tab. Important: do not use Landed cost tab for this, because Landed cost is only allocated to the Items tab, and not to the G/L accounts tab.

- Select the same account, as for the purchase of the asset (5).

- Enter the description of the service (for information only) (6).

- Specify the same Asset in the Extra dimension (7)

- Enter the amount (8).

- If the purchased asset is subject to any taxes, specify the Tax group (9). The taxes will be calculated automatically (provided that the tax setting in the Vendor are maintained).

- Save the document.

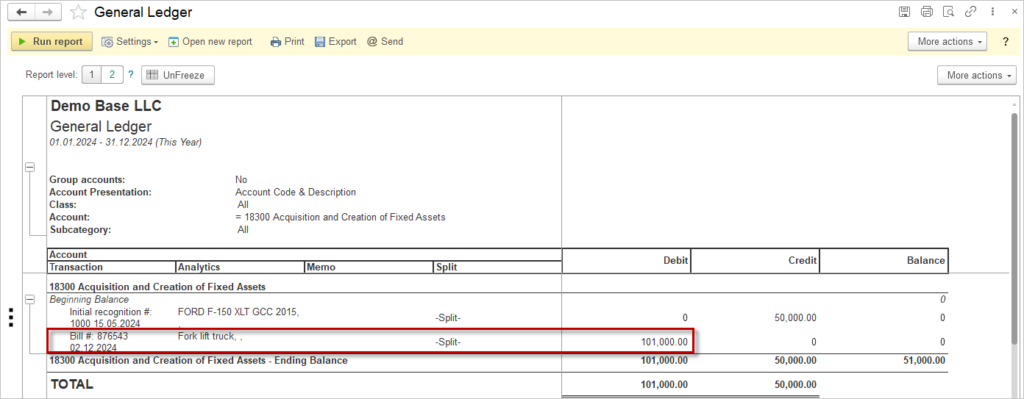

- To check balance on the 18300 Acquisition account, open the General Ledger. The asset has been accounted for as net amount of the asset itself plus the net amount of the associated service:

- The next step is to book the Initial recognition of the asset.