Scenario 1. Purchase with postpayment (no Advance) #

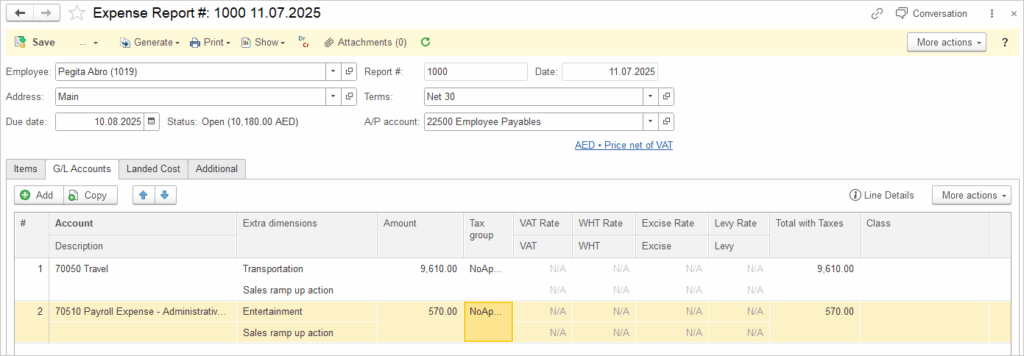

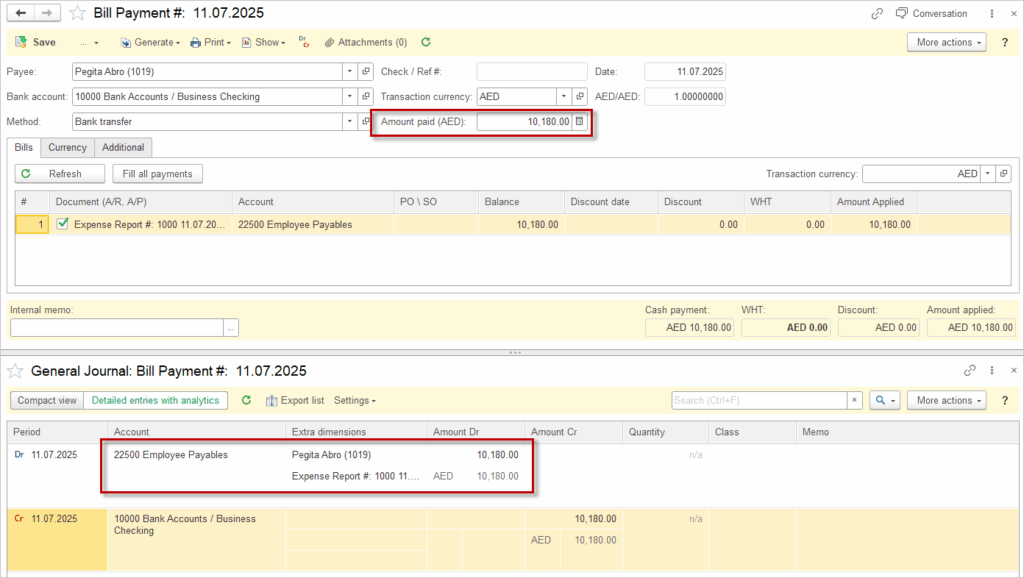

An employee incurred business-related expenses using personal funds, without receiving an advance from the company. After submitting an expense report with supporting documentation, the company reviewed and approved the claim, reimbursing the employee for the full amount spent.

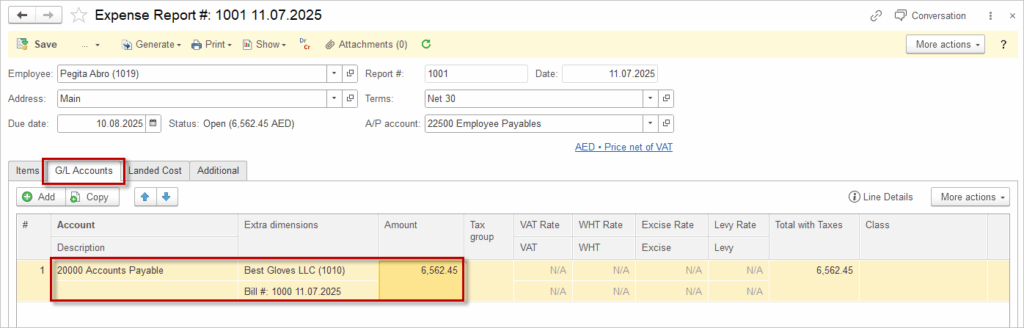

Step 1 it to post the Expense report.

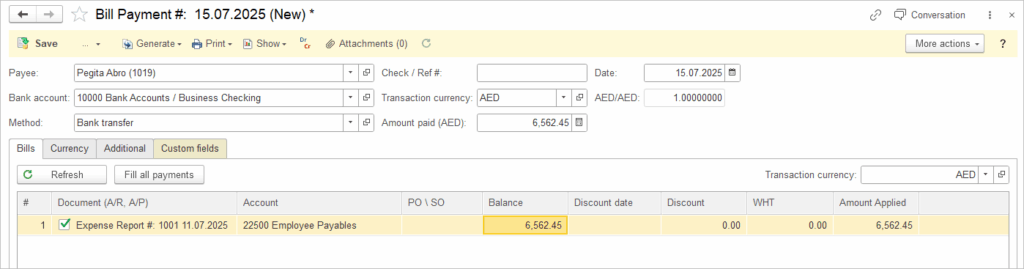

Step 2 is to generate the Bill payment from the Expense report.

An Expense Report is essentially just a type of Purchase Invoice (Bill), and in this case, the Vendor is an Employee. In many countries, individuals are not liable for corporate taxes such as VAT. Therefore, in this scenario, no tax (VAT, Withholding tax, Excise tax or Levy) should be posted when goods or services are purchased.

Please note that the Expense Report is booked outside of the Payroll module and is not related to Personal Income Tax or other payroll-related taxes.

If you want to account for VAT and other taxes, please refer to Scenario 3.

Scenario 2. Business Travel Expenses with Advance Payment #

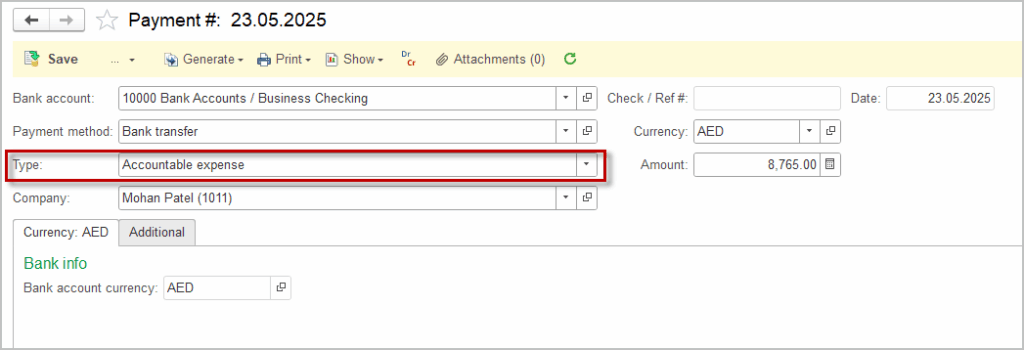

Scenario: employee travels for business purposes and receives an advance payment from the company prior to the trip to cover expected costs. This advance is recorded as an asset (travel advance) on the company’s balance sheet until the employee submits the final expense report.

Step 1 is to post the advance payment to the Employee with a Payment document (Bank – Payments). In the Payment, select the Accountable expense Type.

The Accounts Payable account in the header will be filled in automatically with Employee Advances account from the Accounting Settings.

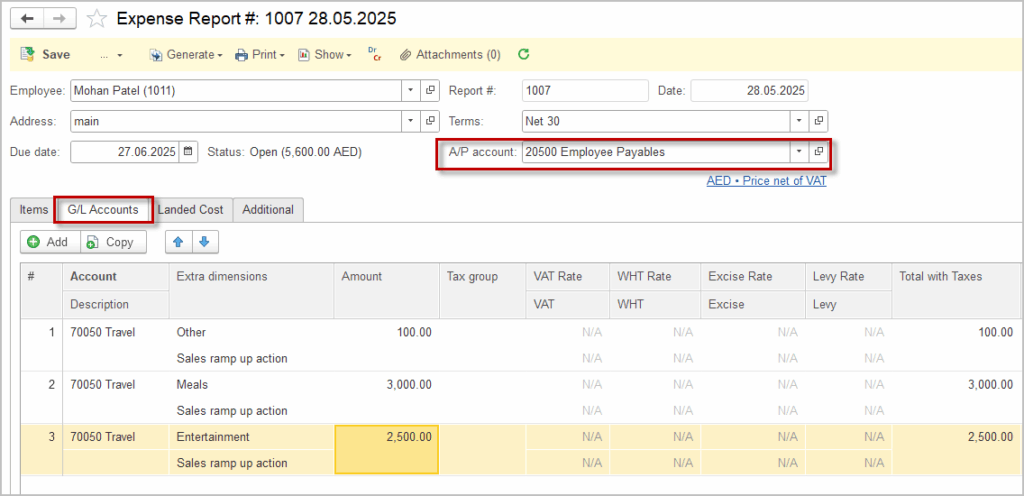

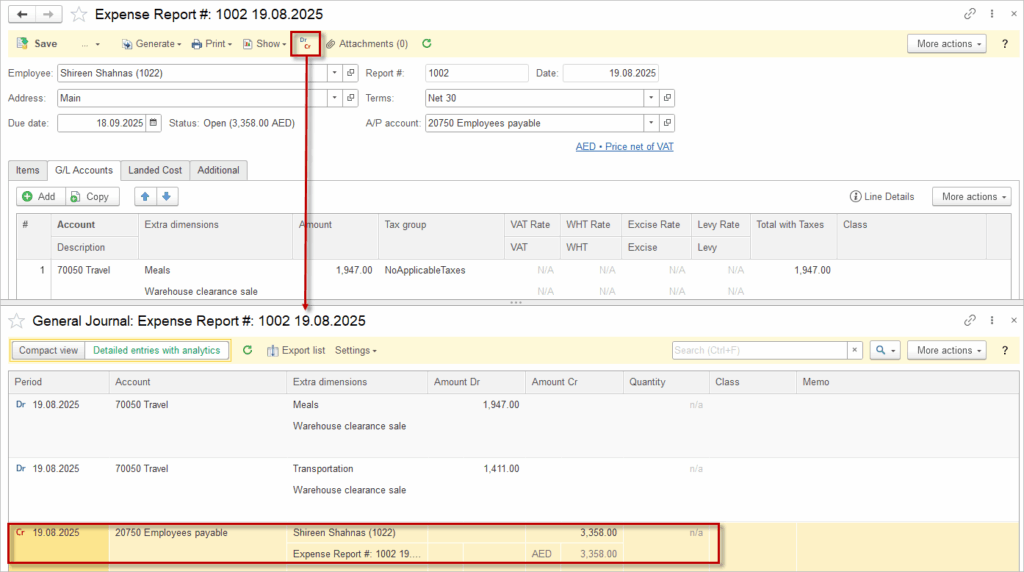

Step 2 is to post the Expense Report after Employee submits receipts and documentation detailing the actual expenses incurred. On the G/L accounts tab, enter the appropriate Expense accounts.

The Accounts Payable account in the header will be filled in automatically with Employee Payables account from the Accounting Settings.

An Expense Report is essentially just a type of Purchase Invoice (Bill), and in this case, the Vendor is an Employee. In many countries, individuals are not liable for corporate taxes such as VAT. Therefore, in this scenario, no tax (VAT, Withholding tax, Excise tax or Levy) should be posted when goods or services are purchased.

Please note that the Expense Report is booked outside of the Payroll module and is not related to Personal Income Tax or other payroll-related taxes.

If you want to account for VAT and other taxes, please refer to Scenario 3.

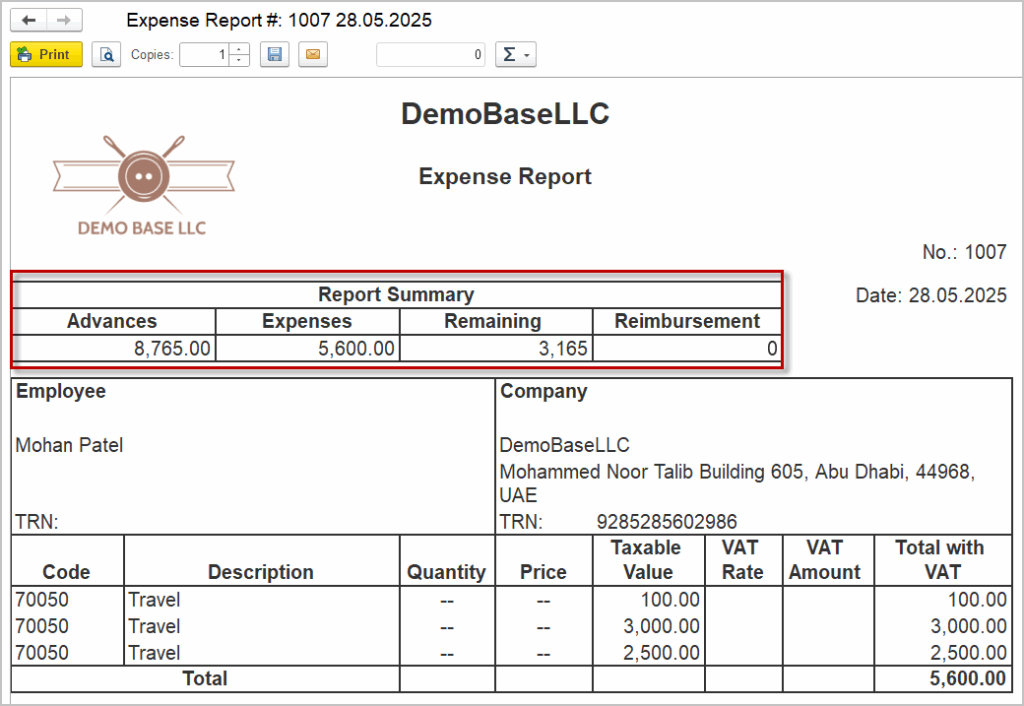

The Expense Report has a standard Print Form, that can be edited. In the header, it shows the Advance and Expense amounts along with Remaining balance and Reimbursement (in case the Expenses have exceeded the Advance).

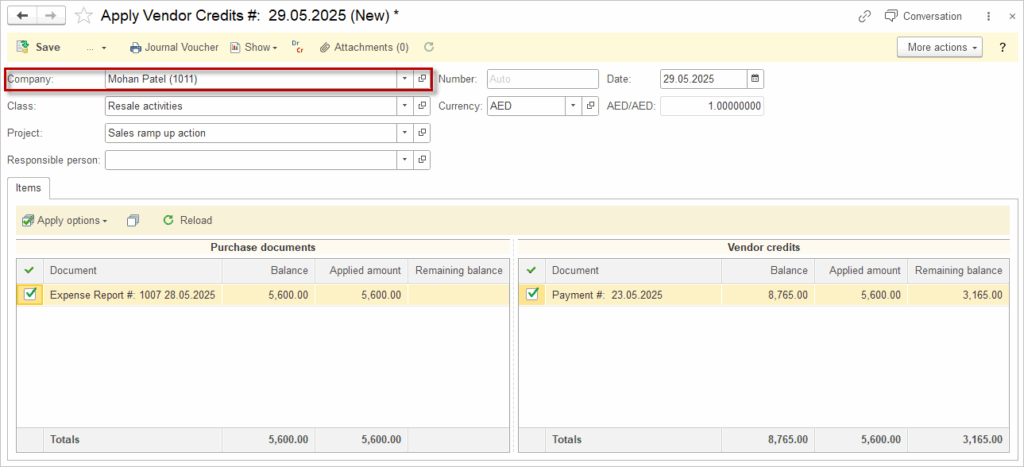

Step 3 is to clear the travel advance asset account. Under Purchases – Apply Vendor Credits create a new document.

The advance payment amount is deducted from the total reimbursable expenses. If expenses exceed the advance, the employee is reimbursed the difference; if expenses are less, the employee returns the unused advance.

The company records the finalized expenses in the appropriate expense accounts and clears the travel advance asset accordingly.

Scenario 3. Bill from Vendor – Payment processed via G/L tab in Expense Report #

Scenario: An Employee procures goods or services from a third-party vendor, where such purchases are subject to VAT, WHT, or other applicable taxes. In this scenario, the Expense Report is processed solely for the purpose of settling the corresponding Accounts Payable. The Employee does not assume the role of a Vendor, but instead acts as an intermediary, facilitating the transfer of funds (assets) on behalf of the business

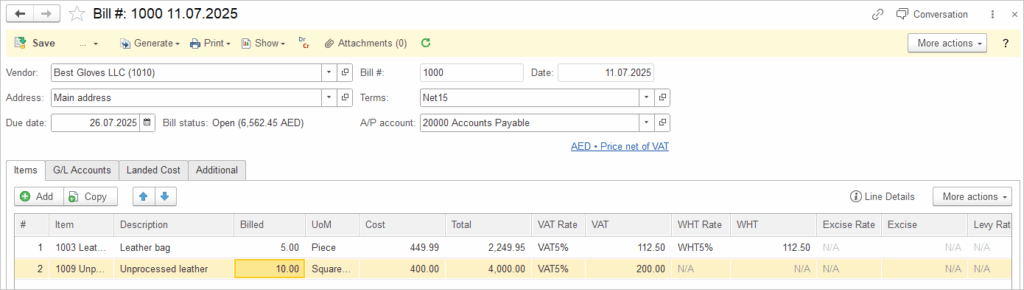

Step 1 is to book a Bill from the third party. Tax invoice should be generated to reflect VAT properly.

Step 2 is to book Expense report, specifying the Accounts Payable account on the G/L tab. The liability will be settled. No taxes should be applied here, as they have already been applied in the Bill in Step 1.

Step 3 is to reimburse the Employee. Generate Bill Payment from the Expense Report.

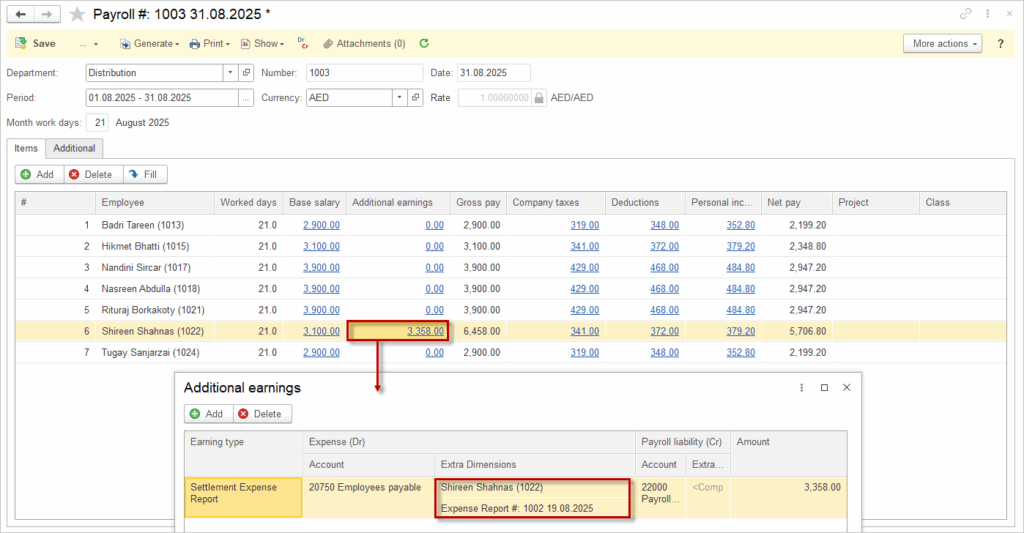

Scenario 4. Settlement of Liability with Payroll document #

Scenario: the company initially records the reimbursable expenses as a liability, this liability is tracked separately in the Employee Liability account. When processing payroll, the company settles this liability by debiting the Employee Liability account.

Please verify the accounting entries with your local auditor, as regulations may vary by jurisdiction. It may be the case, that the liability for the purchase is settled independently of salary payments and should not be considered as employee income.

Step 1 it to post the Expense report. It will create a Liability against the Employee on the account set in the Accounting settings.

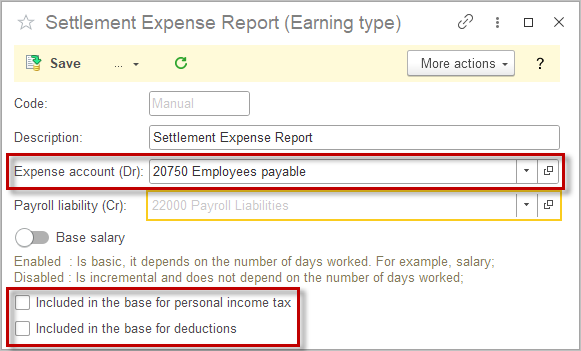

Step 2 is to create an Earning type with a Debit account specified as Employees payable. It should not be included in the base for personal income tax or in the base for deductions.

Step 3 is to create a Payroll document. For the respective Employee, the Earning tab will added automatically in the Additional earnings tab, reflecting the recovery as part of the employee’s payroll transaction. This approach ensures that the employee’s outstanding liability is cleared through payroll while maintaining accurate accounting records for both the expense settlement and payroll processing. Extra Dimensions in the Additional earnings window have to be filled manually.