A retainer invoice is a type of commercial document used to request upfront payment (a retainer fee) from a client before services are rendered. This invoice serves to secure the service provider’s availability and commitment to the project or ongoing work. Retainer invoices also known as retention payments are commonly used by professionals such as lawyers, consultants, freelancers, and accountants, particularly for long-term or recurring services.

Key Characteristics of a Retainer Invoice:

Upfront Payment: The retainer fee acts as a deposit or prepayment to secure the provider’s services.

Liability: Payments received via a retainer invoice are initially recorded as liabilities, not revenue, because the services have not yet been delivered.

Legally Binding: The invoice outlines terms such as fees, scope of work, and payment conditions, making it enforceable in court if disputes arise.

Predictable Revenue: It ensures steady cash flow for the provider while guaranteeing service availability for the client

To book a Retainer Invoice for incoming upfront payment (Vendor side) in AccountingSuite, a Sales Workflow containing a Sales Order should be used (so the workflow starts with a Sales Quote, then Sales Order OR the workflow starts directly with Sales Order).

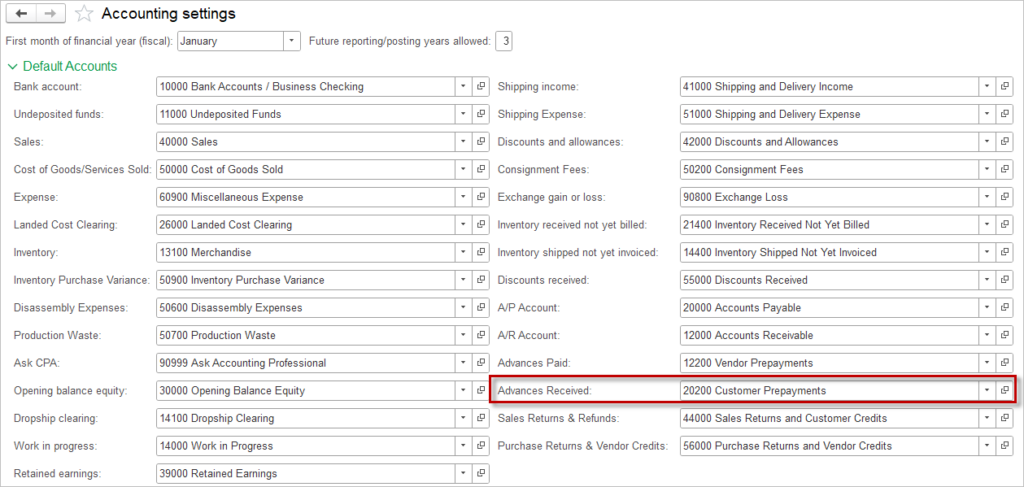

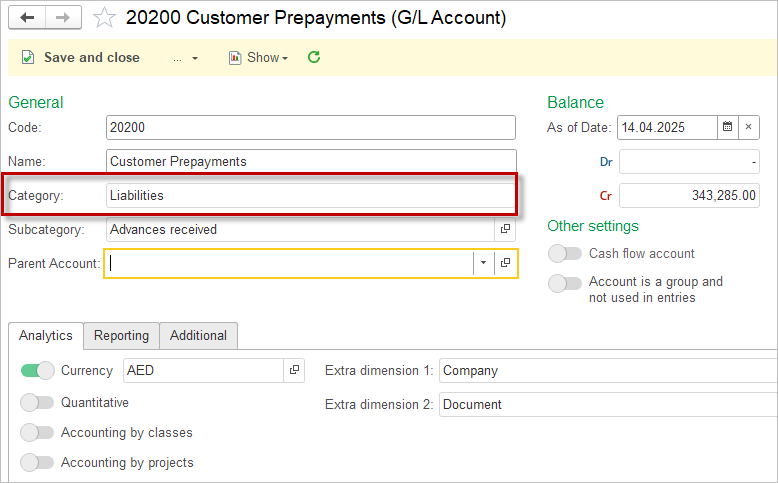

In the Accounting Settings, the Advances Received account should be filled. AccountingSuite standard Chart of Accounts offers account 20200 Customer Prepayments. User may prefer to create own account, for example Retainer Invoicing or similar. Important is, that the Category of the selected account should be Liability. This ensures compliance with the most common accounting frameworks.

Recording Retention Payment #

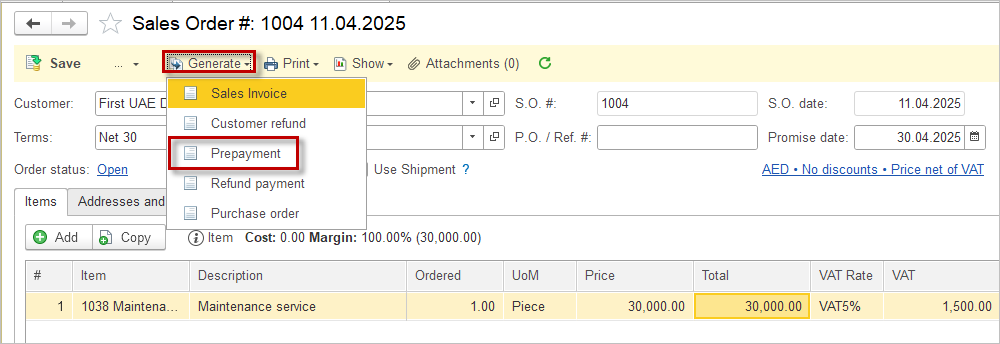

Step 1 is to create either a Sales Order (generate from preceding Sales Quote or create from scratch). For a Sales Order, a custom print form may be developed with a heading Retainer Invoice.

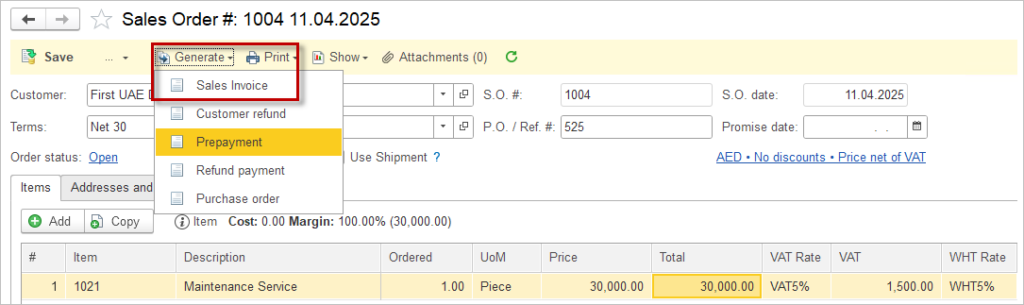

Step 2 is to generate incoming Prepayment from the Sales Order.

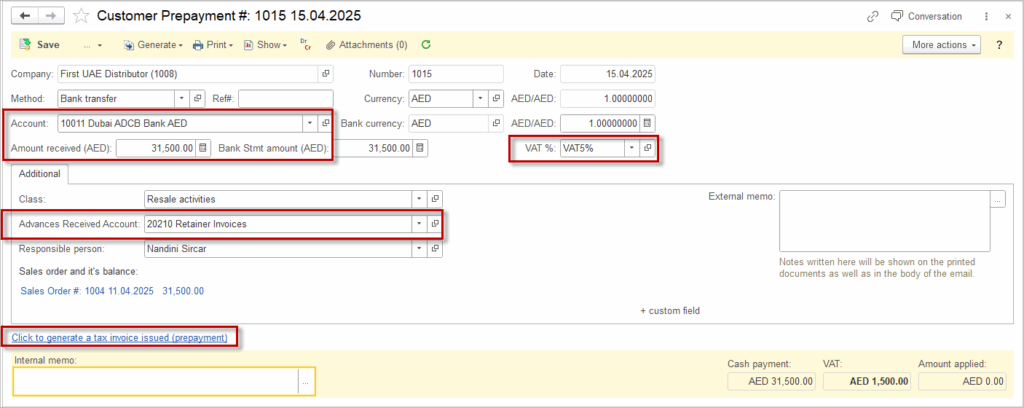

In the Customer Prepaymet document specify:

- Account where the funds are received;

- Amount received (which can be equal, lower or higher than the Sales order amount);

- VAT rate, if applicable;

- Advances Received Account will be filled automatically from the Accounting Settings, but may be changed if required. E.g. user may prefer to select account named Retained revenue or Unearned revenue (available under number 23500 Unearned revenue in the standard AccountingSuite chart of accounts). In this example we have selected 20210 Retainer Invoice account.

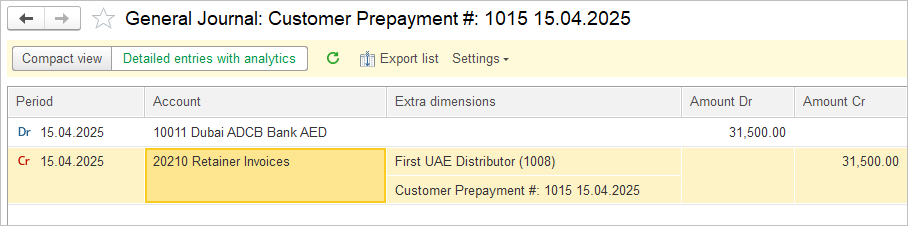

This Document will effect the accounts specified in document form: 10011 Dubai ADCB Bank AED account and 20210 Retainer Invoices accouns.

No revenue has been booked, but rather there has only been an increase in funds and an outstanding liability.

Tax invoiced issued for prepayment may be issued if required.

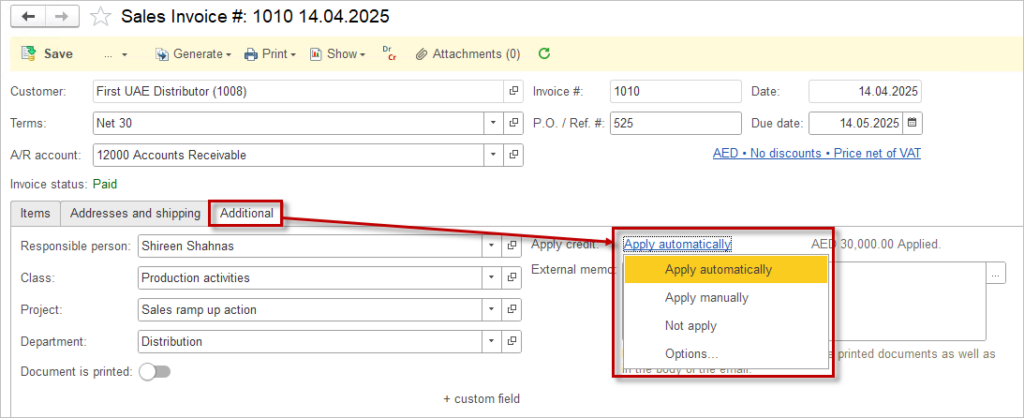

Step 3 is to generate the sales invoice from the sales order once the service has been provided.

All of the required information in the Sales Invoice will be filled automatically from the Sales Order. User may add or delete Items and their quantities if required.

Please note: When a retention payment applies, only part of the advance payment can be used immediately. This happens when the contract specifies that a certain percentage of the payment must be withheld until specific conditions are met, such as project completion or satisfactory delivery. The withheld portion is retained to ensure obligations are fulfilled before the full payment is released.

On the Addtional tab, select the Apply options: Automatically, Manually or Not Apply. The Apply Customer Credits document will be created automatically. The liability will be cleared.

Step 4 (applicable in case the retention payment has not been applied in full in Step 3).

Once the conditions for the project completion are met, create a Sales invoice for the outstanding amount and clear the liability (repeat Step 3).