When you receive cash and check as payment, they will eventually need to be deposited at the bank, usually grouped with other payments. When the group of checks and cash is taken to the bank, a deposit is recorded in AccountingSuite. When a Deposit is created, any new Cash receipts and Cash sales are automatically added to the Deposit document, but may go unchecked if the funds are not included in the bank transaction.

Create Deposit #

- Navigate to Bank → Deposits. A list of previously created bank deposits is displayed.

- Click the Create Button.

- Change the Posting Date, if necessary. This is the date the Deposit was made at the bank.

- Change the Bank Account, if necessary. The default bank account specified in Admin panel → Settings → Bank Settings will be pre-filled. This is the account to which the deposit is or will be made.

- Change the Deposit Number, if necessary. The deposit document numbering is defined in Admin panel → Tools → Auto-Numbering and will increment automatically. For more information, see Document Numbering.

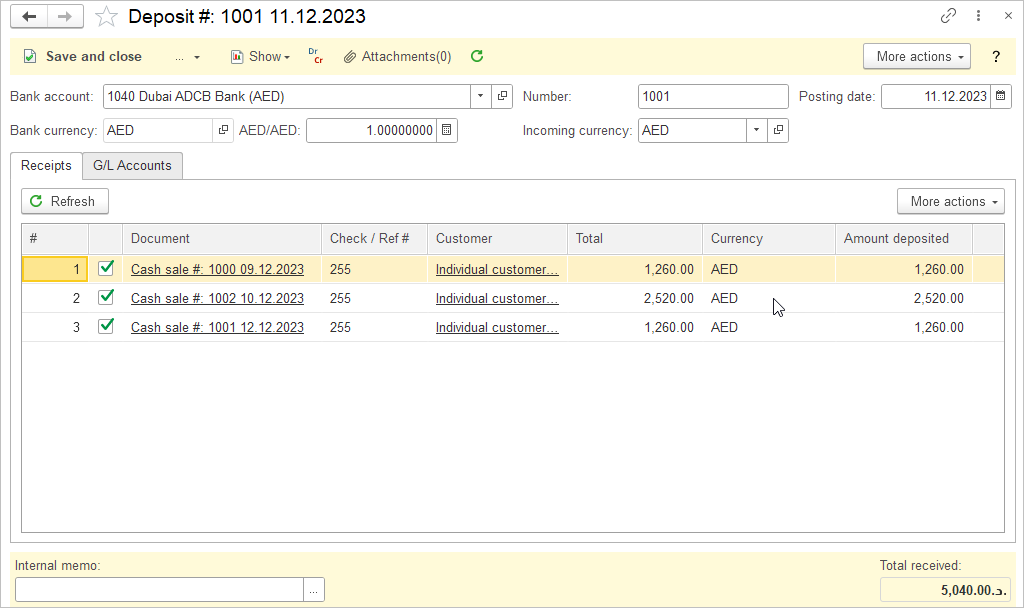

- In the lower half of the deposit document, check the checkbox next to the Cash Receipts and Cash Sales that will be included in the deposit. As each box is checked, the Total at the bottom will change to reflect the total of all checked cash receipts. The initial list that is populated on the deposit includes all Cash receipts and Cash sales that have not been previously included on a Deposit.

- If there are items to deposit that are not part of cash receipts, click the G/L tab to enter. If none, skip to step 8.

7a) Enter the Customer / Vendor.

7b) Enter the G/L Account.

7c) Enter the Amount.

7d) Enter Payment Method (required if transaction is associated with a 1099 account, otherwise optional).

7e) Enter Memo (optional).

7f) Enter Project (optional).

7e) Enter Class (optional). - Add a Memo. (optional).

- Save the document.

Accounting #

Recording a Deposit creates the following transactions in the General Journal:

- Debits: Bank account

- Credits: Petty cash / Check account