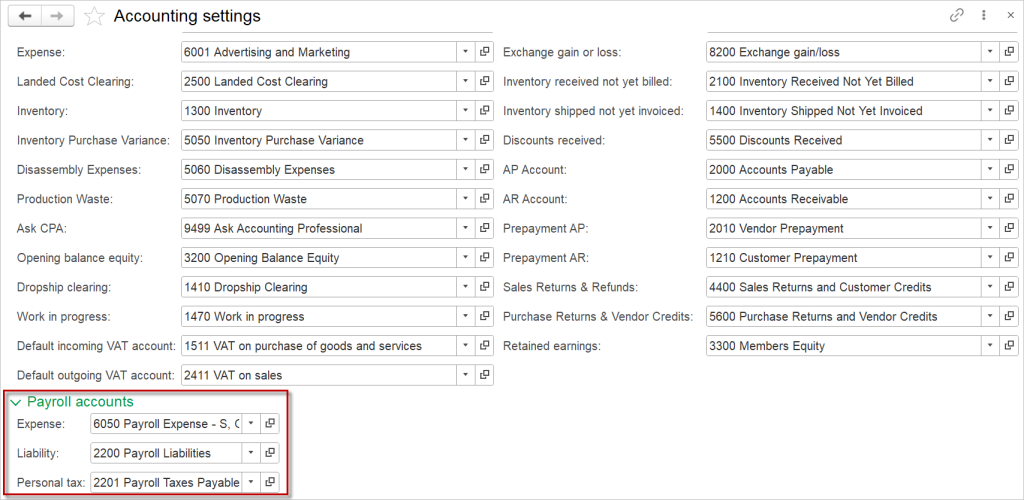

To start accounting for payroll, maintain the respective Accounting settings:

- Expense account

- Liability – the account to be used for entering liabilities to employees

- Personal tax – the account to be used for entering liabilities to tax authorities

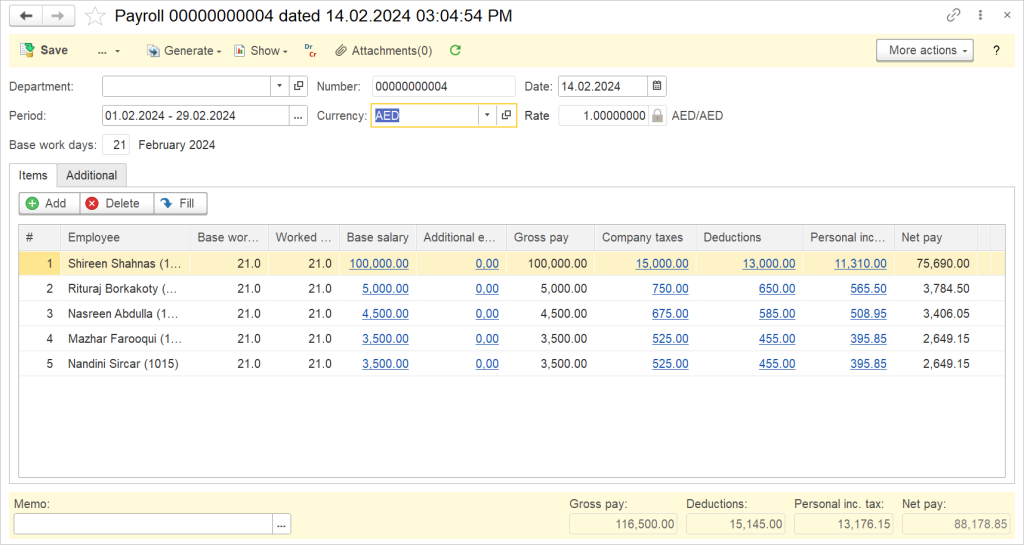

Payroll is the document, where you can:

- record wages and salaries

- record additional earnings (such as bonuses)

- withhold deductions or taxes payable by the employee (such as income tax)

- accrual for presonal-related company taxes

- generate payroll payment.

- Navigate to Payroll – Documents – Payroll

- Click Create

- Choose the Department (optional) and time period. Time period can be custom, e.g. two weeks or a week. Built-in check will not allow to account for the same Employee and the same time period twice.

- Number of work days will be calculated automatically based on the Working calendar (adjust the Calendar if needed)

- Click Fill to fill in the list of Employees, hired before the date of the document

- Adjsut the number of days actually worked to record for Base salary

Accounting #

Wages and salaries within Payroll document create the following transactions in the General Journal:

- Debits: Payroll expense account (set in the respective Earning type)

- Credits: Payroll liability (default account set in Accouting settings)

Record Additional earnings #

- In the column Additional earning choose the respective Earning type

- If earning type is calculated based on days actually worked, the amount will be calculated automatically

- If earning type has manual input, fill in the amount

Accounting #

Additional earnings within Payroll document create the following transactions in the General Journal:

- Debits: Payroll expense account (set in the respective Earning type)

- Credits: Payroll liability (default account set in Accouting settings)

Record Company taxes #

- In the column Company taxes choose the respective Deduction type

- If the deduction type is calculated based on precentage, the amount will be calculated automatically

- If deduction type has manual input, fill in the amount

Accounting #

Company taxes within Payroll document create the following transactions in the General Journal:

- Debits: Payroll expense account (set in the Accouting settings)

- Credits: Payroll liability (set in the respecitve Deduction type)

Record Deductions #

- In the column Deductions choose the respective Deduction type

- If the deduction type is calculated based on precentage, the amount will be calculated automatically

- If deduction type has manual input, fill in the amount

Accounting #

Dedutions within Payroll document create the following transactions in the General Journal:

- Debits: Payroll liability (default account set in Accouting settings)

- Credits: Liability account (set in the respective Deduction type)

Record Personal income tax #

- In the column Personal income tax, the tax will be calculated automatically;

Accounting #

Personal income tax within Payroll document create the following transactions in the General Journal:

- Debits: Payroll liability (default account set in Accounting settings)

- Credits: Personal income tax liability

Please refer to a separate article on how to create a payroll payment.