Bank reconciliations is a crucial process in financial management that ensures the alignment of data from the accounting system with the information provided in the bank statement. The goal of this process is to confirm the accuracy and consistency of all transactions, ensuring that financial records are accurate and free from errors, such as incorrect or duplicate entries. Bank reconciliation also helps identify potential discrepancies, such as deposits that have not yet cleared or checks that have not been processed, as well as detecting bank fees, interest, and any potential mistakes. This process is essential for maintaining financial discipline, preventing fraud, and ensuring compliance with accounting standards.

Please note:

Entering initial balances through the Reconciliation document is unsupported. To initialize a bank account open balance, you can use a Journal entry with the Data Import Tool. The standard Chart of accounts contains an Opening Balance Equity account, and the opening bank balance can be entered as Dr Bank account Cr Opening Balance Equity account.

The info amounts fields from Bank Statement are only to compare the actual data with data from bank report file. You need to enter the adjustment documents of the system manually. The Reconciliation document itself does not make corrections, only G/L entries for commission and interest on the deposit, if specified in the fields.

On a Discrepancies mode there will be Journal Entries (adjustments and open balance documents) that you entered.

Create Reconciliation #

- Navigate to Bank→ Bank Reconciliation.

- Click Create.

- Enter the Bank statement date

- This date represents the last day of the reporting period shown on the bank statement. The transactions to be reconciled will cover the period from the end of the previous reconciliation up to the date entered here.

- Choose the Bank account from the drop down list

- Choose the Bank account you want to reconcile. Based on the selected account, the system will load the relevant transactions.

- Ledger balance

- This value is automatically populated and represents the balance of the bank account according to your accounting system as of the entered statement date. It is an internal figure recorded in your books.

- Enter the Stmt beginning balance

- Manually enter the opening balance from the bank statement. This is the account balance reported by the bank at the beginning of the statement period. This value comes directly from the bank.

- Enter the Stmt credits (deposits)

- Manually enter the total amount of all incoming payments as shown on your bank statement for the specified period. This includes customer payments, interest earned, cash deposits, and any other amounts credited by the bank.

- Enter the Stmt debits (payments)

- Manually enter the total amount of all outgoing payments charged by the bank against your account. This includes vendor payments, cash withdrawals, bank fees, and other debited amounts as shown on the bank statement.

- Enter the Stmt ending balance

- Manually enter the closing balance from the bank statement. This is the balance the bank reports as of the date you entered as the Bank statement date.

- Click Continue to open the bank reconciliation page for the selected bank account

- If you do not intend to make any changes or adjustments, click Save and Close to complete the process and exit the reconciliation screen.

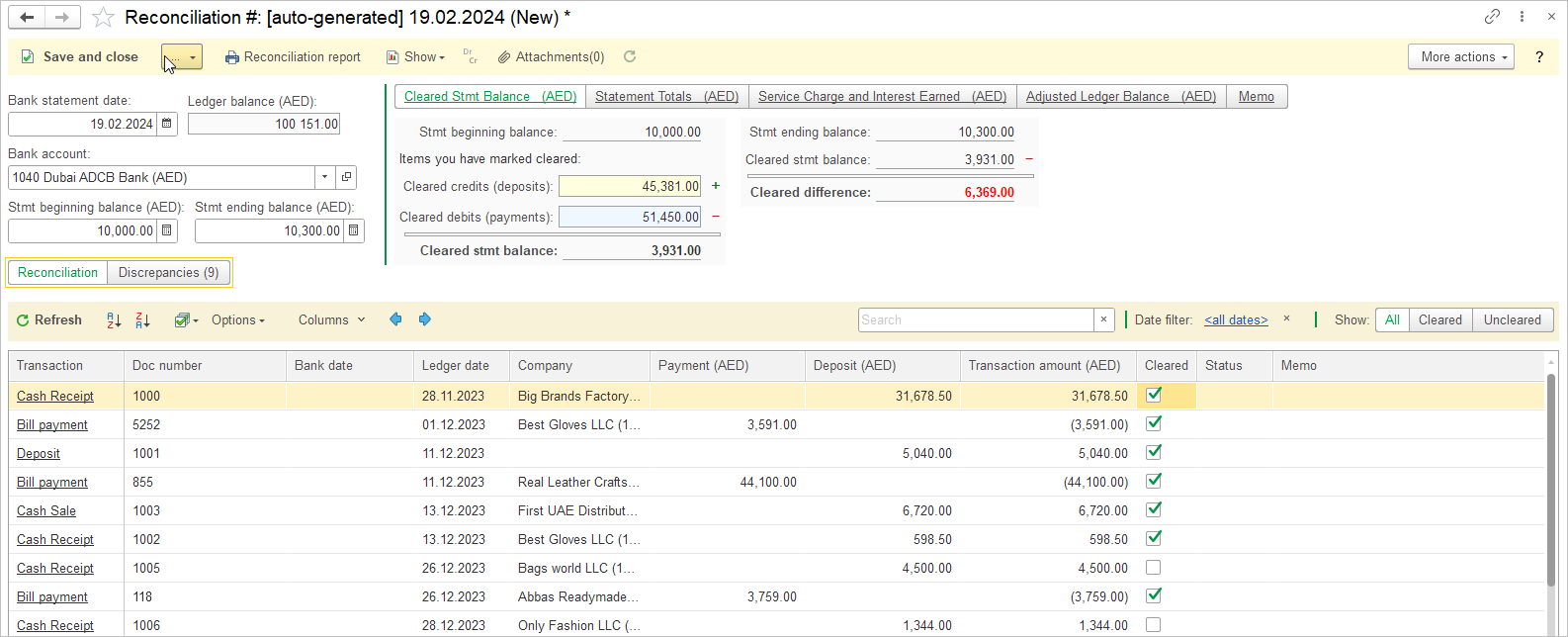

Cleared Stmt Balance #

The Cleared Stmt Balance tab shows the balance calculated after all transactions have been marked as cleared during the bank reconciliation process. This tab allows you to track all credits (deposits) and debits (payments) that have been reconciled between your accounting system and the bank statement, as well as any discrepancies that may arise during the process.

- Cleared credits (deposits) – Deposits that are recorded in both the bank statement and the accounting system

- Cleared debits (payments) – Payments that match in both the bank statement and the accounting records.

- The Cleared stmt balance represents the balance calculated after you have marked all transactions as cleared during the bank reconciliation process. This amount includes all credits (deposits) and debits (payments) that have been reconciled in both your accounting system and the bank statement. Based on these marked transactions, the system automatically calculates the Cleared stmt balance. This balance should match the Stmt ending balance from the bank statement if the Reconciliation has been performed correctly.

- Cleared difference is the variance between the Cleared stmt balance and the Stmt ending balance. A positive or negative value indicates unreconciled or missing transactions; a correctly performed reconciliation should result in a zero difference.

Statement Totals #

The Statement Totals tab provides an overview of how transactions are being matched against the bank statement. It shows the total amounts for both inflows and outflows, with a focus on ensuring that all amounts from the bank statement are properly reconciled with the system records.

- Cleared – this field is automatically populated with the total amount of transactions that have been marked as Cleared during the reconciliation process (e.g., when you mark incoming payments as cleared, their amounts are summed under Credits, and for outgoing payments under Debits).

- Statement Totals – this field is manually filled in with the total amounts from the actual bank statement for both inflows and outflows.

- Difference – shows the variance between the system-calculated Cleared statement totals and the manually entered Statement Totals from the bank statement. The Difference indicates how much is left to reconcile and reflects the overall progress of the reconciliation. The goal is to reach a zero difference, which means all amounts from the statement have been properly matched.

Service Charge and Interest Earned #

The Service Charge and Interest Earned tab is used to record additional items from the bank statement related to bank charges and earned interest that have not yet been recorded in the accounting system. This tab allows the entry of bank charges and interest amounts to the appropriate accounts in the chart of accounts, including the date when the charges or interest were applied or calculated. Each item is linked to the corresponding account in the chart of accounts for accurate record-keeping in the accounting system

- Service charge – the amount of the bank fee charged for services provided (e.g., account maintenance, transaction fees).

- Date – the date on which the bank charge was applied, according to the bank statement.

- Account – the account in the chart of accounts where the bank charge will be recorded.

- Interest Earned – the amount of interest earned, which the bank has credited to the account (e.g., interest on a positive balance).

- Date – the date on which the interest was calculated and credited, according to the statement.

- Account – the account in the chart of accounts where the interest income will be recorded.

Adjusted Ledger Balance #

The Adjusted Ledger Balance tab is used to display the balance in the accounting records, taking into account items that have not yet been marked as cleared. It shows Deposits in transit, Uncleared checks, and the Adjusted ledger balance after considering these items. The tab also calculates the Bank to book difference, highlighting any discrepancies between the accounting records and the bank statement.

- Deposit in transit – deposits that have been sent but have not yet appeared on the bank statement as they are in transit.

- Uncleared checks – checks that have been issued but have not yet appeared on the bank statement because they have not been processed by the bank.

- Adjusted ledger balance – the balance in the accounting records after accounting for all items that have not been cleared.

- Bank to book difference – the difference between the ledger balance and the bank balance, indicating any discrepancies between these two sources.

Additional #

The Additional tab allows for the entry of supplementary information related to the bank reconciliation process, helping to organize and track all relevant data.

- Responsible person – Enter the name of the person responsible for carrying out or overseeing the reconciliation process.

- Class – The category of the transaction during the reconciliation process, such as payments, deposits, bank fees, or other transactions.

- Memo – A field for entering additional notes or comments related to specific transaction details or any further analysis needs.

Reconciliation / Discrepancies #

Reconciliation tab:

- The Reconciliation tab displays the transactions that have been successfully matched and cleared between the bank statement and the accounting records.

- This tab includes all transactions marked as Cleared, meaning both the bank and the accounting system show matching information, confirming the reconciliation of those specific transactions.

- It reflects a complete and accurate match between the bank statement and the accounting system, indicating that those transactions no longer require further investigation.

Discrepancies tab:

- The Discrepancies tab highlights transactions that do not match between the bank statement and the accounting records.

- These are transactions that show a difference in amounts or do not appear in both systems, indicating that there are unresolved issues requiring further investigation and resolution.

- This tab is used to identify and address discrepancies, such as missing or incorrect transactions, to ensure that the reconciliation process is complete and accurate.

The Reconciliation process includes the following Discrepancy types:

- Not Subjects for Reconciliation (0)

- This category refers to transactions that were identified during the reconciliation process but are not subject to bank reconciliation, as they are not relevant for matching between the bank statement and accounting records (e.g., internal records, system-generated entries, etc.).

- Not Cleared/Approved in CB (0)

- This status applies to transactions that are neither cleared nor approved in the accounting system (CB – Central Book or Core Accounting), which prevents them from being matched with bank transactions.

- Cleared/Not Approved in CB (0)

- This category includes transactions that have been marked as cleared but have not yet been formally approved in the accounting system. Although recorded, they have not passed all internal approval steps.

- Bank Transactions: Not Approved (0)

- This category refers to transactions that have been imported or recorded from the bank statement but have not been approved in the system, and therefore cannot be matched with corresponding accounting transactions.

- Each number in parentheses represents the current number of transactions that fall under the specified discrepancy type. The presence of these transactions indicates that reconciliation is not complete for those items and further review or correction is required to finalize the bank reconciliation process.

Status indicators #

Completed and Pending are status indicators commonly used to describe the progress of orders, projects, or tasks within a system

- Completed: This status indicates that all actions or requirements related to an order or task have been fulfilled, and it is now fully finished.

- Pending: This status indicates that an order or task is still in progress, with some actions or requirements yet to be completed, meaning it is not finalized.